We rely on commercial vehicles to move goods from one place to another in the U.S.

Eighteen-wheel semitractor-trailers take large amounts of freight to a warehouse. Your Amazon driver takes it from there, using a van to deliver your packages to your front door.

None of this is possible without heavy-duty vehicles.

The chart above shows commercial vehicle sales dropped from 2019 to 2020.

In 2021, the industry got back on track, and this upward trend will get even stronger.

I believe sales will surpass their 2019 record by 2023 — and keep going.

Today’s Power Stock grew from a single truck dealership in Texas to more than 200 commercial vehicle dealerships in the U.S. and Canada: Rush Enterprises Inc. (Nasdaq: RUSHA).

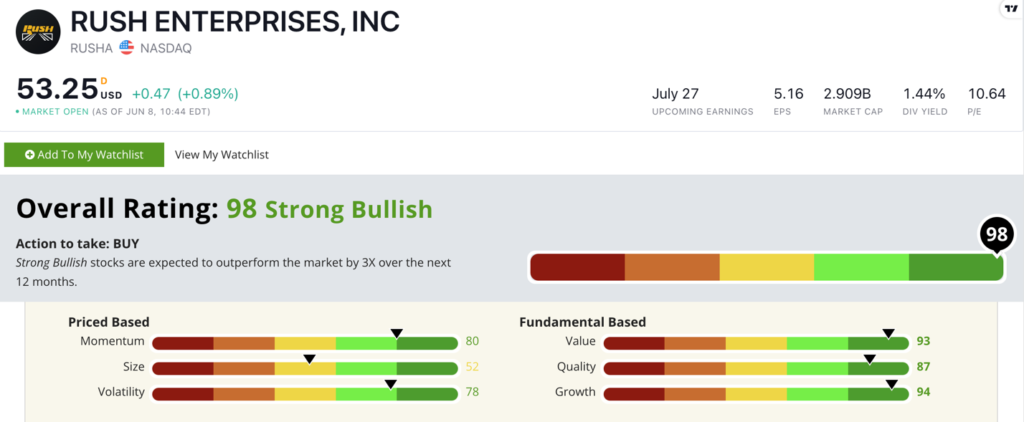

RUSHA Stock Power Ratings in June 2022.

Rush sells new and used commercial vehicles, ranging from school buses to construction cranes.

It also operates 140 truck centers that perform vehicle maintenance and offer repair services.

Rush Enterprises stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

RUSHA Stock: Growth + Value in One

Rush just had a solid first quarter. Here are two high points:

- It grew its revenues by 26.9% over the same quarter a year ago!

- Its aftermarket division — part sales and vehicle maintenance — recorded a 30.7% growth in revenue from first-quarter 2021 to second-quarter 2022.

Rush Enterprises rates high on our Stock Power Ratings system’s growth and value metrics.

Its one-year earnings-per-share growth rate is 104.2%, earning it a 94 on growth.

The stock’s price-to-earnings ratio of 10.6 is much more reasonable than the auto retail sector average of 14.2.

RUSHA’s price-to-sales ratio is a low 0.56 — half the average of its peers. These figures tell us that Rush Enterprises’ stock is inexpensive.

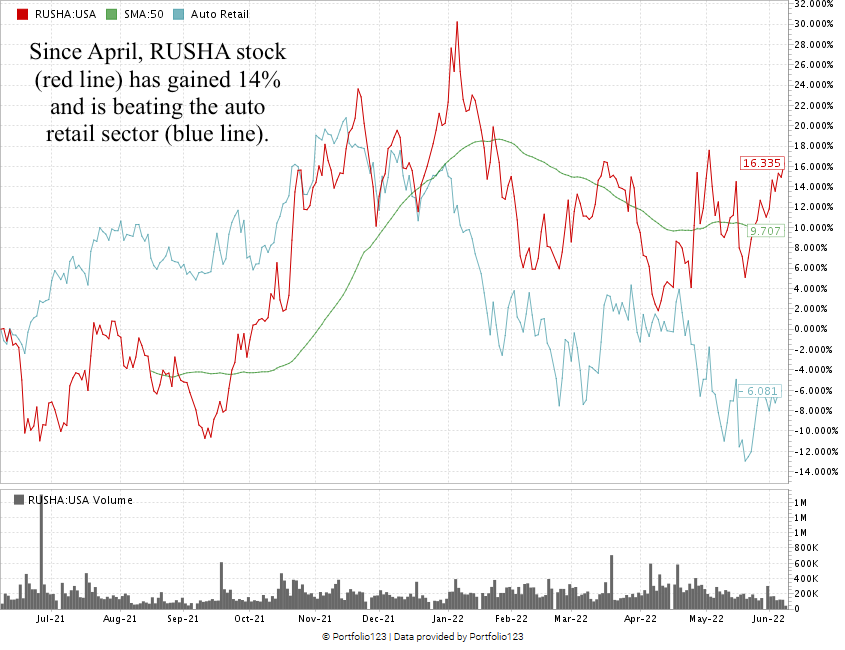

In the last 12 months, RUSHA stock has gained 16% and is hammering the auto retail industry — which is down 6.1% over the last 12 months.

It’s pushed 14% higher since April and now trades $3 over its 50-day simple moving average.

Rush Enterprises Inc. stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The commercial vehicle segment of auto sales is catching up after its COVID drop.

RUSHA is in a terrific position to capitalize on this trend … and investors who recognize it are too!

Bonus: The company’s 1.4% forward dividend yield translates to a $0.76 per share, per year payout if you own the stock.

Stay Tuned: Top Video Game Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on the No. 1 video game stock to buy right now.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.