As a newspaper editor, I learned a lot about life in rural communities.

One newspaper I worked for was in the middle of nowhere, North Carolina.

It provided awesome morning views of fog-covered mountains and fantastic river streams ripe for fly fishing.

But rural life comes at a cost…

Amenities like restaurants and technology weren’t as abundant as what I now have in South Florida.

Most notably lacking was fast internet connections. This was particularly noticeable in business.

According to a study commissioned by Amazon conducted by the U.S. Chamber Technology Engagement Center, more than 33% of rural businesses rely on in-person sales.

It’s because these businesses don’t have the infrastructure to generate sales online.

The Biden administration plans to build out rural internet infrastructure, giving less populated areas the same internet advantages as urban areas. And I found a company that will capitalize on that.

I’ll tell you about this high-growth stock in a bit.

First, let’s look at rural internet and where it’s going.

The Rural Broadband Challenge

Rural America is home to more than 20% of all Americans.

But more and more people are leaving rural areas to seek opportunities in more populated areas.

Lack of internet access is driving some of that migration out of rural America.

As part of his campaign pledge, President Joe Biden wants to expand broadband, or wireless broadband via 5G, to every American.

Rural Access to Digital Technology Is Lacking

As the Chamber study found, less than 45% of businesses in rural areas have “very good” access to digital technology.

What’s more is 55% of those surveyed said technology could help them grow their customer base, and 46% said conducting business online was an opportunity for their business to grow.

Having access to faster, more reliable internet allows Main Street businesses to flourish.

The challenge is getting them access.

Laying cables and building towers is especially challenging in areas like the mountains of North Carolina.

Ribbon Communications (RBBN) Is A Rural Solution

A roadblock in getting 5G internet speeds to rural areas is the infrastructure of rural network providers won’t support it.

Rural network infrastructure doesn’t support 5G speeds, which is a major roadblock for Biden’s plan.

That’s where Ribbon Communications Inc. (Nasdaq: RBBN) comes in.

The company provides internet service providers with the equipment they need to build out their networks.

Its products include optical and internet protocol equipment that are the backbone of fast and stable internet connections.

Ribbon‘s rural broadband initiative helps rural providers build out that crucial infrastructure, allowing blazing fast internet connections for customers.

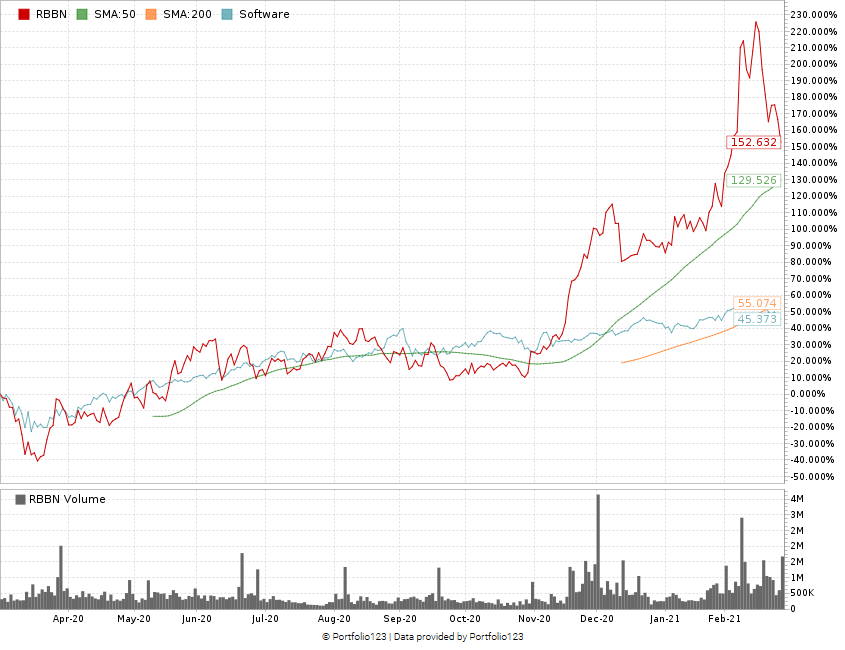

Ribbon’s Stock Price Caught Fire

After hitting a low of around $2 per share in March 2020, Ribbon’s stock jumped more than 448% to eclipse $11 per share in mid-February 2021.

The stock experienced the recent tech pullback as investors took profits and invested in higher-yield bonds and other sectors.

But Ribbon stock is still 332% higher than its March 2020 low, and the pullback has investors can now buy in at a cheaper price.

