I’ve never been big on waiting in line for a specialty coffee.

I’d rather make one at home. It’s cheaper and doesn’t take as long.

Coffee shops, however, are extremely popular. Reuters tells us there are more than 38,000 coffee shops in the U.S.

While these cafes are popular, some publicly traded coffee company stocks are not.

Today, I’m sharing the “High-Risk” stock Dutch Bros Inc. (NYSE: BROS).

With our Stock Power Ratings system, you can get to the heart of a company’s stock movement and financial picture to figure out if you should buy or sell.

A quick look helps you see the real picture of a company.

And Dutch Bros stock doesn’t look great.

The Ups and (Mostly) Downs of Dutch Bros.

Dutch Bros was launched in 1992 as a direct competitor to Starbucks Corp. (Nasdaq: SBUX).

It started as a single pushcart in Grants Pass, Oregon, but expanded to 603 coffee shops across 14 states.

The company also sells coffee beans in stores and online.

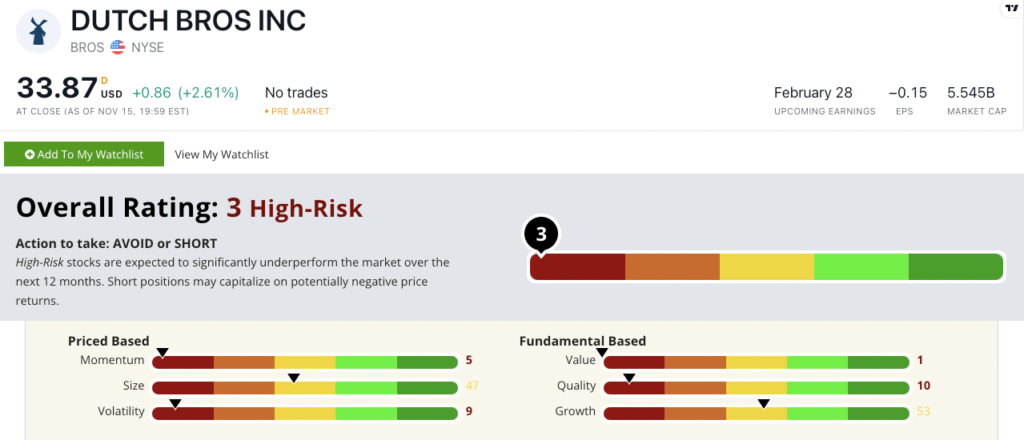

BROS stock scores a “High-Risk” 3 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market over the next 12 months.

Dutch Bros Stock: Sagging Momentum + Low Value

I use this space to tell you about impressive company performance.

That’s not the case for BROS:

- Despite increasing sales by 52.1% year over year, BROS still has negative earnings per share!

- Its total net loss for the quarter was $295 million.

That is why BROS scores a 53 on growth.

It scores in the red on four of our other five factors.

BROS has negative price-to-earnings and price-to-cash flow ratios, meaning it’s not making money. It scores a 1 on value.

The company has a return on equity of negative 6.3% and return on assets of negative 1%. That earns it a 10 on quality.

BROS doesn’t make a profit. And it’s considerably overpriced compared to its peers.

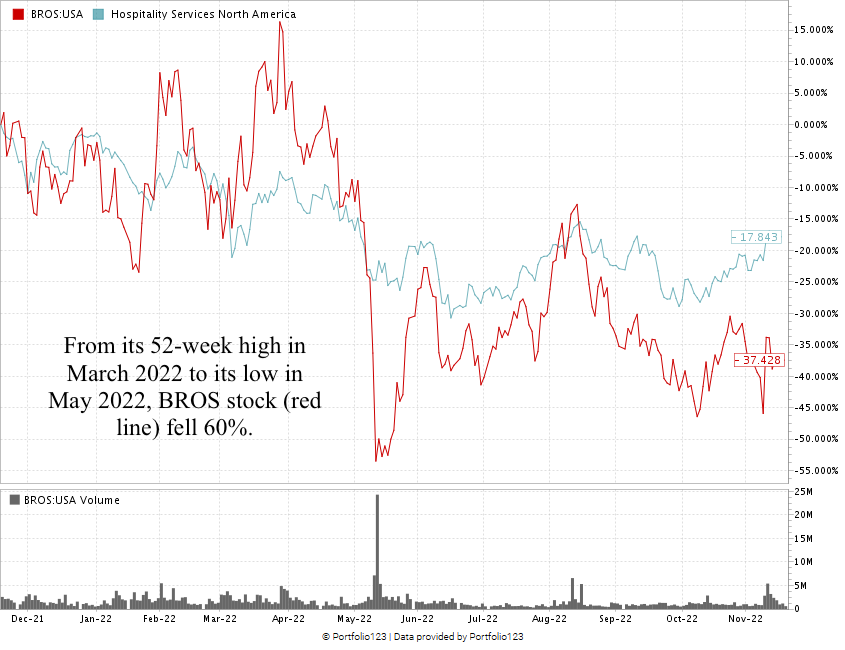

It’s been a rough 12 months for BROS. The stock is down 37.4%.

Stocks in the hospitality services industry only lost an average of 17.8% over the same time.

From its high in March 2022 to its low a little more than a month later, BROS stock dropped 60%.

Dutch Bros. stock scores an atrocious 3 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Coffee shops remain wildly popular in the U.S.

Even an increase in sales hasn’t pulled Dutch Bros. up to a level of profitability.

That’s one of the reasons why BROS is a coffee stock to stay away from.

Stay Tuned: One Exchange Exceeds Expectations

Tomorrow, we’re returning to our original Stock Power Daily form.

Stay tuned. I’ll share all the details on an investing platform that scores an incredible 97 on our Stock Power Ratings system.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?