It’s so old it’s new again.

Today, we’re going to take a look at a stock that is simultaneously older than dirt and brand spanking new: premier chemicals–maker Dow Inc. (NYSE: DOW).

Dow, in its current iteration, started trading in 2019. But this is after a whirlwind that saw its predecessor merge with rival DuPont. The new entity spun off some of its combined assets to form the company we know today.

The original Dow was founded in 1897 and sold only bleach and potassium bromide. So, today’s Dow, which is a global leader in specialty plastics, packaging, coatings, adhesives, paints and more, has come a long way.

Dow has had a fantastic run over the past year, as its shares have more than doubled from early pandemic lows.

Dow Surged off March 2020 Lows

And as the global economy comes roaring back after more than a year of on-again, off-again lockdowns, I believe more gains are coming.

Dow Inc.’s Dividend Is Young

Let’s talk dividends.

At current prices, Dow yields 4.1%, which makes it one of the highest-yielding stocks in the S&P 500. We don’t have a lot of dividend history here, given that the new Dow only started paying a dividend in May of 2019. But the old Dow regularly raised its payout, and if I’m right about the industrial economy roaring back, we can expect more dividend hikes in the future.

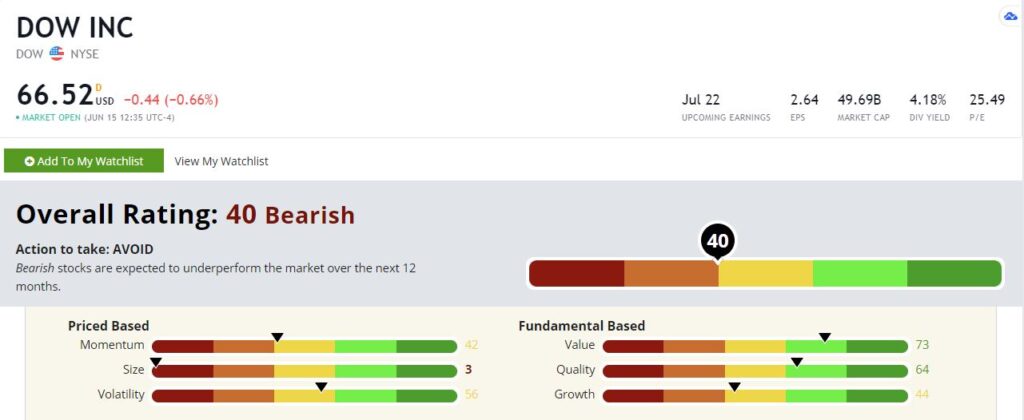

You know the drill. Whenever we look at a stock, we like to use the lens of our Green Zone Ratings model. This forces us to be objective and to leave any emotional attachments at the door. Chief investment strategist Adam O’Dell developed this system to easily look at the cold, hard numbers.

Dow Inc.’s Green Zone Rating on June 15, 2021.

Well, at first glance, Dow doesn’t look so hot. It rates a 40 on our composite score, which would make it a “Bearish” stock we’d normally avoid. This requires a deeper dive.

Why Is This Green Zone Rating Lower Than We’d Like?

As I mentioned, the new Dow has limited trading history, and that can throw some of our ratings off. Sub of our sub-factors use five or even ten years’ worth of data, and having gaps can really punish the score. So, let’s look at each factor separately.

Value — Dow rates highest on value with a rating of 73. That places it in the cheapest 27% of all stocks in our universe. Our valuation data is recent and is unaffected by Dow’s lack of trading history. Perhaps most encouraging here is that, despite the nice run in the stock price, by some metrics, the stock has gotten cheaper. It rates a 98.6 on the sub-factor that measures improvement in the price-to-cash flow ratio.

Quality — Dow also rates well on quality, at 64. This is despite being punished on several of the sub-factors. We measure returns on investment, assets and equity over varying time horizons, one of which is five years. A rating of 64 is great in its own right. But it’s very safe to assume this rating could be considerably higher in a couple of years as our model has more data to work with.

Volatility — This stock rates slightly better than average on volatility with a rating of 56. The higher the score here, the less volatile the stock is. Dow is a cyclical chemicals stock, so it’s not surprising to see a relatively low score here. But the stock is also punished by the lack of trading history, as some of our sub-factors use 3- and 5-year averages. This is another factor that should improve as time goes by.

Growth — On the surface, the growth factor rating doesn’t look great at 44. But again, the lack of data on some of the longer-term sub-factors hurts. The sub-factors that use more recent data are very good for the most part. Dow rates an 88.3 on year-over-year earnings per share growth and a 72.2 on year-over-year revenue growth. Again, this is a cyclical stock, and growth will wax and wane within various stages of the business cycle. But as we get more data, I would expect the growth metric to improve.

Momentum — Dow doesn’t rate particularly well on momentum, and this is a strike against it for sure. With a rating of 42, this stock is below average. Taken in context with the rest of the ratings, it’s not a deal-breaker.

Size — And finally, we get to size. Dow is a large company with a market cap of nearly $50 billion. It rates a 3 based on size.

Bottom line: Overall, Dow Inc. is a cheap dividend stock that I believe is significantly underrated due to its lack of trading history. And frankly, it isn’t easy to find good stocks with yields over 4% these days. So, when we find them, we need to pounce!

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.