Most traders ignore seasonals, an indicator that is truly independent of widely followed indicators.

Instead, they follow fundamentals, using tools such as the price-to-earnings ratio and dividend yields to find value.

Popular fundamental indicators are ratios that include the stock’s current stock price. The fundamental factor derived from financial statements is only updated once every three months. That means these tools are highly correlated with technical indicators that are derived solely from price.

Many technical indicators are also based on prices. They are almost all calculated with formulas that add, subtract, multiply or divide the closing price. While the formulas can be complex, they are all based on the price action.

Seasonal tendencies are different. They identify how often a stock or index moves up during a given timeframe.

Some stocks will do better than others at different times of the year. The same concept applies to commodities where fundamentals are difficult to apply.

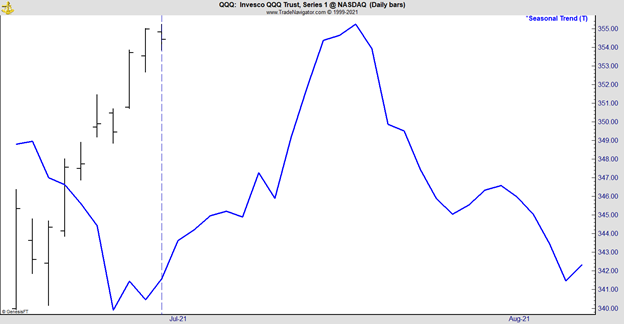

Based solely on the calendar, we are at the beginning of a bullish month for tech stocks. The chart below shows the seasonal trend for the Invesco QQQ Trust (Nasdaq: QQQ), an index that tracks the tech-heavy Nasdaq 100 Index.

QQQ Shows Tech Stocks Are Bullish in July

QQQ Offers a Seasonal Opportunity

Overall, QQQ is up about 70% of the time in July. The first half of the month is especially bullish. The seasonal trend in the ETF peaks on the twelfth trading day of the month. That’s July 19 this year.

It’s possible there is an underlying fundamental reason that explains the bullish seasonal in tech stocks and the Nasdaq 100 Index.

But seasonal traders don’t need to know the reason why the stocks go up. They can simply buy and know that they have an edge in the market based on the historical trading pattern of QQQ.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.