I used to just pass them over when shopping for a drink at my local convenience store.

Now, it’s the first place I look when I’m thirsty.

I drink one just about every day. I’m drinking one as I write this.

I’m talking about energy drinks.

They’re now just as commonplace in grocery stores or gas stations as soda and beer.

And there’s a reason for it.

Because they sell … and sell a lot.

Energy drink market sales were $53 billion in 2019 and they are projected to grow even more in the coming years.

Using Money & Markets Chief Investment Strategist Adam O’Dell’s stock rating system, we’ve uncovered an energy drink stock that will give investors like you and me double-digit profits, thanks to the surge in energy drink sales.

I’ll get to that in a moment.

But first, I’ll explain where the energy drink market is going.

Global Energy Drink Sales to Jump 60%

Energy drinks are a $53 billion market.

And that’s growing.

Allied Market Research expects the market to grow to $86 billion by 2026.

Energy Drink Sales to Reach $86 Billion Globally

You can’t deny the massive jump in sales in the next six years.

And using Adam’s system, we’ve found one energy drink stock that will give investors a solid jump in their portfolio.

This Energy Drink Stock Is Poised for Big Gains

Using Adam’s stock rating system, we found a high-quality, high-growth energy drink stock with the potential for double-digit gains for you in the near future.

Monster Beverage Corp. (Nasdaq: MNST) sells and distributes energy drinks in the U.S. and internationally. It distributes nearly 30 different brands of energy drinks — making it an industry leader.

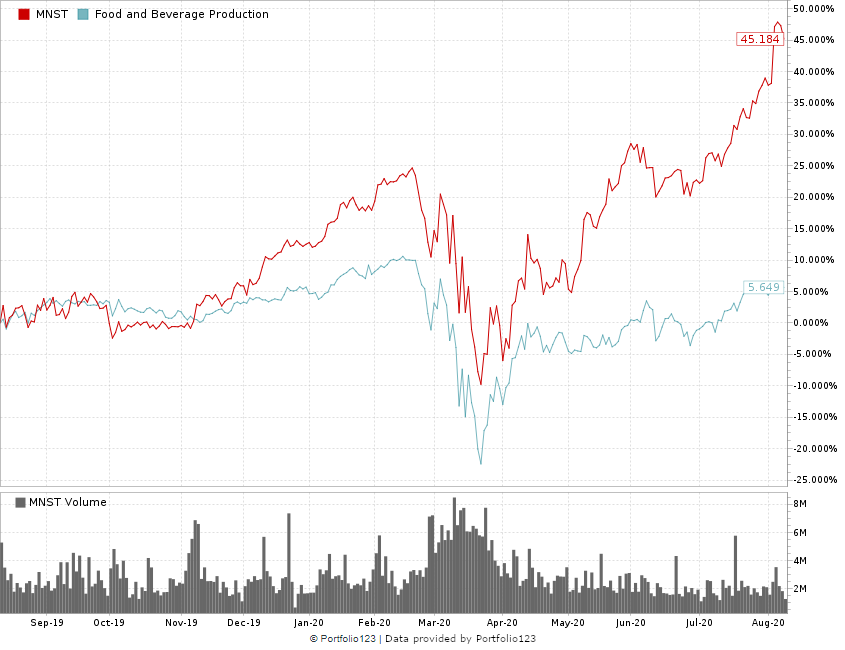

Monster Beverage Soars to New Heights

Monster Beverage earns an 81 on Adam’s stock rating system. It rates highest in quality, growth and volatility.

Here’s a deeper dive into Monster Beverage:

- Quality — Monster rates a 99 on quality — only 1% of all other stocks are rated better. It has strong margins (97) and even better returns on investment, assets and equity (99). The company also rates better than 75% of all other stocks rated in debt (90), stock efficiency (77) and cash flow (75).

- Growth — Thanks to a five-year annual growth rate of 17% on earnings per share and 11% sales growth over five years, the company rates a 96 on growth.

- Volatility — Monster’s growth and quality comes with mild volatility (90). The company’s beta and risk-adjusted returns are better than nearly 75% of all other stocks rated.

What to Do With This Monster

According to its 8-K filing with the Securities and Exchange Commission, Monster sales increased 16% from 2015 to 2019.

Energy drinks are becoming more recession-proof as a consumer staple — Monster’s annual sales are a testament to that.

With energy drinks becoming a daily luxury that people will indulge in, even if they are pinching pennies elsewhere, those sales will rise from here.

That means a profit for the company — and even better gains for you.

Several analysts have a price target on Monster of between $90 and $94 a share. At its current price of around $81 per share, reaching that price target would yield a 16% gain.

We think it can go even higher.

Energy drink stocks will be profitable for investors, and Monster Beverage Corp. is the best way to do it.