In 2022, old energy (oil and gas) dominated the market as it ended the year in the black.

It doesn’t mean that new energy (renewables) won’t take off … because it will.

Trends suggest countries are going to pour even more money into renewable energy, such as wind, from here.

This graph shows the six global regions pushing for more offshore wind energy.

According to the International Energy Agency, these six regions will spend $785 billion between 2019 and 2040 on offshore wind energy alone!

The European Union is projected to spend $376 billion, while the U.S. expects to invest $98 billion on wind power.

And today’s Power Stock is set to benefit from that growth.

Eneti Inc. (NYSE: NETI) specializes in offshore wind turbine installation.

In 2020, Monaco-based Eneti transitioned from transporting commodities to using its fleet to install offshore wind turbines.

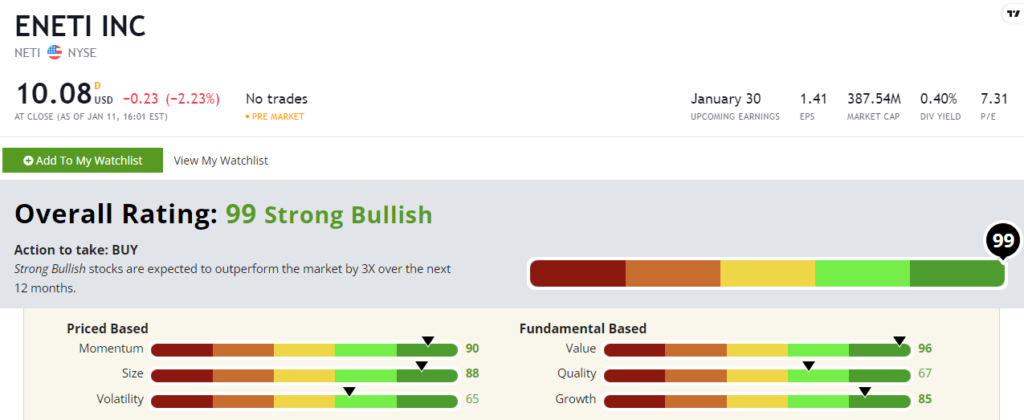

Eneti stock scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

Eneti Stock: Strong Momentum + Excellent Value and Growth

Eneti turned in a strong third quarter in 2022.

Here are some of the highlights:

- Total quarterly revenue was $69.2 million — 4% higher than the same period a year ago!

- It only increased costs by 17% quarter over quarter.

As you can see from those numbers, NETI is a terrific growth stock, scoring an 85 on that factor in our Stock Power Ratings system.

It also excels on value — where it scores a 96.

NETI’s price-to-book value ratio is nearly three times lower than its industry average.

Its price to earnings is 7.03. The cargo transportation industry average is 8.72.

This tells us NETI is undervalued compared to its competition.

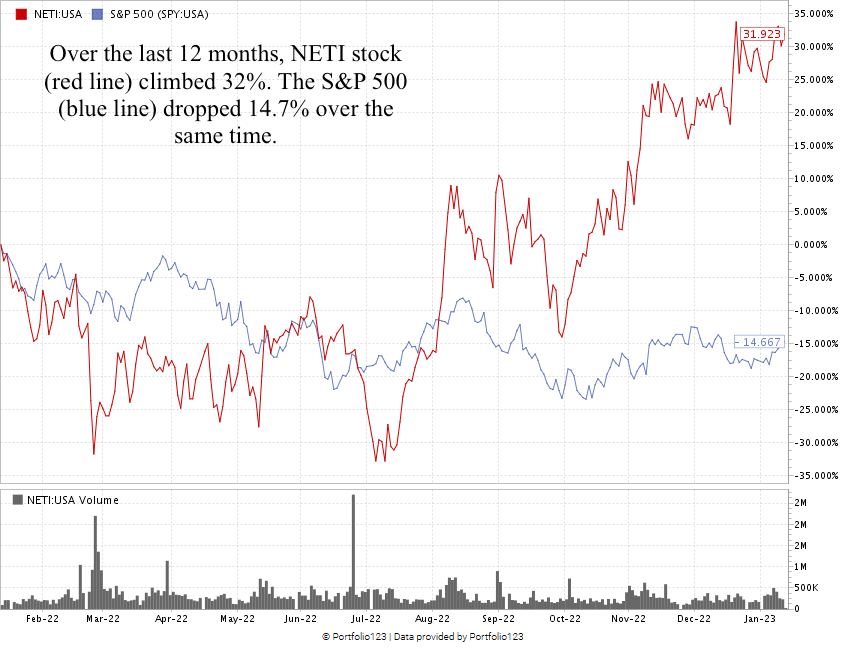

You can see what strong growth and value factors can do to a stock in the chart below.

Created in January 2023.

Eneti stock climbed 98.8% from its 52-week low in July 2022 to its most recent high in December 2022.

The stock is 5% off its 52-week high. And I’m confident it can run higher.

Eneti stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Old energy, such as oil and gas, continues to make a run in the market.

But new energy, like renewables, isn’t far behind.

Eneti pivoted away from transportation to installing offshore wind turbines as it recognized this trend.

That’s why I’m confident that NETI is a strong contender for your portfolio.

Note: If you want to know more about the renewable energy mega trend…

My colleague Adam O'Dell’s “Infinite Energy” presentation highlights the largest untapped energy source in the world.

This source is worth trillions of dollars and makes massive oil fields look tiny in comparison.

We’re still in the early stages, but this breakthrough is set to turn the global energy market on its head.

Make sure to watch his presentation for more information about this revolutionary new renewable tech (and the one company behind it all).

Stay Tuned: Something a Little Different

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

But we’re going to bring you something a little different over the long holiday weekend.

Chad Stone, our managing editor, is going to highlight some of your responses to our recent poll where we asked about your top concerns for 2023 — and how the Money & Markets team will help you conquer them as the year goes on.

Markets are closed on Monday in observance of Martin Luther King Jr. Day, but I’ll still send you a 100-rated bank stock that’s boasting strong growth and momentum.

And then on Tuesday, I’m going to show you why Adaptive Investing™ is the key to surviving and thriving as the bear market continues. Stay tuned!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets