Every month, the Federal Reserve completes a Survey of Consumer Expectations (SCE).

This survey includes data on the level of inflation that consumers expect. Survey questions ask about prices for food, gas, housing and education. The central bank also collects data on Americans’ views about job prospects, earnings growth and family finances.

Economists designed the SCE to be a representative sample of American households. Respondents answer the survey for 12 months and then rotate out — providing continuity to the data that other surveys don’t have.

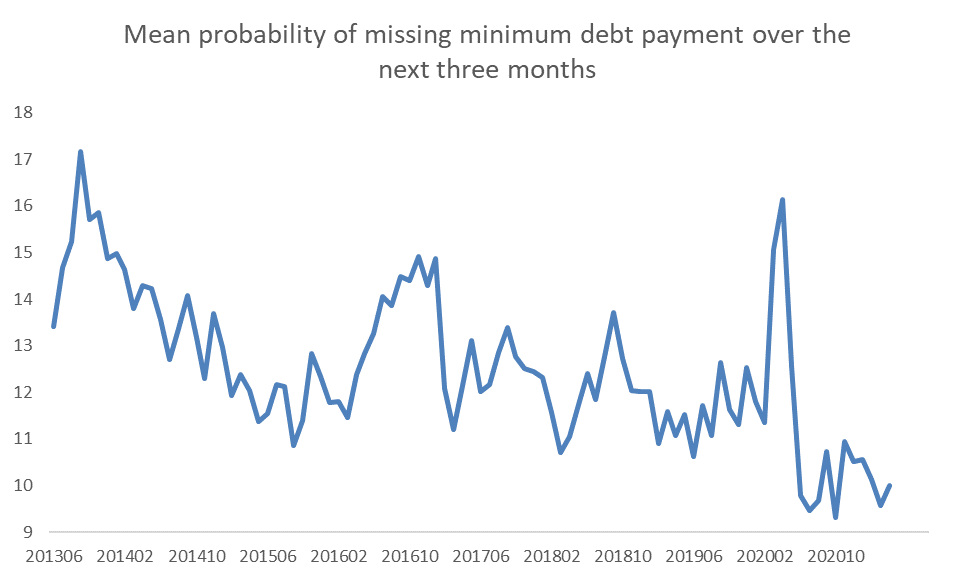

Many questions have been the same since 2013. Looking back, we can see that family finances, for example, have always been stretched for some. On average, 12.5% of families have expected to make a late payment in the next three months. You can see this data in the chart below.

Despite Shutdown, Late Payments Are at Record Lows

Source: NY Federal Reserve.

Late Payment Probability Says: Wrap Up Benefits

After spiking in April 2020 as the economy shut down, the probability of late payments has been below average. In fact, the percentage of families expecting to fall behind on their bills fell to record lows.

With unemployment above average, there is only one reason for the increased health of family finances: government transfer payments. Stimulus checks and expanded unemployment benefits have helped families pay their bills.

Unemployment benefits of an extra $300 a week were blamed for April’s worse-than-expected employment data. Digging through that report, it’s impossible to determine if that discourages potential workers from accepting jobs.

The SCE seems to provide a clearer picture. That extra $300 a week is helping families pay their bills, and many are in better shape than ever. This is good, but it’s not sustainable.

Now could be a good time for Congress to declare victory and wrap up the emergency programs. That could help get people back to work. It could also avoid a second recession caused by small businesses closing when they can’t find enough employees.

At some point, Congress needs to allow the economy to get back to normal. An increase in late payments will show that process is underway.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.