The energy sector was a top performer last week, up 5.9% versus the S&P 500’s slight 0.4% gain.

That bullish move ran counter to the sector’s longer-term bearish trend, as shares of the SPDR Energy Sector ETF (XLE) are still down 17% over the past year … the worst of all major U.S. sectors.

Today, we’ll dig deeper into the 22 energy stocks in the large-cap S&P 500.

The question is … are there good deals to be had?

Let’s find out!

Sector “X-Ray”

The first step in assessing a sector’s strength is to examine its trend and determine whether it’s “up” or “down.”

While I mentioned that energy stocks are down 17% over the past year, the sector has been stuck in a sideways trend since early 2022. Shares of XLE are now at the lower bound of that range after dropping sharply during the April 2 to April 9 “Liberation Day” sell-off.

With a negative trend like this, the question is whether there are now good bargains to be had. Of course, we have to be careful not to fall for “value traps,” too.

That’s why we’ll size up energy stocks’ overall Green Zone Power Ratings, while also paying attention to Value, Quality and Growth metrics.

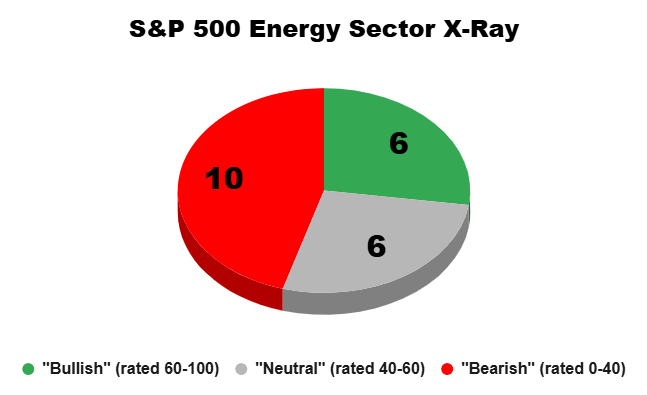

As a reminder, my system’s Overall rating can broadly be categorized into one of three buckets:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

Now let’s have a look at the breakdown of the 22 energy sector stocks in the S&P 500, according to my system:

Insight:

- 27% of the sector’s stocks rate “Bullish” (60-100), slightly more than the 24% of the S&P 500 across all sectors.

Next, it’ll help to see where any bullishness in the energy sector is coming from … it’s certainly not in the price action…

What You’re Buying When You Buy Energy Stocks

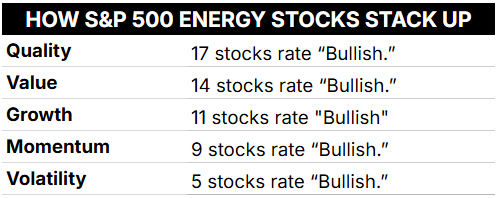

Here, we’re simply asking: “How many S&P 500 energy stocks rate ‘Bullish’ (60-100) on Momentum … on Volatility … on Value … and so on?”

Listed in order, from the factor with the most “bullish” stocks down to the factor with the least number of bullish stocks, here’s how the consumer staples shape up today:

First, I’m not surprised to see the sector rate so poorly on Momentum and Volatility — as evidenced by the fewest number of energy stocks with bullish ratings on those factors. As I mentioned, the sector has been the worst performer over the last year.

Meanwhile, the sector shines on Quality and Value … which implies that discerning investors can find quality energy companies at cheap valuations.

And then there’s growth…

Kudos to Matt Clark for flagging this chart, which shows the year-over-year change in the energy sector’s earnings-per-share is also coming in at the bottom of the pack, at -18%!

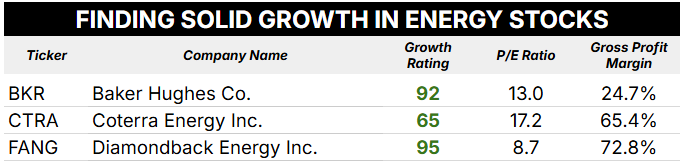

Seeing that, the real becomes: Can we find cheap, high-quality energy stocks … that are actually growing?

To answer that question, I ran a custom screen on the S&P 500’s 22 energy stocks, with these criteria:

- Positive EPS Growth (YoY).

- Growth rating > 60.

- Value rating > 60.

- Quality rating > 60.

- Overall rating > 60.

Only three stocks passed the screen:

To me, Diamondback Energy (FANG) is looking pretty attractive…

The stock is down 37% from its July 2024 highs. But now sporting a P/E ratio of 8.8 … a gross profit margin of nearly 73% … and positive sales and earnings growth … this one looks like an overall good buy.

To good profits,

Editor, What My System Says Today

P.S. I’ve been recommending energy stocks to my Green Zone Fortunes subscribers for years now because I believe there’s massive potential in both oil and gas, as well as cleaner options like nuclear. If you want to see my highest-conviction recommendations in the energy sector, click here to see how you can join now.