My post-workday routine includes playing soccer on my phone via the FIFA Mobile app.

I’m not alone. Gaming isn’t just for kids, folks.

The COVID pandemic pushed video game sales higher as millions of Americans shifted to work from home.

A more flexible schedule with no commutes left them more time to play:

The chart above breaks down video game revenue in the U.S. by category.

In 2020, the U.S. market’s value of $27.3 billion increased 18.7% from 2019.

By 2025, the market will grow to $42.5 billion — a 55.7% increase from 2020 — as video games get even more popular.

Today’s Power Stock is one of the world’s largest video game distributors: Electronic Arts Inc. (Nasdaq: EA).

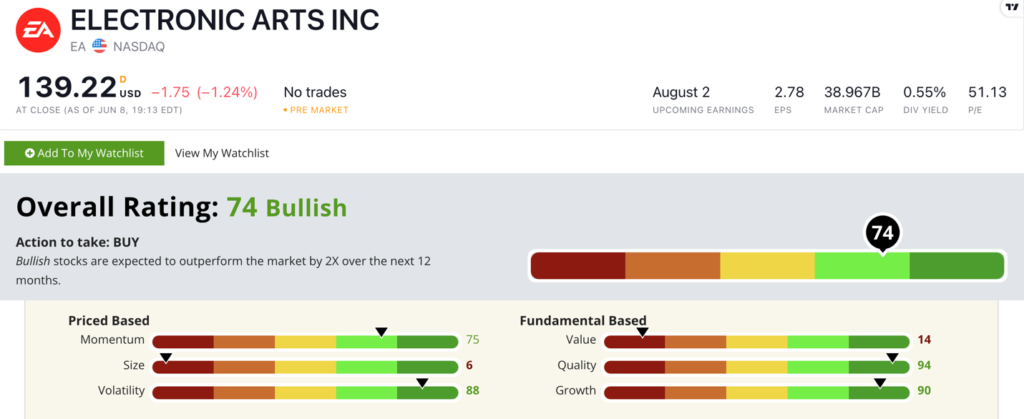

EA Stock Power Ratings in June 2022.

Electronic Arts creates and distributes console, PC and mobile games.

Its biggest titles include:

- Battlefield.

- The Sims.

- FIFA.

- Madden NFL.

- Star Wars.

EA stock scores a “Bullish” 74 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 2X in the next 12 months.

EA Stock: Massive Quality + Strong Growth Potential

EA’s recent fiscal year was a monster.

Here are two highlights:

- EA’s annual revenue was $7 billion — up 25% from a year ago.

- The company expects next year’s net revenue to increase from $7.6 million to $7.8 million.

EA has outstanding returns on assets, equity and investment when you compare them to the software industry’s averages.

The company’s return on equity is 10.2% — eclipsing the industry average of negative 24.2%.

Its one-year annual earnings-per-share growth rate is 99%, and its sales growth rate is 27%. It earns a 94 on our quality metric.

Electronic Arts grew its earnings per share by 203% from its most recent quarter to the same period a year ago.

Its sales jumped 32.8% in the same period.

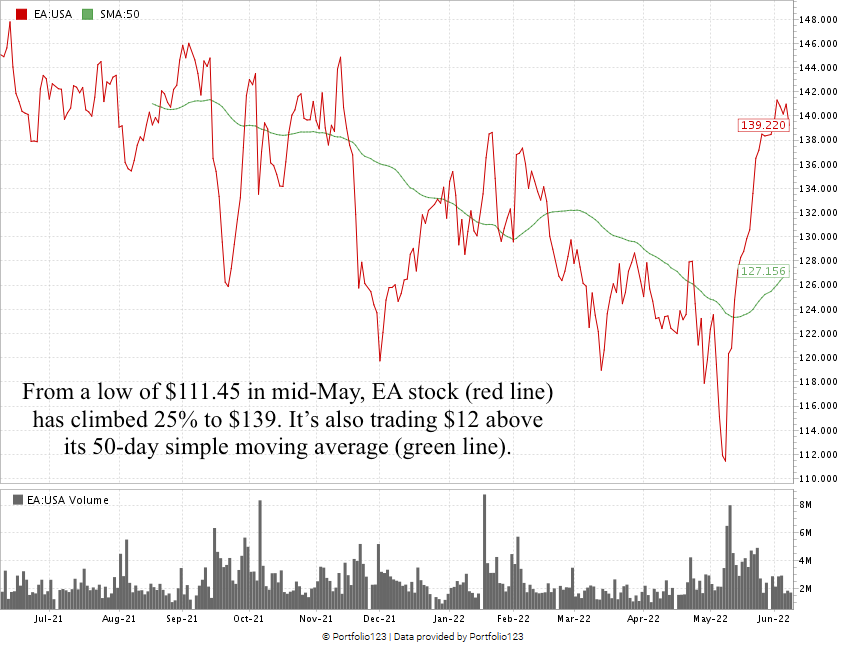

EA stock has made remarkable gains in the last four weeks. After hitting a 52-week low in mid-May, EA jumped 25% and trades $12 above its 50-day simple moving average.

EA is down 4% over the last 12 months. However, the software industry is down 12.3%.

Electronic Arts Inc. stock scores a 74 overall on our proprietary Stock Power Ratings system.

That means we’re “Bullish” and expect it to beat the broader market by at least two times in the next 12 months.

The demand for video games continues to build.

EA already has strong market share, and it will grow along with demand. This makes EA a strong contender for your portfolio.

Bonus: From last year to this year, EA doubled its annual dividend. Its current forward yield is 0.6%, meaning shareholders earn an additional $0.76 per share, per year just to own the stock.

Stay Tuned: Excellent Solar Stock to Buy Now

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a terrific solar stock for you to consider.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.