Greek tragedies and bull markets often end with the demise of a hero.

Older investors may remember Gerald Tsai and the Manhattan Fund — the most dominant fund in the bull market of the 1960s and the biggest loser in the subsequent bear market.

Middle-aged investors may recall Thomas Marsico and the Janus Twenty Fund, which delivered great returns in the late-1990s and ceased operations a few years later.

Young investors may be learning this lesson with ARK Investments and Cathie Wood. ARK’s flagship fund, the ARK Innovation ETF (NYSE: ARKK), gained 150% in 2020. It held large positions in Tesla, Zoom and other tech stocks.

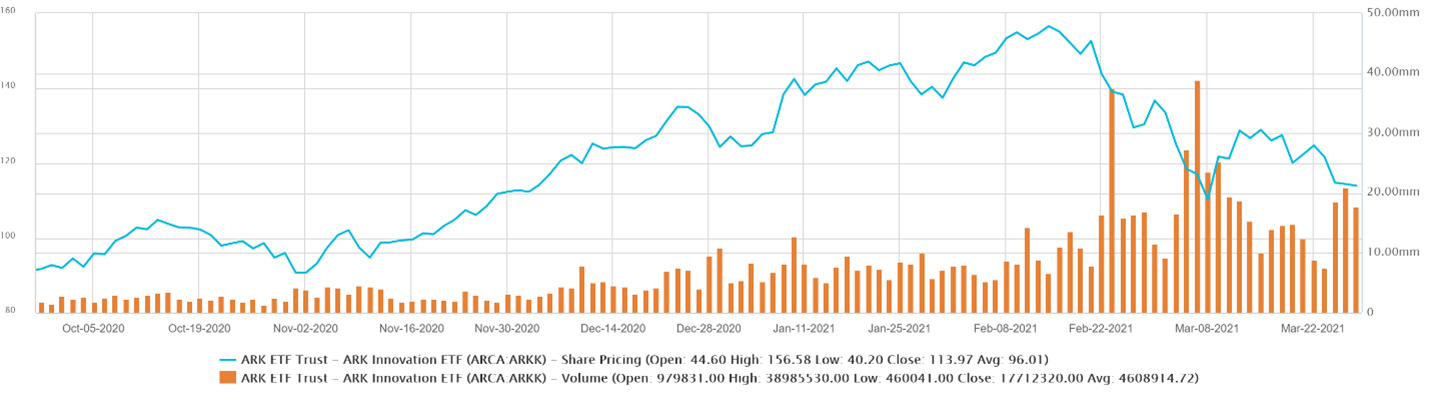

This year, ARKK dropped more than 30% from its high, but investors are buying the dips. The chart below shows heavy volume in ARKK as the price fell in recent weeks. Volume is shown as orange bars in the chart, while ARKK’s price is the blue line.

ARKK’s Price Decline to Trade Volume

Source: Capital IQ.

ARKK Is a Sinking Ship

Volume can be an indicator of buying or selling. Since ARKK is an exchange-traded fund (ETF), we can use other indicators to determine whether buyers or sellers caused the chart’s spikes.

Data on market capitalization confirms investors were buying the dips. Market cap is the value of the ETF’s holdings.

ETFs are required to invest the assets they hold in stocks. The falling price of ARKK indicated those stocks were declining in value. But the market cap fell at a slower rate indicating investors were adding money to the fund.

Based on an indicator known as the volume-weighted average price, we know that, for now, the average dip buyer shows a loss, creating a risk for the broad stock market.

New investors in ARKK are likely excited about last year’s gains. They may grow frustrated if they continue to see losses. That could lead them to sell.

As investors sell, the fund managers will have to sell positions to fund redemptions. This selling pressure will affect major market averages that hold positions in the stocks, and losses in funds that track those indexes could lead to more selling pressure.

This all points to steep losses for ARKK in the next bear market.

After last year’s performance, ARKK will likely find its place in stock market history alongside the Manhattan Fund and the Janus Twenty Fund.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.