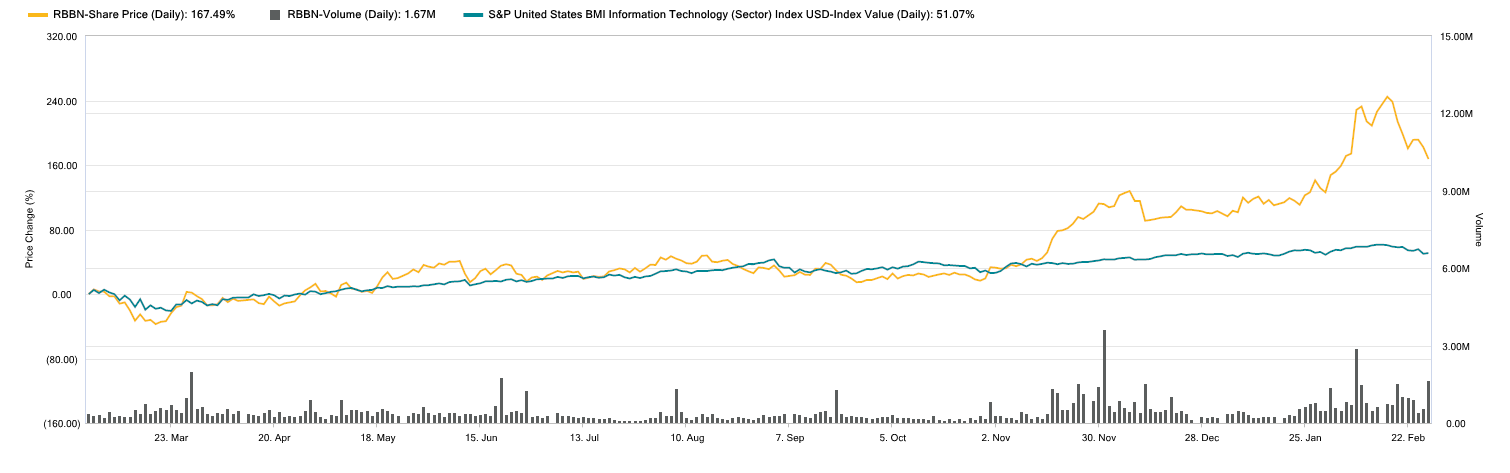

Ribbon’s stock continues to outperform the information technology sector by a wide margin.

RBBN Stock Triples the IT Sector

In the chart above, RBBN (yellow line) has a trailing 12-month gain of 167%. The S&P U.S. Information Technology Index (green line) has gained only 51% in the same timeframe.

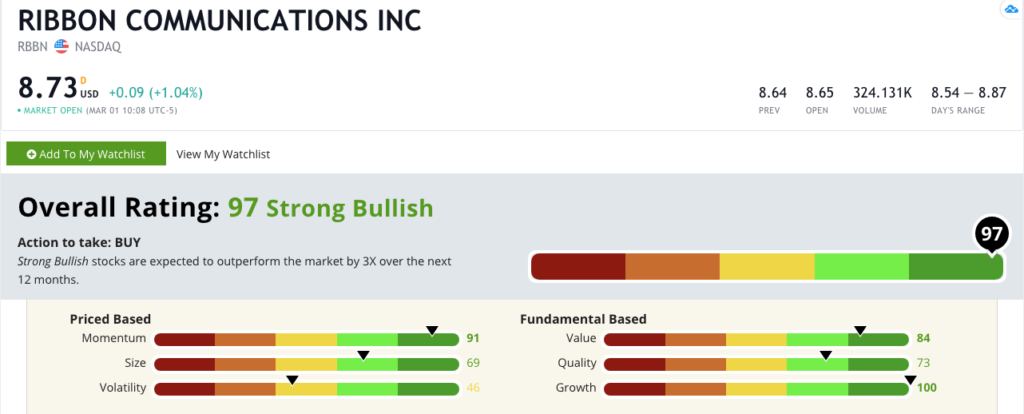

Ribbon rates a 97 out of 100 overall in Adam O’Dell’s six-factor Green Zone Ratings system, meaning we are “Strong Bullish” on the stock and expect it to beat the broader market by at least three times in the next 12 months.

Ribbon Communication Inc.’s Green Zone Rating on March 1, 2021.

The company grew its total revenue from $577 million in 2019 to $843.8 million in 2020 — a 46% increase.

Total revenue is projected to hit $975 million by 2022.

That earns it a 100 on our growth metric.

Looking at the stock chart above, you can see the strong uptrend in the stock price, giving it a 91 on momentum.

The recent downtrend has put Ribbon’s price-to ratios well below the software industry, making it a strong value — it rates an 84 on the value metric.

The bottom line: As infrastructure moves to the center of Biden’s spending plan, rural internet is going to be front and center.

Companies could benefit from tax incentives, grants or low-interest loans to build out their rural internet infrastructure.

Internet service providers will use companies like Ribbon Communications Inc. to bring fast, reliable service to rural America.

For investors, the recent pullback means Ribbon’s stock is one to buy now.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.