Industrial production reached an all-time high in July.

This is good news for the economy.

The Federal Reserve maintains an economic indicator that measures the output of manufacturers, miners and utilities.

In July, total industrial production increased 0.6%, reaching a new high.

The report showed strength throughout the economy.

The Fed’s Economic Indicator Turned Bullish

Manufacturing output increased 0.7% after falling 0.4% in June and May.

Miners increased output by 0.7%, offsetting a 0.8% drop in utilities.

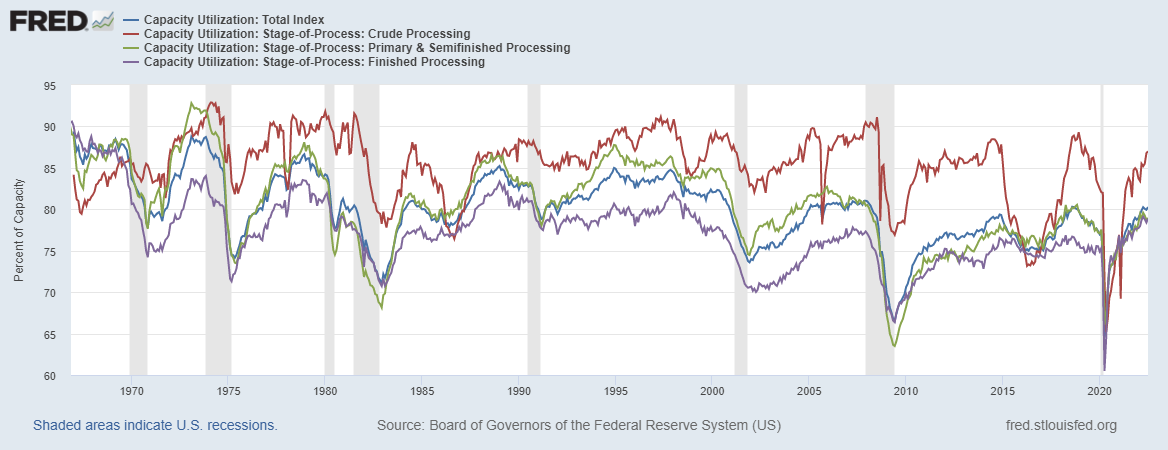

The Fed also tracks how much slack there is in the production process.

Manufacturing, mining and utilities require significant fixed investments.

They need plants and equipment in addition to raw materials to generate output.

The capacity utilization indicator measures the usage of that fixed asset base.

The Capacity Utilization Indicator

In July, the indicator increased 0.4%, reaching 80.3%.

That’s 0.7% above its long-term (1972 to 2021) average.

High capacity utilization can be a concern.

It indicates there is little slack in the economy, and that is not a problem that has a quick fix.

Building new factories or opening new mines or power stations can take years.

High utilization can be inflationary.

But the details of the report show some slack in the economy.

We aren’t out of the woods, but the chart below shows crude processing capacity (the red line), where producers refine materials, is at 87%.

That’s 2% above its long-term average.

High Processing Capacity Shows Slack in Economy

Source: Federal Reserve.

The industries stretched are miners and oil producers, while manufacturers still have room to grow.

Capacity at manufacturers is about 79%.

That’s below the long-term average of 81%.

Like most economic data, capacity utilization presents a mixed picture.

What Economic Picture Does Capacity Utilization Paint Now?

Raw materials are the first step in the supply chain.

There is some pressure there, but there is room for the economy to expand beyond that.

Overall, this data presents another challenge to policymakers.

Raising interest rates could force capital-intensive miners and oil producers to scale back expansion plans.

That increases the risk of inflation, countering the potential of higher interest rates to reduce supply and lower inflation.

Bottom line: The Fed is trying to find a balance, and the economy depends on its success.

P.S. My team and I have recently added my “Safety Cash” strategy to our Market Leaders premium trading service.

With this options income strategy, you know exactly how much you’re risking on each trade — down to the dollar. And by placing these trades every week, you can turn small, consistent gains into a considerable nest egg.

You’ll receive a free report with the full details of my “Safety Cash” strategy when you join Market Leaders. Click here for more information from my colleague and fellow Chart of the Day contributor, Mike Carr.

On top of that, you’ll also get exclusive access to Mike’s portfolio of the market’s strongest sectors — and a monthly options trade on one of his top picks.

For access to my weekly income trades and Mike’s portfolio for only $4 per month, click here to watch his presentation now.

Click here to join True Options Masters.