Many individual investors believe stocks gain an average of about 10% a year in the long run. That’s what experts tell them.

To find that average annual return, many sources take an average of all years. One source notes, “according to historical records, the average annual return [of the S&P 500 Index] since its inception in 1926 through 2018 is approximately 10%-11%.”

That tells us nothing about what to expect, as many investors have exposure to the stock market for many years.

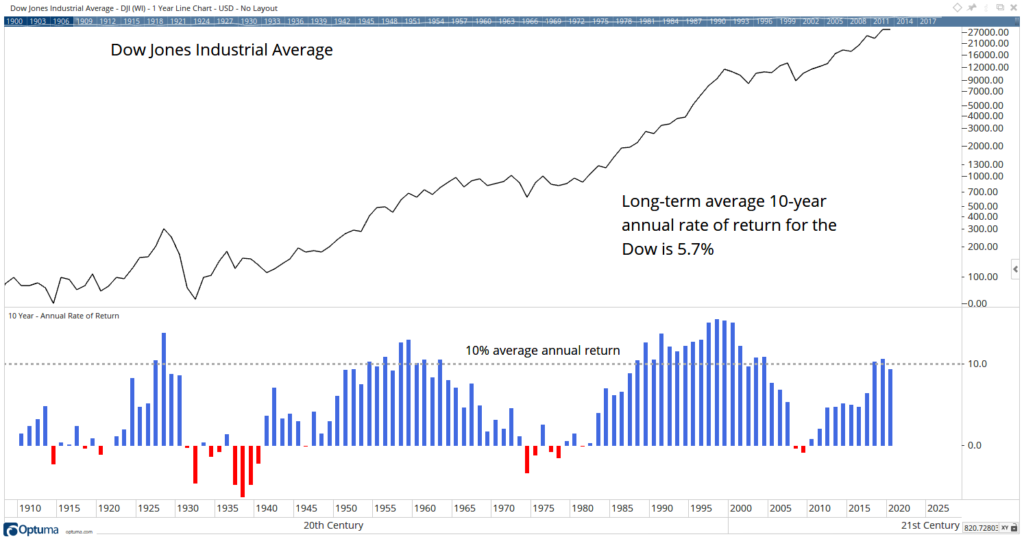

The chart below shows that the Dow Jones Industrial Average’s average annual return for holding periods of 10 years is 5.7%. This uses data back to 1900. Returns averaging 10% a year occur about 24.5% of the time.

The Dow Jones’ Average Returns

Source: Optuma.

Red bars highlight times when average returns over 10 years were negative. This happened 18 times since 1900, about 16.4% of the time.

Long-term investors will hold stocks for more than 10 years. That reduces the risk of losses.

But that doesn’t increase returns. The average annual return for a 20-year holding period is 5.4%. Average annual returns are also 5.4% for 30 and 40-year holding periods.

Returns averaging more than 10% a year are a historical anomaly, but it’s recent history. Big gains in the 1980s and 1990s created the perception that double-digit gains are normal.

That was a time when interest rates were dropping from historic highs. Tax rates were also being cut.

Looking ahead, these factors cannot be replicated in the next few years:

- Interest rates are at historic lows.

- Tax rates are also relatively low. Increased government spending makes more cuts unlikely.

Investors should expect average long-term returns from a passive index investing strategy, about 5-6% a year. To earn more than that, aggressive, active trading strategies are necessary.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.