Our publisher said it best while mulling over the downtrodden market in one of many meetings we have throughout the week:

“This stock market sucks.”

Not the most graceful response, but it was accurate.

It got me and the rest of the Money & Markets team thinking about market downturns and the kinds of opportunities they create down the road.

So, we started digging, and we found that a bear market is the perfect catalyst for certain stocks to soar higher. You just have to know where to look.

I’ll show you that even when the market is down, there are still profits to make.

The Market Is Down, But You’re Not Out

April showers are supposed to bring May flowers.

But that hasn’t been the case for the stock market.

Record high inflation, a slow reaction by the Federal Reserve and a war in Ukraine are just some of the factors pushing the market down.

Despite a bump up last week after the Fed announced a 50-basis point rise in interest rates, the S&P 500 couldn’t hold the rally and is down around 17% from the start of the year.

Other indexes haven't fared better:

The table above shows the total returns of the big three indexes (S&P 500, Dow Jones Industrial and Nasdaq Composite) over different time frames.

As you can see, all three indexes are down between 11.8% and 27.7% since the beginning of the year.

Bottom line: It’s clear that we are in a market downturn, but it isn't time to panic.

This Isn’t the First … It Won’t Be the Last

Just two years ago, stocks suffered one of the most prolific drops in history due to the COVID-19 pandemic … dubbed the “coronacrash.”

The Dow Jones Industrial Average dropped 31.68% from a high in February 2020 to its low set in mid-March 2020.

But after the market reached that trough, stocks started to rally again.

Market Downturns Are a Catalyst for Certain Stocks

In the market, just as things go down, they also go back up.

The aftermath of the 2020 coronacrash was no different.

Several stocks saw a massive run-up in the months following one of the biggest — and most sudden — market drops in history.

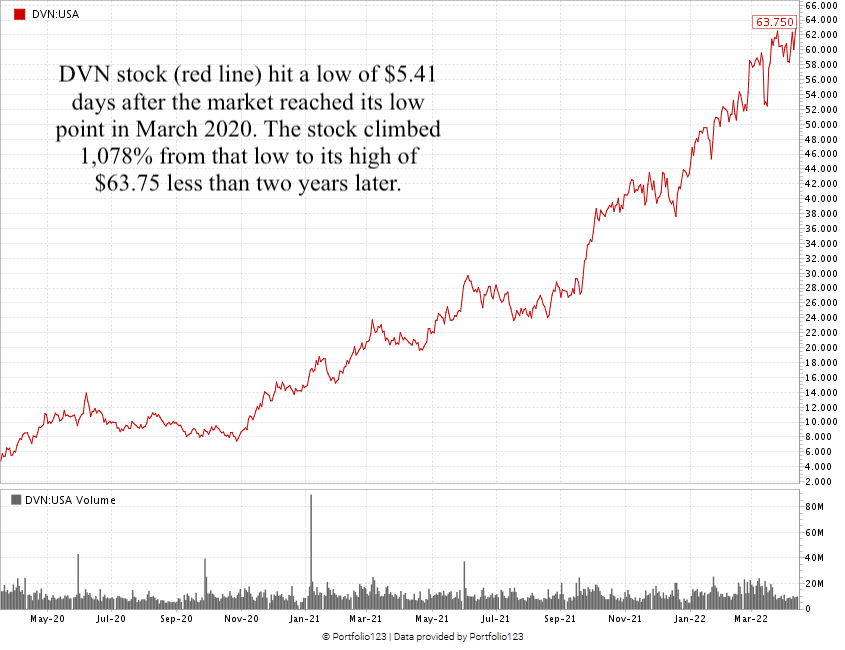

Devon Energy Corp. (NYSE: DVN) is just one example.

DVN’s 1,000% Recovery Rally

The energy company hit a low of $5.41 just two days after the Dow Jones Industrial Average bottomed out during the coronacrash.

Then DVN skyrocketed 1,078% to reach a record high less than two years later.

DVN rode the energy bull market mega trend that carried into 2022. Energy stocks have gained around 123% since June 2020!

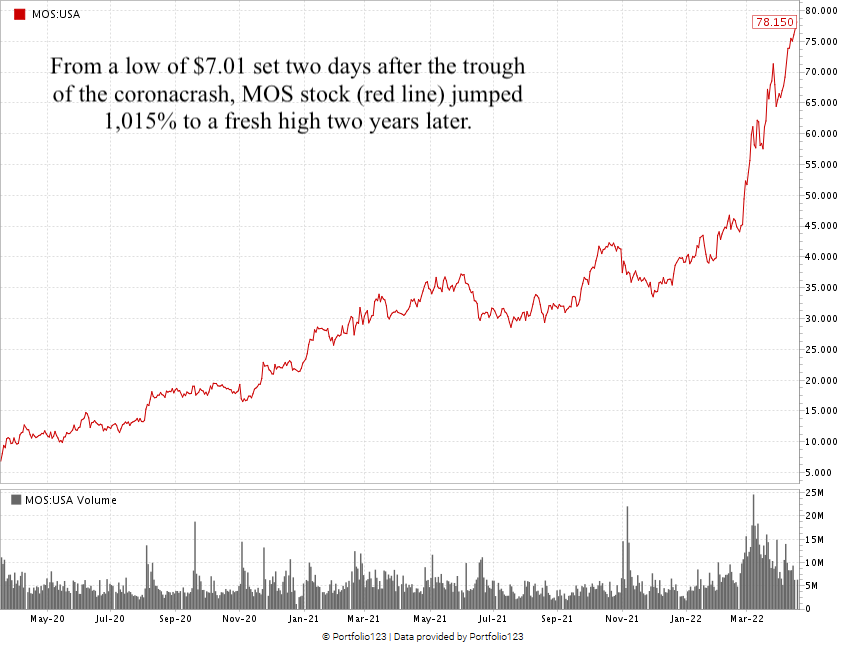

The Mosaic Co. (NYSE: MOS) did the same.

Commodity Mega Trend Pushes MOS 1,000% Higher

MOS is a fertilizer company based in Tampa, Florida.

From a low of $7.01 per share set the same day as DVN, MOS stock jumped 1,015% to an all-time high just two years later.

The mega trend here is related to the cost of fertilizer. Supply and demand issues have driven retail fertilizer prices 68% higher in the last year alone. As natural gas prices have jumped, so has the cost of the nitrogen used to create fertilizer.

So, we know that the market goes up and down… Right now it’s going down.

But certain stocks within powerful mega trends will come out of this turmoil even stronger.

Bottom line: Chief Investment Strategist Adam O’Dell isn’t turning his back on this market. Instead, he’s identified a strategy to help you find profits as these stocks come out of the downturn.

He, along with the rest of the Money & Markets team, is putting the finishing touches on this strategy that identifies stocks within mega trends with 1,000% potential. Sign up here and be one of the first to find out more. Remember, the market doesn’t look great now, but it won’t be like this forever … and we’re already identifying the next mega trends that will produce more 1,000% gains in the future!

Stay tuned.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.