There’s no way to deny it now. The market is in serious trouble.

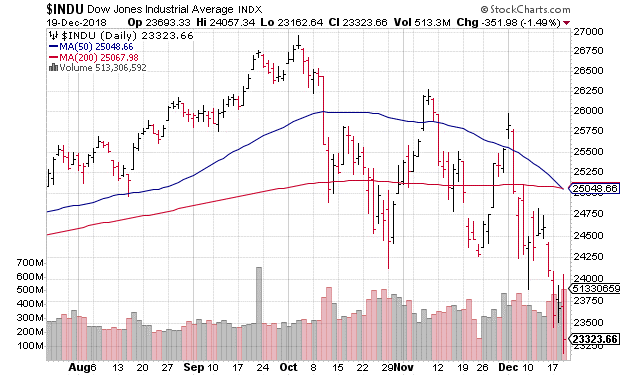

The Dow Jones Industrial Average (DJIA) “death cross” is here.

About a month ago, I warned of a technical pattern that had formed for several of the major technology stocks. The FAANGs — Facebook, Apple, Amazon, Netflix and Google (Alphabet) — had seen their 50-day simple moving average (SMA) cross below their 200-day SMA. These technical formations are widely known as death crosses, and they have bearish implications.

Essentially, when a short-term SMA moves below a long-term SMA, it means that recent price action has deteriorated significantly. To traders that deal with technical analysis, a death cross is bad news and a sign that more losses are on the way. In other words, investors have started demanding lower prices for these stocks.

This development was eventually bound to happen for momentum plays like the FAANGs. After all, they can’t stay red hot forever. The problem is that the demand for lower stock prices was infectious. FAANGs were market leaders for the last few years of the 10-year bull market. When their leadership evaporated, so too did the market’s supports.

Shortly after the death cross in FAANGs, one occurred in both the Nasdaq Composite and the S&P 500 Index. The Nasdaq cross was inevitable given the circumstances, but the S&P 500 cross hit technical market traders hard. The S&P is widely considered an indicator of the broader market and the strength of the U.S. economy. A death cross on the S&P 500 is tantamount to predicting a market recession to some degree.

Despite these warning signs, Wall Street remained positive, by and large. While the Nasdaq and the S&P 500 had been dealt a serious blow, the Dow Jones Industrial Average was still holding on. There was a chance things wouldn’t get too bad.

That all ended this week.

While the Nasdaq is a barometer for the tech sector, and the S&P 500 is widely viewed as a gauge of the broader U.S. economy, the Dow is a market sentiment indicator. By its nature, the Dow is a curated list of essentially the most popular U.S. companies. They are not selected by market capitalization, sales, performance or any other such measure. They are selected for their representation of a popular cross-section of all U.S. businesses.

The Dow, despite all of its history, is the single biggest U.S. market sentiment indicator. As long as market sentiment remained neutral to bullish, there was a hope that investors would eventually bid prices higher and the market would rebound.

The Dow death cross changed that market outlook. It means the popularity contest has been lost. It means stocks are out of the driver seat as an investment asset class. Money is moving elsewhere: bonds, gold even cash. Anywhere but stocks. Market sentiment has officially soured.

There is some irony in the timing for the Dow death cross. Yesterday, the Federal Reserve hiked interest rates for the fourth time this year, bringing the official rate to a range of 2.25% to 2.5%. The Fed also projected two more rate hikes in 2019. While this was down from prior expectations of three hikes, it clearly wasn’t enough to salvage market sentiment.

The irony lies in the fact that the Fed acknowledged that the U.S. economy is softening.

“Despite this robust economic backdrop and our expectation for healthy growth, we have seen developments that may signal some softening,” said Chairman Jerome Powell.

The writing on the wall is bold and clear. President Donald Trump warned ahead of the rate hike that it was the wrong signal to send. He urged the Fed to tread more cautiously “before they make another mistake.”

As far as the market is concerned, that mistake was yesterday’s rate hike. The Dow death cross confirmed it.