StitchFix is a technology-driven online personal styling service. But how does StitchFix stock (Nasdaq: SFIX) rate as 2023 kicks off?

Launched in 2011, the company’s mission is to “deliver a truly personalized shopping experience that helps you look and feel your best every day.”

Its unique combination of technology, data science, and human stylists has enabled it to become one of the most successful subscription services in the world.

Let’s take a look at what it does and its stock outlook for 2023 using our proprietary Stock Power Ratings system.

How Does StitchFix Work?

Stitchfix uses algorithms to analyze customer preferences based on style, size, price point, lifestyle and more.

Customers fill out an online survey when they sign up for the service, which helps StitchFix tailor a curated box of clothing and accessories that meet their preferences. Every customer receives five items per box from popular brands like Madewell, Nike, Levi’s and Anthropologie.

Customers can keep the items they like and return those they don’t with free shipping both ways. They also have the option to purchase additional items at discounted prices whenever they wish.

StitchFix’s Business Outlook for 2023

In 2020, StitchFix went public on the Nasdaq stock exchange with an initial offering price of $15 per share. Within six months, StitchFix stock had risen over 300% to an all-time high of $54 per share in February 2021.

Since then, the stock has struggled.

StitchFix stock is now trading around the $3 per share level after investors sold off many shares through 2021 and 2022.

Let’s see how that has affected its outlook using our proprietary system.

StitchFix Stock Power Ratings

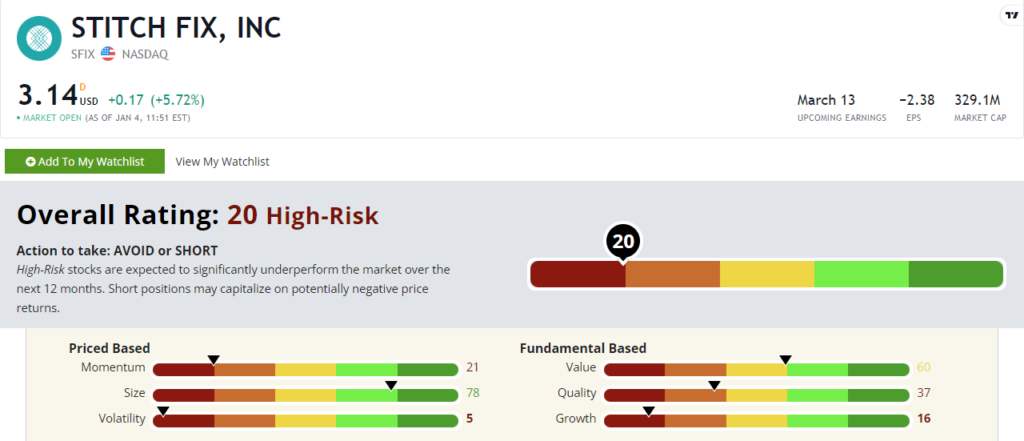

StitchFix stock rates a “High-Risk” 20 out of 100 on our Stock Power Ratings system. That means its expected to underperform the overall market over the next 12 months.

It has struggled to turn revenue into sustainable profits. That’s why it rates at 16 on the growth factor and a 37 on quality.

And StitchFix stock was not immune to the broader market sell-off in 2022. It fell more than 80% over the last 12 months. That’s why it rates a 21 on momentum and a lowly 5 out of 100 on volatility. When looking a volatility, a lower rating means the stock is more prone to wild price swings as investors bid the price up and down.

Going by Stock Power Ratings, SFIX is one to avoid for now.

Conclusion for StitchFix Stock

It was a rough year for StitchFix, and that may continue in 2023 as consumers deal with higher prices and a potential recession.

Time will tell if StitchFix stock can recover and return to its glory days of the 2020 bull market.

But our proprietary system says this is one to avoid for the time being.

What about you? Have you invested in StitchFix stock? Tell us how it’s worked out for your own portfolio in the comments below!