I loved playing video games as a kid. I spent thousands of hours playing Super Mario Bros., The Legend of Zelda and a host of others. It was a major part of my childhood, ranking right up there with street baseball.

But my interest in video games fell to approximately zero the day I turned 16 and got a car. And it wasn’t a particularly nice car, I might add. It was a 1984 Pontiac Parisienne sedan with no paint, a broken radio and a ripped seat that perpetually stabbed a sharp spring into my right hamstring.

The freedom of driving that piece of junk far exceeded my interest in gaming.

But it seems the market has changed in the decades since. In fact, 89% of American console gamers are now over the age of 17, and over half of all gamers are aged 25 to 44.

Video games are a booming industry that took in $180 billion in revenues last year, which is more than four times what movie theaters make in a typical year. And competitive gaming — this means spectators watching other people play video games — has more annual viewers than the Super Bowl … by a wide margin.

Today, let’s take a look at leading video game maker Electronic Arts Inc. (NYSE: EA). EA develops games for consoles, PCs, mobile phones and tablets.

You’ve no doubt come across its titles (or your children have). It’s a leader in sports games, with the Madden NFL and FIFA soccer franchises. And it has a large catalog of popular titles and franchises, including: Apex Legends, Battlefield, Dragon Age and an assortment of Star Wars and Harry Potter-themed games, among many others.

Video games were a booming business before the pandemic. And you can imagine that having hundreds of millions of people confined to their homes was good for business in 2020. Long after the pandemic has come and gone, many of the habits and hobbies picked up during lockdowns will remain. And I’ll bet that gaming is part of that story.

Electronic Arts’ Green Zone Rating

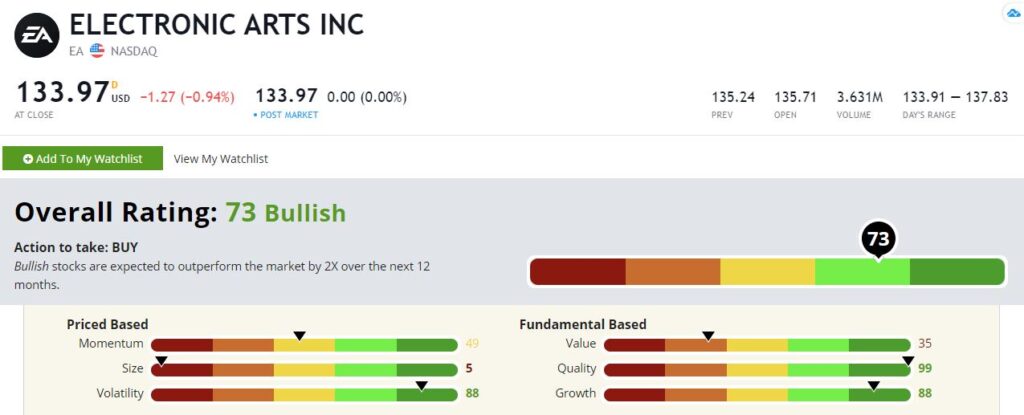

Let’s see how EA stacks up on Adam O’Dell’s Green Zone Ratings model. It sports an overall score of 73 out of 100, which puts it firmly in “Bullish” territory for us. Let’s drill down further.

Electronic Arts Inc.’s Green Zone Rating on February 26, 2021.

Quality — EA scores exceptionally well on quality, with a rating of 99. This isn’t surprising. Most software companies have “capital-lite” business models and outsized profit margins. These are the exact factors that lead to a high rating on this metric.

Growth — Electronic Arts also rates highly on growth at 88. Video games were already a booming business years ago, and the emergence of mobile gaming accelerated that trend. Then, add in the effects of a pandemic, and you have the pieces in place for a growth boom.

Volatility — EA also rates well on volatility, coming in at an 88. Our model prefers low-volatility stocks, so an 88 here means that EA is less volatile than all but 12% of the stocks in our universe. While the profits of individual video game companies fluctuate with the releases of new titles, profits for the industry as a whole are stable. This is not a cyclical business tied to the economic cycle.

Momentum — EA rates in the middle of the pack based on momentum with a score of 49. That’s not great, but it’s not awful. It shows that EA’s momentum is roughly in line with the broader market.

Value —Electronic Arts isn’t a great value at the moment, with a rating of just 35. It’s not uncommon for companies that rate high on quality to sell for a premium, and that is the case with EA.

Size — And finally, we have size. EA is a large company with a market value (number of shares times share price) of $39 billion. So, it scores a 5.

Bottom Line: With its “Bullish” Green Zone Rating, Electronic Arts is a smart addition to your portfolio. However, in Green Zone Fortunes, we found a “Strong Bullish” stock within the video game industry that we like even better. Instead of creating the games, it’s found a niche in the multibillion-dollar video game accessories market.

As online gaming continues to grow, so will this company’s clientele. And that means more profits for its investors.

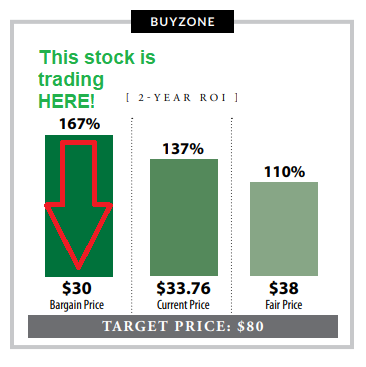

The recent dip in the markets gives us the chance to buy this stock at a bargain!

For more about this company, which rates a 99 out of 100 in our system, click here to find out how to get exclusive access to February’s issue of Green Zone Fortunes.

Along with our highest-conviction stock recommendations each month, you’ll gain immediate access to Adam’s Millionaire Master Class. Find out how Adam and I use the Momentum Principle to “buy high, and sell higher” today!

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.