It’s election week. Let’s see what that means for investors and the stock market — if anything.

Also, I’m going to look at one company reporting earnings this week.

Here are some things investors should watch on Wall Street this week:

It’s Election Week

That’s right.

The wildest election in modern American history winds down on Tuesday. Millions of Americans will cast their vote for president, as well as for the Senate and House of Representatives.

While I don’t think the markets are going to be too driven by election results, I think this week will be one to watch for investors.

I talked about the post-election stock market in a recent episode of The Bull & The Bear podcast.

In research, I found that the markets may make short-term movements based on the outcome of the election. But in the end, it doesn’t really matter who wins the White House — the stock market balances out.

The biggest impact the election will have on the markets is dependent on how long the results take to drag out.

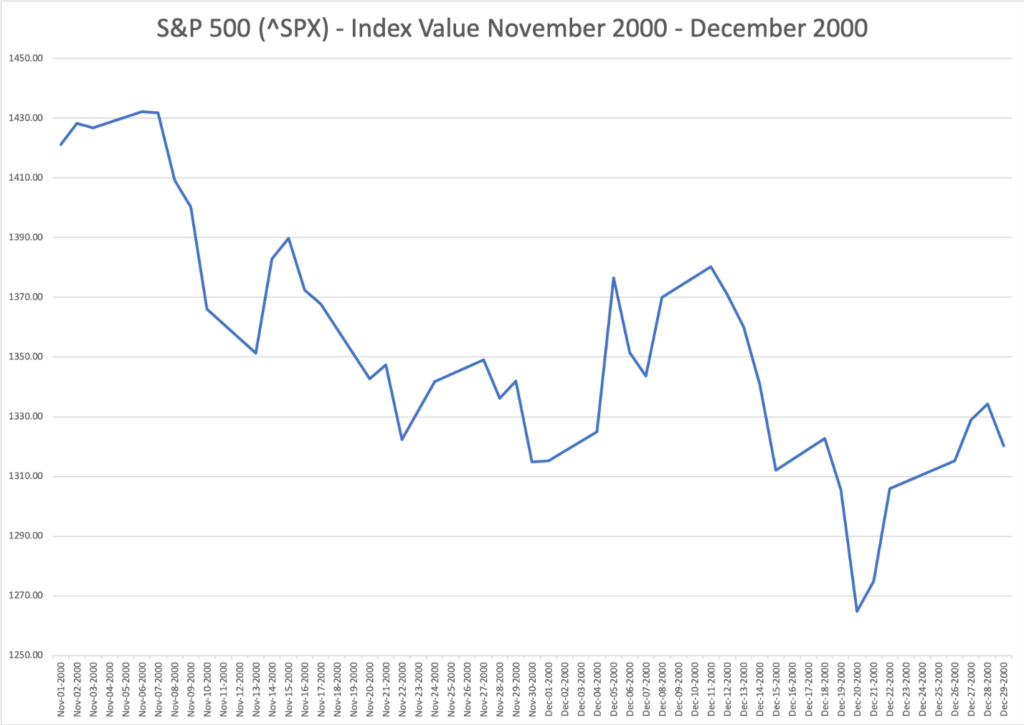

Take 2000 for example.

It wasn’t until December that Vice President Al Gore conceded the election to then-Texas Gov. George W. Bush after the U.S. Supreme Court halted the recounting of ballots in Florida.

From Election Day to the day Gore conceded, the S&P 500 fluctuated more than 11%.

The biggest thing for investors to watch for is uncertainty.

Markets don’t like uncertainty … as we clearly saw in 2000.

I think the markets will be more impacted by an increase COVID-19 cases, Congressional stimulus discussion and other factors before we see a serious impact from the election.

On the IPO Front

There are no initial public offerings (IPO) scheduled for this week.

Earnings to Watch

There are several more companies reporting earnings this week, but there is one I am watching closely.

On Monday, before the market opens, Clorox Co. (NYSE: CLX) will release its third-quarter earnings for the period ending September 30.

The reason I’m watching Clorox is because it has had a very strong year this year, thanks to COVID-19.

In fact, its revenue for the quarter ending March 31, 2020 was $1.98 billion.

That was an 11% jump from the previous quarter.

Big market retailers couldn’t keep Clorox products on the shelves for very long as their bleach wipes and sprays sold-out like hotcakes.

The company has had a nice run of earnings surprises as well.

In each of the last three quarters, Clorox has beaten Wall Street projections. And, in the second quarter of 2020, its actual earnings per share of $2.41 blasted those projections by 20%.

Consensus estimates for earnings this quarter are around $2.34 per share.

I think there is some logic that suggests Clorox’s earnings could be a bit lower than the second quarter, but I don’t see a massive drop anytime soon.

This doesn’t mean I think Clorox will make a big run in share price — price targets are as low as $177 and as high as $263 per share.

Clorox shares are hovering around $210 per share now.

I can see a realistic target of $225 per share, but it’s going to take some time for the company to reach it.

I also like the consensus estimates of around $2.34 per share in earnings for this quarter.

Money & Markets Week Ahead: Data Dump

Election week isn’t the only thing to keep track of.

It’s also another full week of data for investors to go over.

On Monday, the Institute for Supply Management (ISM) will release its October Manufacturing Report on Business.

In September, the report indicated that economic activity in the manufacturing sector notched its fifth straight month of growth.

The September Purchase Manager’s Index was at 55.4% — down 0.6 percentage points from the previous month.

A reading of 50 or higher indicates growth in the sector, while 49 and lower signify contraction.

All indicators in September were down compared to August, but forecasts have the purchase manager’s index reading 55.6 — slightly higher than September.

The manufacturing prices index is projected to be at 58.6 — down from September’s reading of 62.8.

ISM will continue to give numbers of interest to investors on Tuesday when they unveil their non-manufacturing reports.

These include all sectors, aside from manufacturing.

Activity, new employment and new orders all registered growth numbers in September.

Crude oil inventories and gasoline production figures will also come out on Wednesday.

The Federal Open Market Committee (FOMC) will conclude its two-day meeting for November on Thursday.

It’s widely expected the Fed will hold interest rates between 0.00% and 0.25%, as they have over the course of the COVID-19 pandemic.

There will be a press conference after the meeting concludes at 3:30 p.m. EST.

The data dump continues Thursday when the Labor Department releases its initial and continuing jobless claims.

Last week, claims were around 751,000. This was well below the 778,000 analysts projected.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out next week:

Monday

PayPal Holdings Inc. (Nasdaq: PYPL)

Waste Management Inc. (NYSE: WM)

Clorox Co. (NYSE: CLX)

Beyond Meat Inc. (Nasdaq: BYND)

Tuesday

McKesson Corp. (NYSE: MCK)

Thomson Reuters Corp. (NYSE: TRI)

Wednesday

Qualcomm Inc. (Nasdaq: QCOM)

Metlife Inc. (NYSE: MET)

Allstate Corp. (NYSE: ALL)

Franco-Nevada Corp. (NYSE: FNV)

Kinross Gold Corp. (NYSE: KGC)

Thursday

T-Mobile US Inc. (Nasdaq: TMUS)

AstraZeneca PLC (Nasdaq: AZN)

Bristol Myers Squibb Co. (NYSE: BMY)

General Motors Co. (NYSE: GM)

Friday

Marriott International Inc. (Nasdaq: MAR)

INmune Bio Inc. (Nasdaq: INMB)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.