One of the few forward-looking economic reports is the monthly report from the Census Bureau on new orders for durable goods.

Durable goods are products designed to last at least three years. They include kitchen appliances, computers and industrial machinery used in factories.

New orders for durable goods are one of the few indicators that combine consumer and business confidence. This makes it an important leading economic indicator.

Consumers make big purchases when they’re optimistic about the future. That’s especially true for financed purchases. Financing shows confidence in the ability to make payments.

Pessimistic consumers delay purchases. Think of your household. If you’re worried about losing your job, you probably avoid new debt. This idea applies to the larger economy. Millions of households behave that way.

These same factors affect business decisions as well. Businesses make big purchases when managers are optimistic and defer decisions when they are pessimistic.

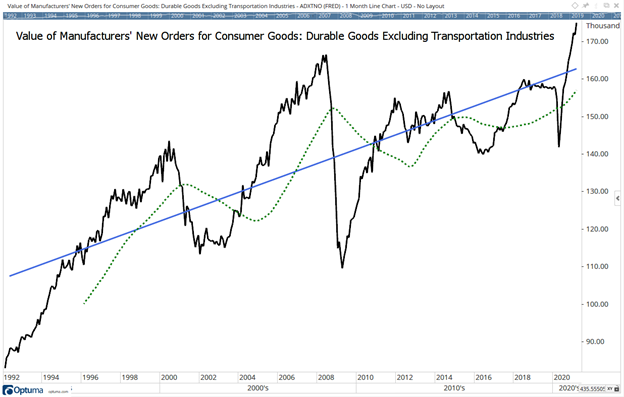

The long-term trend in durable goods orders is bullish. The chart below shows the trend in durable goods has been below trend for a decade.

New Durable Goods Orders Suggest Another Roaring ’20s

Source: Optuma.

Increased Economic Growth Could Herald a Roaring ‘20s

The blue line is a linear regression of the data. It shows the long-term uptrend in new orders required for the economy to grow in the long run.

A 48-month moving average of new orders is shown as the green dashed line. This MA shows the direction of the trend in the business cycle. The MA has been below trend since October 2010.

Without new orders, we know that consumers and businesses have pushed equipment and appliances past their expected useful life. They will need to make up for that with new purchases in the coming years.

That indicates the recent surge in new orders is the beginning of a long-term trend. The peak in new orders is most likely years in the future. That could benefit equipment and appliance manufacturers. That could drive an increase in productivity that would increase economic growth and deliver on the promise of the Roaring 20s.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.