Despite the best wishes of gold promoters, contrarians and fundamental analysts, the U.S. dollar is still king around the world. In fact, thanks to a decade of zero-bound interest rates in dollars, the synthetic demand for them is higher now than it’s been in years.

What do I mean by “synthetic demand?”

It’s simple, really. There are trillions of dollars in debt on the balance sheets of emerging market corporations that are denominated in dollars. They were built up because borrowing in dollars was cheaper than the local currency.

Those debts have to be repaid in dollars, while the companies earn their revenues (for the most part) in their local currencies. If the currency weakens versus the dollar, the effective value of that debt in local currency terms rises quickly.

And that dollar demand is what hangs over the markets today which, despite terrible U.S. economic fundamentals, kept the dollar buoyant during the Janet Yellen-led Fed years. The problem is so widespread that Yellen delayed raising interest rates for more than a year to keep from blowing up banks and the world economy.

Of course, without raising rates the Fed doesn’t change the incentive structure to stop people borrowing in dollars. When Yellen finally did begin raising rates she quit, knowing full well that her replacement would have to deal with the fallout.

And the fallout is here.

Current Fed Chair Jerome Powell balked on normalizing rates and signaled the end of quantitative tightening, though not much in the way of evidence exists yet per the Fed’s weekly balance sheet report.

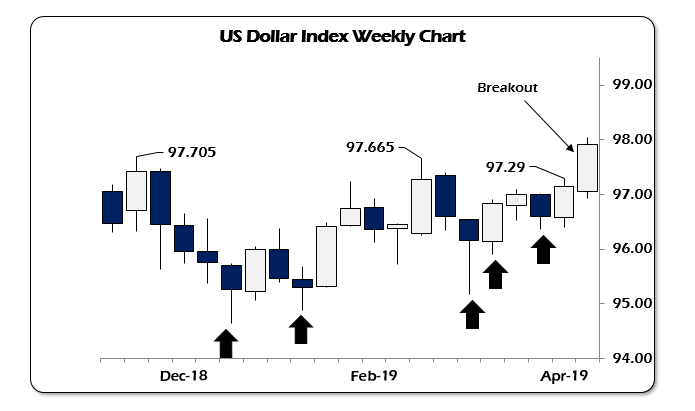

For months, the U.S. dollar index has been butting up against the 97 area (chart below). While the index has been capped at around 97, each pullback has been shallower and shallower (black arrows).

Until this week. This week’s breakout on the U.S. Dollar Index is very significant. It’s a formation that’s been forming for months and has now moved into the next phase.

And it stems not from any fundamental strength of the U.S. economy — though, as terrible as it is it is still far better than Europe — but rather the aforementioned “synthetic demand.”

Look around you. Not only are important emerging market currencies in trouble, like the Turkish lira, as I talked about a few weeks ago, but also major ones like the euro and the British pound.

As I said then:

… what we’ve seen is a massive flight into the dollar despite the Fed rolling over last week. The U.S. Dollar Index is threatening a big breakout above 98. The only thing keeping it in check is the daily head-fakes coming out of Brexit negotiations, which keep both the pound and the euro range-bound.

The problem now is that both the pound and euro have broken down out of their ranges and are threatening free fall. The euro broke support at $1.12 and looks for all the world that it is headed to the 2017 low of $1.034. The pound is fairing a bit better, trading just below $1.29 with the February low of $1.277 still in play. A weekly close below that and $1.198 comes into play.

This wasn’t supposed to happen with the European Union winning the Battle of Brexit by keeping the U.K. locked into its death spiral like a peregrine falcon hanging onto a wolverine and getting torn to shreds.

So while we’ve been focused on the Turkish lira, it is the euro and pound that are the worrying ones as Europe now seems to be losing the real war, the one for investor confidence.

And as I pointed out in my previous article, major European banks are heavily exposed to Turkish corporate debt. They did this why? Incredibly low interest rates set by both the ECB and the Fed having them scrounge around the world dumpster diving looking for yield to replace their now destroyed lending businesses.

It’s clear now with gold under continued pressure despite record central bank buying (including those wily Russians picking nickels up off the ground to the tune of another 37.3 tonnes in February and March) there is a real scramble for dollars happening around the world.

It’s a tug of war between the need for dollars to keep collateral chains from breaking, and safe-haven buying on increasing distrust of government leaders having any clue as to what to do to stop them.

But this problem goes beyond the gold market. That’s just one aspect of it. The U.S. equity and bond markets are also part of this. Thursday, April 25, was one of those days that make you see clearly the forest for the trees.

Across the board the only thing bought, on balance, was the U.S. dollar.

Treasuries? Off 3 basis points.

Equity markets? Off in the U.S. and Europe.

Gold? Flat to negative.

As the euro and pound slid quickly out of their ranges, cash was simply stockpiled, deciding what to do for the weekly close.

Even the cryptocurrency markets saw a boost, with Bitcoin breaking above $5300 and threatening $6000 until New York opened up an injunction against Bitfinex and its stablecoin, Tether.

Moreover, emerging markets got crushed. Not just the Turkish lira but the Argentinian Peso as well as the Swedish Krona. Intel and 3M were pounded on poor guidance, Brent Crude pumped above $75 and dumped below $73 before the next New York open.

The only thing saving the markets from a complete dollar-induced rout was the U.S. GDP print of 3.2% for Q1. But don’t get too excited, MAGApedes, most of the beat came from inventory builds and a one-time positive shift in the trade balance.

Also, salt this to taste as these positive GDP beats are almost always quietly revised lower next month.

Oh, and the less said about Tesla in anything other than mocking terms, the better.

I glanced through the headlines at Zerohedge and it was literally a smorgasbord of dollar illiquidity news.

If the Riksbank in Sweden is calling for more QE, then the European Central Bank is out of ammunition. Germany is sliding quickly into recession as car sales fell off a cliff. German exports collapsed in February by 1.6%, well below expectations.

This breakout in the U.S. Dollar Index is only the beginning of a summer of pain for a lot of people. And we’re still a month away from European Parliamentary elections.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.