There’s always a bull market somewhere…

I know that.

I ran a specialized hedge fund for institutional clients, where I traded more than 50 futures contracts spanning the stocks, bonds, commodities and currencies asset classes … using a trend model I developed.

So I can tell you: There is always a bull market somewhere.

If investors are dumping Apple stock, they might roll the proceeds into Microsoft.

Or if they’re shedding tech stocks in general, they might scoop up financials or utilities. When it gets nasty, they might sell out of stocks altogether and buy bonds or just stay in cold hard cash.

Yes, you can have a bull market even in cash. If you think that sounds crazy, consider that the Invesco DB US Dollar Index Bullish Fund (NYSE: UUP), which tracks the U.S. dollar relative to a basket of other currencies, is up more than 10% this year.

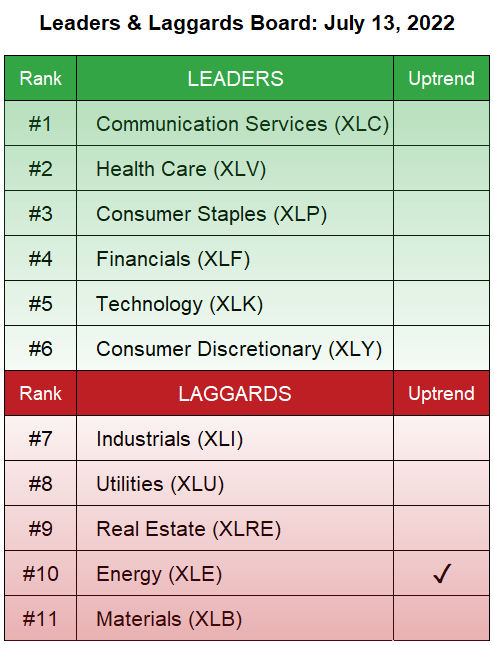

I pondered this while reviewing my latest Leaders & Laggards Board — my high-level analysis of the 11 major sectors that make up the S&P 500. I publish this every week for my subscribers in Green Zone Fortunes.

You can see last week’s L&L board below.

Start With the Big Picture

Of course, you can “beat the market” and still lose a lot of money when the overall trend is down! And that’s where the second part of this comes into play.

The right-hand column indicates whether a sector is in a “buy qualified” uptrend. Without bogging you down in technical details, this is an intermediate-term indicator that measures the sector’s uptrend over the past six months.

After a brutal start to 2022, we have one sector still in a buy-qualified uptrend: energy.

But even here, despite having solid intermediate-term strength, the sector is at the bottom of the heap in terms of short-term momentum. It’s getting killed relative to the S&P 500 over the past several weeks.

Energy Sector Warning: Don’t Fall Asleep at the Wheel

The shorter-term and intermediate-term indicators are giving conflicting signals. During market transitions or periods with a lot of churn, the trends can get muddled — and that’s what we’re seeing today.

This doesn’t necessarily mean we should sell everything and hide. But it does mean that caution is warranted. Now isn’t a time to fall asleep at the wheel.

I was an energy bull as far back as two years ago. My models suggested that energy was set for an epic run, which we saw.

But today, energy stocks are starting to break down relative to the S&P 500. This may be nothing more than short-term profit-taking … or it could be the beginning of a major trend change. It’s still too early to say.

For now, you’re not going to see me “buying the index” in energy. It’s not that I don’t see opportunities in this sector. I see incredible opportunities in energy. Some of the greatest fortunes of our lifetimes will be made in energy, particularly in the transition to renewable sources like wind and solar.

That’s my focus in the July issue of Green Zone Fortunes. I identified a key supplier to the world’s solar panel manufacturers. Government mandates and basic economics all but guarantee increased demand for this burgeoning energy technology. That translates to higher demand for this company’s wares — it’s that simple.

In a year in which the market is down 20% and well into bear market territory, this stock is up more than 50%. And I believe it’s just getting started.

To join Green Zone Fortunes, my premium stock research service, click here. You’ll see where my highest conviction lies within the renewable energy space.

And get ready. I’m sending my July stock recommendation out to subscribers before the market opens tomorrow morning! Click here to join so you’ll be one of the first with a chance to buy in before this stock rides the renewable energy mega trend higher.

To good profits,

Adam O’Dell

Chief Investment Strategist