As the global economy grows increasingly connected, the risk of contagion is growing — meaning investors should pay attention to emerging economies. Right now, risks are growing in those markets.

Emerging markets are those with globally average incomes. They fall between underdeveloped markets and advanced economies.

Brazil is an example of an emerging market. Many African countries are considered underdeveloped, and the world’s largest economies like the United States are advanced economies.

In the past, financial crises have unfolded in emerging markets and advanced economies. In 2008, the crisis began in advanced economies, while in 1998, many emerging markets suffered crises.

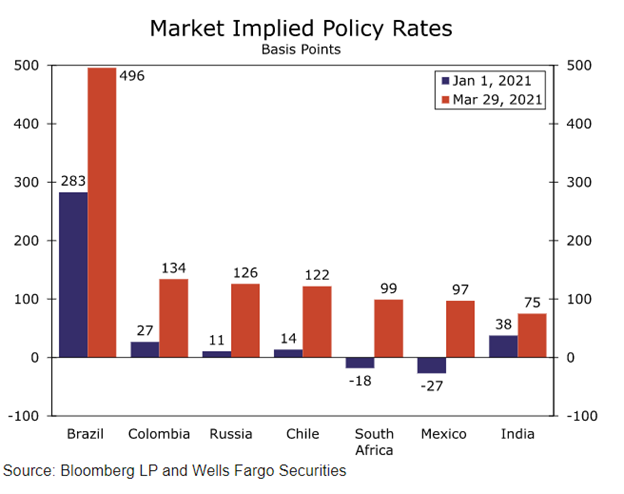

Central banks in emerging markets are raising interest rates. The chart below shows how expectations of rate changes for several markets have changed since the beginning of the year.

For example, traders expected the Mexican central bank to cut rates by 27 basis points (bps) on January 1. Now, they expect the central bank to increase rates by 97 bps. A bps is equal to 0.01%.

Market Implied Policy Rates

Source: Wells Fargo.

Emerging Market Inflation Could Threaten Global Economy

In several cases, banks have already acted. In the past few weeks, policymakers in Brazil, Russia and Turkey raised interest rates. Central bankers in South Africa and Mexico issued statements indicating rate hikes were likely.

In their comments, policymakers are referencing higher inflation.

While inflation is a threat to advanced economies as well, central banks in the U.S., Europe and Japan will likely hold rates near zero. This means the dollar, euro and yen could fall.

As rates rise in emerging markets, their currencies become more attractive since investors could choose to chase higher yields in those markets. To make those investments, they need to sell other currencies and buy emerging markets.

Once those investments are made, higher than expected inflation could spark a panicked exit. On the other hand, lower than expected inflation could lead central bankers to hold off on hikes. That could also spark panic selling.

In this way, the prospect of higher or lower inflation is now creating risk for global financial markets.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.