In this episode of The Bull & The Bear podcast, I explore an ETF that capitalizes on the growth of emerging markets.

One of the first lessons an investigative journalist learns is to cast a wide net.

When you’re probing into the dealings of a business or government official, it’s important to focus on the big picture initially before moving on to smaller details.

You look at everything.

Investing is no different.

It’s easy, as an American investor, to solely focus on companies in the United States.

But smart investors like you know diversification is important.

That goes beyond just investing in different sectors … it also means different countries.

That’s the very definition of casting a wide net.

I have a way you can invest in stocks in different countries without painstakingly combing through index after index and chart after chart.

But first, here’s why investing in emerging markets makes sense.

The Emerging Market Come-Up

By definition, emerging markets are just what they sound like: countries with emerging economies becoming more engaged with global markets.

According to Bloomberg, the top emerging markets in 2020 were:

- Thailand.

- Russia.

- South Korea.

- Taiwan.

- Malaysia.

- Hungary.

- Chile.

- South Africa.

- Turkey.

- The Philippines.

China, India, Brazil and Mexico are also considered emerging markets, but COVID-19 hit those economies particularly hard in 2020.

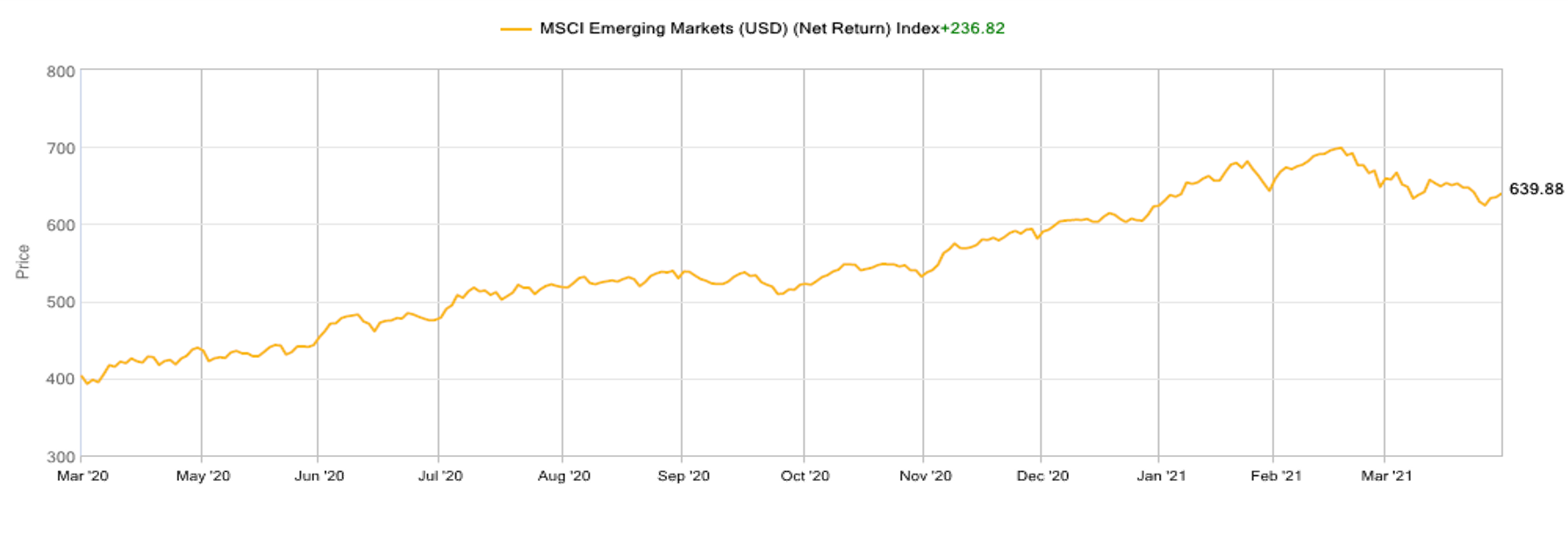

Emerging Market Index Grows 236% in 12 Months

Over three years, the MSCI Emerging Market Index has a net return of 111.6%.

However, in the last 12 months, that return has been 236% — indicating emerging market stocks have climbed tremendously in the last year.

And I don’t think emerging market stocks are done.

iShares MSCI Emerging Markets Small-Cap ETF

If you’re familiar with our Green Zone Ratings system, you know that small-cap stocks tend to provide bigger gains than large-cap stocks over time.

The iShares MSCI Emerging Markets Small-Cap ETF (NYSE: EEMS) takes advantage of small-cap growth, portfolio diversification and the expansion of emerging markets.

In this episode of The Bull & The Bear, I tell you why EEMS is a great investment that gives you strong exposure to emerging markets with continuous growth.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.