Last week was all about the Federal Reserve.

Though it hiked interest rates for the first time since December 2018, the market took it in stride, rallying on the news.

That was encouraging. It shows that the market is comfortable with more rate hikes this year.

It will take more than the Fed’s rate hikes to pull stocks into a bear market.

With last week’s Earnings Edge stocks, RYAN dropped more than 10% on earnings. It was more than enough to trigger some profits if you took a straddle play ahead of it.

CMC didn’t do much on earnings, but the stock is trending higher.

This week we are looking at a bargain retailer Ollie’s Bargain Outlet Holdings Inc. (Nasdaq: OLLI) and car wash Mister Car Wash Inc. (NYSE: MCW).

While this may seem random, both are setting up for big moves in the weeks ahead. And we know earnings are always a volatile moment.

So let’s dive in and see what to expect from these consumer-focused stocks…

Earnings Edge Stock No. 1: Ollie’s Bargain Outlet Holdings Inc. (Nasdaq: OLLI)

Earnings Announcement Date: Wednesday, after the close.

Expectations: Earnings at $0.66 per share. Revenue at $513 million.

Average Analyst Rating: Hold.

Ollie’s is sort of like a Walmart, but even more discounted. It’s the Dollar Store variation. This company offers everything from food, electronics and health items to clothing, hardware and lawn products.

With inflation surging, you’d think discount stores would come back into focus more as consumers try to save money wherever they can.

That just hasn’t been the case for OLLI.

Shares are down 50% since August last year.

OLLI’s Falling Wedge Is Closing

There’s a falling wedge pattern in place with resistance (in red) and support (in green) closing in on each other.

Earnings this week could easily tilt the scales in one direction or another.

Maybe it’s the perfect time for consumers to begin looking for discounts, as the price of gas has surged in recent months. With all sorts of items feeling inflationary pressures, discount retailers should perform well in 2022.

I’ll be watching this week to see if the tide is changing for OLLI.

Earnings Edge Stock No. 2: Mister Car Wash Inc. (NYSE: MCW)

Earnings Announcement Date: Thursday, after the close.

Expectations: Earnings at $0.08 per share. Revenue at $188 million.

Average Analyst Rating: Outperform.

As we jump from bargain stores to car washes, the consumer remains in focus.

Both earnings reports this week will begin to tell the underlying impacts of inflation on the consumer economy. Car washes are in an odd spot.

First, we are just now getting back to normal. Back to the office, which means driving more and wanting a clean car around your co-workers.

That hasn’t been the case for almost two years.

Then there’s inflation. With the cost of gas surging, people will look to drive less. And if they are driving less, they likely are looking to save some money and get fewer car washes.

So this price chart makes sense — MCW is down 30% since last July.

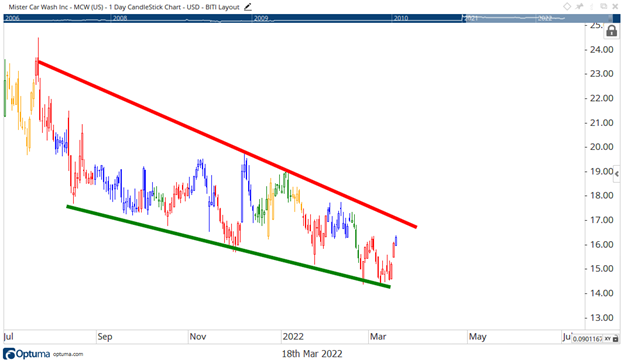

MCW’s Wedge Could Provide Breakout

MCW is also trading in a falling wedge pattern, though not as tight as OLLI’s. Still, the stock could just as easily break out this week on earnings.

That’s what I’ll be watching for with these two.

There are no short-term options for either stock. April 14 is the closest expiration, and both are fetching near a 10% premium for an at-the-money option. Without a good indication of the breakout direction, I simply prefer to wait until the breakout occurs.

Then I can jump in and ride the trend.

In a whipsaw market like this, patience is key.

Regards,

Chad Shoop

Editor, Quick Hit Profits

Click here to join True Options Masters.