By the end of July, more than half of the companies in the S&P 500 Index will report earnings for the second quarter of the year. By that time, we should know if analysts are correct to be optimistic.

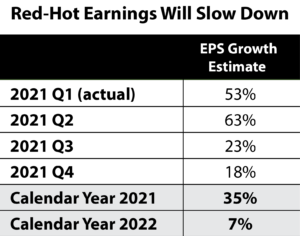

According to FactSet, earnings per share (EPS) should grow 63% compared to the same quarter in 2020.

It’s not surprising that earnings will be up compared to the three months starting in April 2020. In mid-March, policymakers imposed a 15-day pause to slow the spread of the coronavirus. At the end of March, policymakers extended the pause for another 30 days. More than a year later, the economy is still recovering from the shutdown that slowed the economy in the second quarter of 2020.

But recovery has been rapid in some parts of the economy. Large-cap companies that are part of the S&P 500 have largely recovered. This can be seen in EPS growth of 53% last quarter and this quarter’s even stronger expected rebound.

Rapid earnings growth like that is not sustainable, and the chart below shows that EPS growth should be in line with its long-term trend by the end of 2022.

Post-Earnings Season Sell-Off Is Possible

Since 1988, the median rate of EPS growth was 8.8%. The bounce in the coming earnings season is a temporary one, and in the long run, earnings growth is likely to average less than 10%.

That means stocks are overvalued.

In 2022, analysts expect EPS of about $210 for the companies in the S&P 500. If the index trades at 20 times earnings, an above-average price-to-earnings ratio, the S&P 500 would be at 4,200, which is about 2% below the current level.

Investors may think they will enjoy the next few weeks as they watch spectacular earnings reports. But there is a risk that the good news will lead to a sell-off as large investors sell on the realization that this is as good as it gets.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.