Is it a good time to buy sports betting stocks? Here’s what Green Zone Power Ratings says…

It’s a good time to be a sports nut … for the most part.

We’ve got the World Series opener between the Dodgers and Yankees later tonight, along with NFL, college football, NBA and NHL (Go Panthers!) seasons in full swing now.

If the “Big Four” leagues aren’t enough, Lionel Messi is hitting the pitch in his first MLS playoff game tonight, and the most compelling Formula One season in years is reaching a climax.

Every day is chock full of compelling match-ups and must-see drama.

But watching sports these days comes at a price — and not just the hefty subscription packages that give you access to your favorite team’s coverage.

I’m talking about sports betting advertisements…

If you live in a legal state (and even if you don’t), you’re bombarded with ads for FanDuel, DraftKings, Underdog Fantasy, ESPN BET … the list goes on.

It’s clear that sports betting is becoming a massive industry, but is it a lucrative investing idea?

I’m Not a Fan

I’m not a fan of sports betting.

To me, sports are entertainment. It’s a chance to watch athletes at the top of their game attempt seemingly impossible feats.

Bracing through the highs and lows of a championship run is enough of a tax on my emotions. I don’t need to add fretting about an over/under into the mix. My heart might explode…

But I realize sports betting isn’t going anywhere. With 38 states now offering legal sports books in some form, revenue is booming.

In 2018, sports betting revenue hit $430 million. That number has soared to just over $11 billion in 2023.

We all have a choice in what we do with our money. If you get a kick out of placing a wager on the Falcons winning the Super Bowl (I can dream) or if Lebron James will rack up 10 triple-doubles this season — more power to you.

I’ll stay on the sidelines and see if one of the top sports betting stocks is worth your money instead.

Let’s see what Green Zone Power Ratings says…

How 2 Sports Betting Stocks Rate

FanDuel has been a top dog in fantasy sports and sports betting for years. Founded in 2009, the site now boasts 12 million registered users.

In May 2018, Paddy Power Betfair (now Flutter Entertainment) merged with FanDuel as sports betting legalization spread across the U.S. Since that acquisition, shares of Flutter Entertainment PLC (NYSE: FLUT) have almost doubled from around $119 to north of $228 today.

But Green Zone Power Ratings isn’t buying the hype…

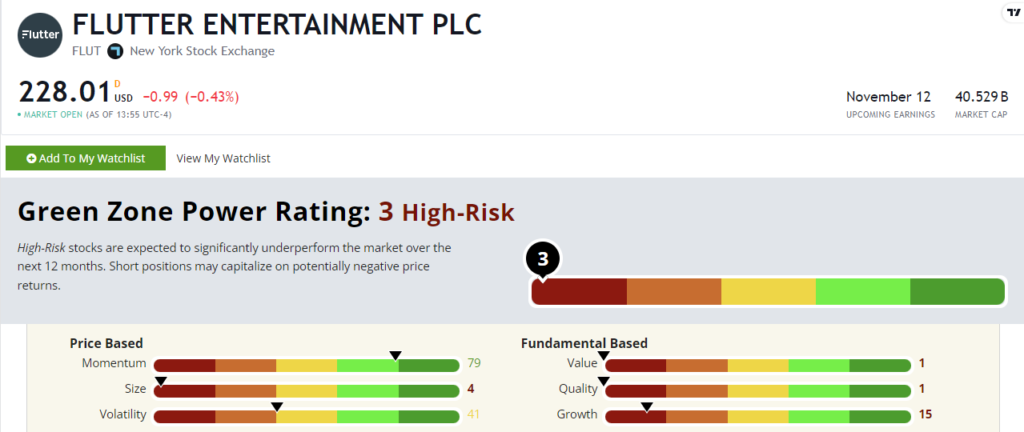

FLUT rates a “High-Risk” 3 out of 100 in our proprietary system. Stocks in this category are slated to underperform the broader market over the next 12 months.

Flutter stock’s Momentum is solid at 79. FLUT has gained 45% over the last year, beating the S&P 500’s 36% gain.

But the rest of FLUT’s factor ratings are a huge red flag. It rates a 1 on both Value and Quality and a 15 on Growth.

On Value, FLUT has negative price-to-earnings, price-to-sales and price-to-book value ratios. This means the company is losing money, which is not a good thing.

Relative to Quality, the company does not register returns on assets, equity or investments, nor does it have positive gross, net or operating margins.

The bottom line is that this company is swimming in red ink on its balance sheet.

These low ratings on fundamental factors tell me that the company is facing some headwinds, such as stiffer competition.

And speaking of competition…

The second stock I wanted to look at today is DraftKings Inc. (Nasdaq: DKNG).

Green Zone Power Ratings tells a similar story here:

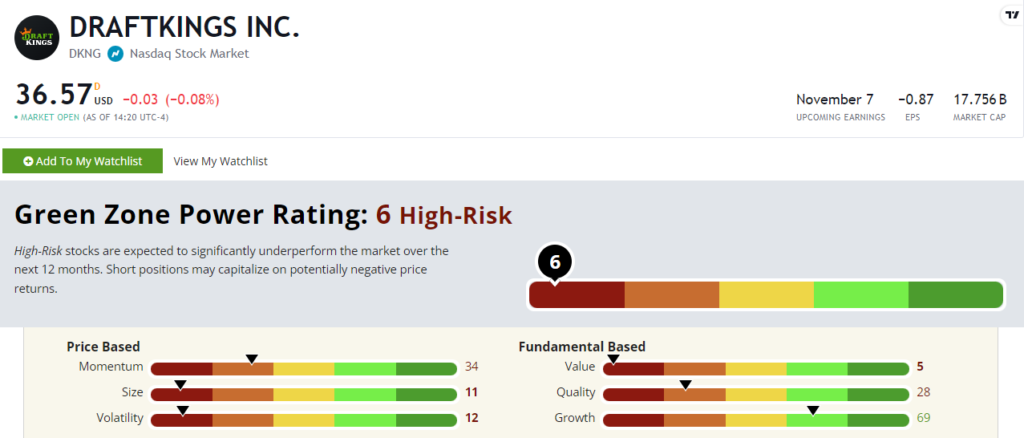

DKNG also rates “High-Risk” at 6 out of 100.

Its Growth rating (69) is solid. In DraftKings’ latest quarterly earnings, it reported $1.1 billion in revenue, a 26% year-over-year increase. Net income was also up 182% year over year to $63.8 million.

But that’s the only factor rating that’s in the green.

Looking at Momentum (34), DKNG is down 24% from its March 2024 high. Zooming out, the stock is almost 50% off its all-time high from March 2021!

And this is a massive stock with a $17.7 billion market cap, which is why it rates an 11 on Size. Larger stocks like DKNG need a lot of capital to really move the needle.

If you’re looking for a sports betting stock, Green Zone Power Ratings is saying to look for a better bet elsewhere.

Until next time,

Chad Stone

Managing Editor, Money & Markets