If earnings are falling, how can stock prices rise? Investors are increasingly optimistic.

Earnings are one of the most important drivers of the stock market. In theory, earnings account for much of the changes in a stock’s price.

This is one of the ideas behind standard discount cash flow models to value stocks. These models estimate a company’s future cash flows. They assume a dollar in the future is worth less than today’s dollar because of inflation. Discounting reduces the value of future cash flows to reflect that fact.

These are widely accepted models that value stocks to the penny. Because they are widely accepted, current stock prices generally reflect a company’s future growth prospects.

Changes in prospects are immediately incorporated into prices when the information becomes known, which explains why prices often make a large move when a company announces earnings.

This theory does work sometimes. At other times, current prices are irrationally above or below the expected values.

Right now, market action conflicts with the models.

Q1 2020 Earnings

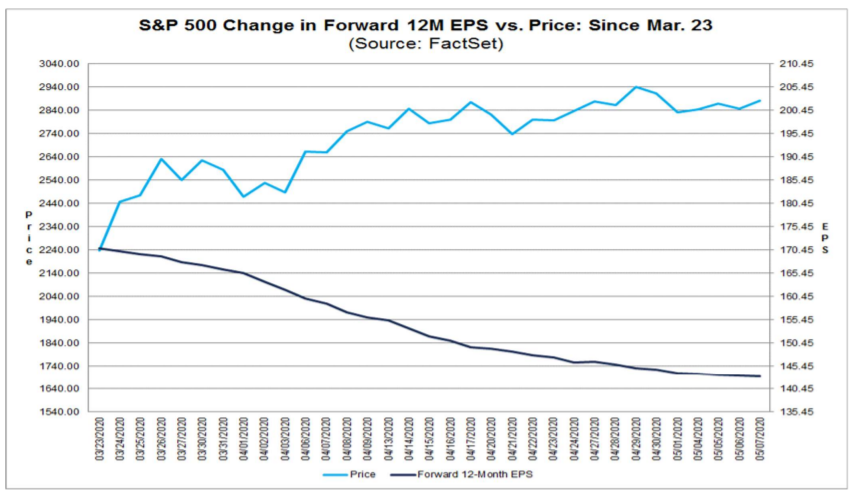

Stock prices have moved sharply higher since bottoming in late March, even as earnings estimates are dropping. The chart below shows the S&P 500 rose even as earnings estimates declined rapidly.

Source: FactSet

Earnings revisions match what companies are reporting. For the first quarter, companies in the S&P 500 reported earnings per share declined 13.6% compared to the same quarter a year ago.

Investors are acting as if the earnings decline is an aberration. That ignores a widely overlooked trend. This is the fourth time in the past five quarters that earnings declined on a year-over-year (YoY) basis.

In other words, earnings were already in a downtrend before the economy shut down. That downtrend is expected to continue.

Analysts are expecting earnings this quarter to fall 40.6% compared to 2019. YoY declines are also expected in the last two quarters of the 2020. That would mark four straight declines and two years of falling earnings.

If earnings are falling, how can stock prices rise? Investors are increasingly optimistic. In time we will know whether the optimism is justified or not.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru