It just doesn’t make any sense right now.

The stock market seems to be completely unaware of the fact that the U.S. economy is in a recession, likely a prolonged one.

The S&P 500 crossed the psychological 3,000-point mark and the Dow recently closed above its 200-day moving average for the first time since February.

Recession? What recession?

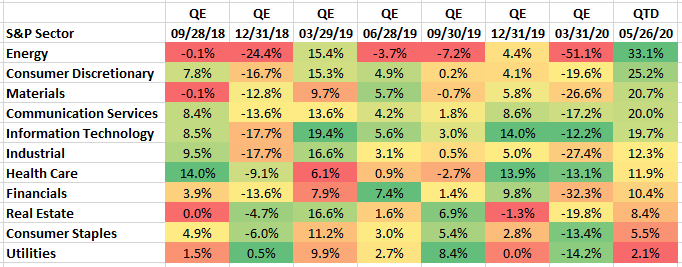

Even though the market isn’t responding in a way it typically would, there have been some constants: Tech and health care have led the way while energy stocks have been weak.

In fact, according to Banyan Hill Publishing’s Brian Christopher, energy stocks have registered the worst performance of any sector in five of the last seven quarters.

But, as you can see, energy stocks are starting to rally. That means, as an investor, the time is now to find that diamond in the rough to produce big future gains.

30% Potential Gains In 1 Month With This Energy Stock

Investing in big energy companies is easy, but come with pitfalls. They are typically prone to big market moves up or down.

The key is to find an energy stock that is affordable, pays a dividend and isn’t nearly as volatile.

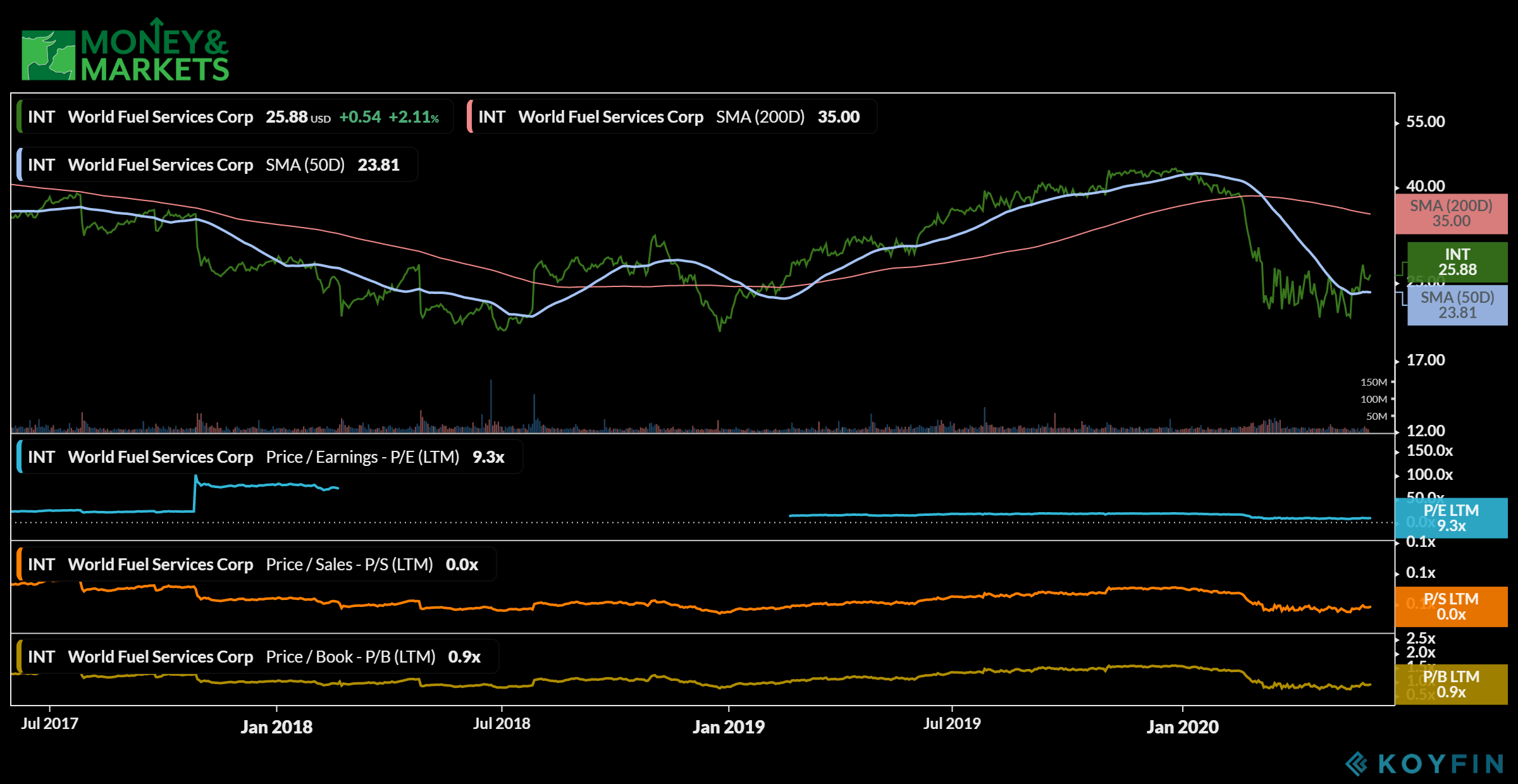

This particular stock dropped more than 50% from its recent high. It fell with the rest of the stock market but has yet to recover from that dip.

World Fuel Services Corp. (NYSE: INT) provides fuel and payment management systems to air-, land- and marine-based users. Basically, it services fueling for trucks, boats and aircraft. And it’s already up 3.3% today at 11:40 a.m. EDT.

As far as energy stocks are concerned, World Fuel Services is a bargain.

It’s priced around $26 per share and has a price-to-earnings ratio of 9.3. Its price-to-sales is 0 and its price-to-book is 0.9.

World Fuel Services is also less volatile than typical energy stocks with a 60-month beta of 1.1. To compare, Chevron Corp. (NYSE: CVX) and Exxon Mobil Corp. (NYSE: XOM) have betas of 1.3.

“The chief financial officer said the company entered the crisis with its strongest balance sheet ever,” Christopher, a former controller for a Fortune 100 company, said. “And World Fuel just announced its normal quarterly dividend on May 22.

“It began paying a dividend in 2010. It has raised the payout by 167% since. The current yield is 1.5%.”

The Leadership of This Energy Stock Tells a Story

When you research a potential company to buy, you want to look at its track record, but you also want to know who is steering the ship.

In the case of World Fuel, its CEO is Michael Kasbar, who came into the industry in 1985. That means he’s been around in previous market downturns and knows how to weather the storm.

The company’s chief operating officer is the former chief information officer for IBM Corp. (NYSE: IBM). When he left the technology giant, its market capitalization was $150 billion.

“Management began its global response to the virus in January. In February, it began requiring self-quarantining for certain employees,” Christopher said. “It has been in constant contact with its customers, suppliers and partners. World Fuel is serving as a resource to its customers who are planning their post-quarantine needs.”

Don’t Miss Out On Huge Returns

For some reason, the rest of the market is missing the potential for World Fuel.

But its loss can be your gain.

As the coronavirus lockdown subsides, activity is getting back to normal. Oil prices are also trending higher.

More and more people are driving on America’s roadways and there is increased activity in the air and on the seas.

World Fuel will benefit the most from an uptick in aviation. That sector has historically generated most of its profits,” Christopher said. “No one expects the world to get back to normal overnight. But things are improving.”

In May, the number of people passing through TSA checkpoints more than doubled the previous month.

The bottom line is this energy stock has the potential to provide investors with a 30% upside in a month once the market starts paying attention again.

Get in now to capture those gains.