As our chief investment strategist, Adam O’Dell, pointed out … 2023 was the Magnificent Seven’s year.

The seven largest U.S. tech stocks (AAPL, AMZN, META, TSLA, GOOGL, MSFT and NVDA) accounted for a massive chunk of the S&P 500’s 24% gain and the Nasdaq Composite’s incredible 43% rally in 2023.

Of course, what goes up can also go down — as we saw with the broader index losing 1.6% on Tuesday following a downgrade to Apple Inc. (Nasdaq: AAPL) stocks.

While these seven stocks pushed the market near new highs by last year’s end, the biggest question for investors in 2024 is: Will it continue?

Magnificent 7 Head Major Market Rally

Throughout 2023, the S&P 500 rallied 24%, but much of that rally was due to the rise of these Magnificent Seven stocks.

If you take those stocks out of the equation, that rally was much more muted:

Source: S&P Global Market Intelligence.

As you can see, if you take the Magnificent Seven out of the S&P 500, the index only rose about 7.3%.

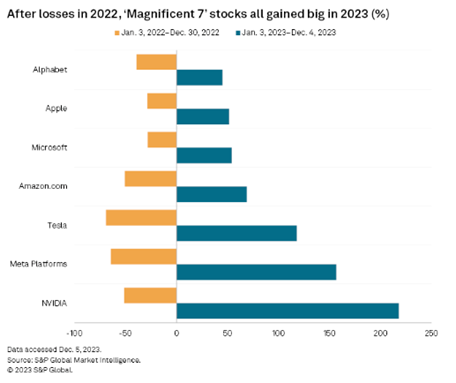

And the meteoric rise of these seven stocks is highlighted even more if you take into account how they performed the year prior:

Source: S&P Global Market Intelligence.

Hype over artificial intelligence coupled with the Federal Reserve warning a “higher for longer” period on interest rates pushed these stocks higher … along with the broader market.

They are considered safe in high interest rate environments because these companies carry less debt relative to their cash flow … and the cash they do have is earning higher interest rate yields.

But that environment is changing … and so is the S&P 500 investment landscape.

The Rest of the Market Is Catching Up

Looking at the full-year gains of the Magnificent Seven stocks is impressive.

But if we zoom in to just the last two months of 2023, the difference isn’t nearly as dramatic:

Source: S&P Global Market Intelligence.

The full index rose 11% to close out the year, but if you take out those seven big stocks, the gain was around 10.8%.

Once the Fed hinted at potential rate cuts in 2024, bond yields started to fall and the remaining 493 stocks in the S&P 500 started to look just as — if not more — attractive as those seven big names.

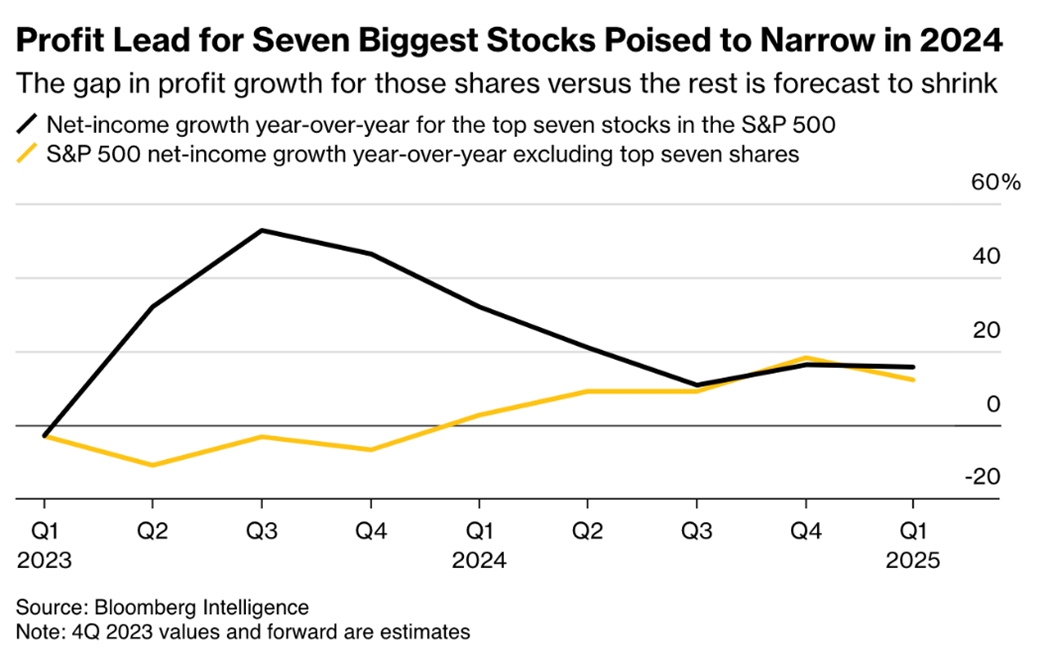

Looking ahead as we kick off 2024, one big comparison stands out.

The net income gap between those seven large stocks and the rest of the S&P 500 is projected to shrink dramatically by the end of the year.

By the third quarter of this year, Bloomberg Intelligence projects the net income growth of the seven big stocks will fall more in line with the rest of the S&P 500.

And when interest rates do come down, those stocks hit hardest by high rates (think regional banks, consumer staples and utilities) could get a big boost.

One Last Wrinkle for the Magnificent 7

Another factor to consider with the Magnificent Seven is valuation. Because of their massive rise in 2023, the average price-to-earnings (P/E) ratio of each of these stocks is now above 50, according to Apollo Global Management Chief Economist Torsten Slok.

To put that in perspective, the average P/E ratio of the tech market leaders during the dot-com crash was 63.

Bottom line: These Magnificent Seven stocks will continue to influence the direction of the market as they make up nearly 30% of the overall S&P 500.

But they’ve reached stratospheric valuations while the rest of the S&P 500 stocks continue to trade for what they’re actually worth.

I wouldn’t expect a repeat performance from the entirety of the Magnificent Seven in 2024.

The good news is this opens the door for smaller stocks to outperform. Investors looking for growth will turn to smaller companies trading at more reasonable valuations.

And if you’re looking for a guide to show you some of the best small caps around, Adam has you covered with 10X Stocks. Click here to learn how to gain access to his top recommendations.

Stay Tuned: New Year, New Stocks

Tomorrow, our managing editor, Chad Stone, is going to have some fun with our proprietary Green Zone Power Ratings system.

Since New Year’s resolutions are top of mind for all of us right now, Chad is going to explore how some related stocks rate in Adam’s system.

If you’ve ever thought about buying gym stocks around January 1, you won’t want to miss this one.

Until then…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets