Winter is coming.

That’s not just a slogan from a popular television show … it’s a massive problem that part of the world faces.

With Europe choked off from Russian natural gas due to sanctions from the invasion of Ukraine, EU countries are desperate to find new sources of this essential fuel used to heat homes.

One place they can look is in their own backyard … Italy:

In 2020, Italy exported 316 million cubic meters of natural gas.

The country’s Ministry of Ecological Transition projects the country will ship off more than 2 billion cubic meters by the end of this year. That’s a 549.1% jump in just two years!

And today’s Power Stock is set to benefit from that growth.

Eni SpA (NYSE: E) is an Italian energy giant.

Eni produces and refines oil and natural gas. It also provides electricity to Italy.

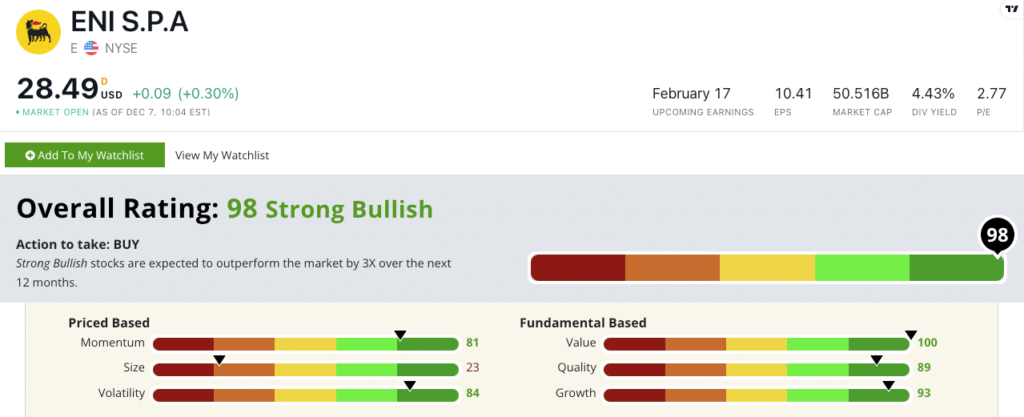

Eni stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

Eni Stock: Great Value + Strong Growth and Quality

Eni turned in a strong third quarter, leading to an outstanding year:

- Adjusted quarterly operating profit was $6.1 billion — 132% higher than the same period a year ago!

- Adjusted quarterly net profit was $3.9 billion — a 161% jump from the same quarter last year.

As you can see from those numbers, E is a terrific growth stock, scoring a 93 on that factor in our Stock Power Ratings system.

It also excels on value — where it scores a 100.

E’s price-to-earnings ratio is more than three times lower than its industry average.

Its price-to-cash flow is 1.8. The integrated oil and gas industry average is 5.1.

This tells us E stock is undervalued compared to its competition.

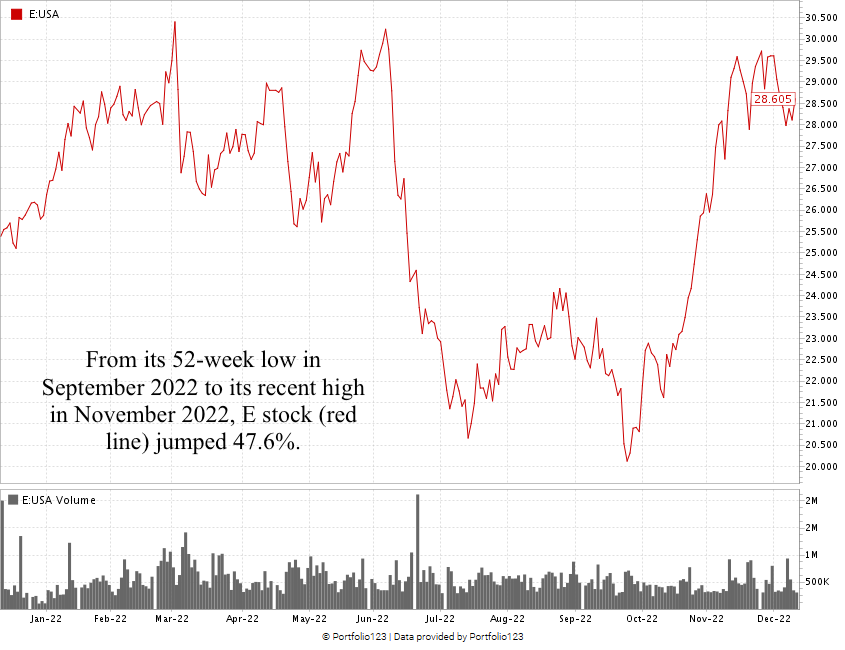

Created in December 2022.

E climbed 47.6% from its 52-week low in September 2022 to its most recent high in November 2022.

The stock is 8.4% off its 52-week high. I’m confident it can run higher.

Eni stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Europe is at the start of a potentially harsh winter.

The demand for natural gas to heat homes and businesses will skyrocket.

With Russian natural gas cut off, European countries need to look elsewhere for this precious commodity.

That’s why I’m confident that E is a strong contender for your portfolio.

Bonus: Eni stock’s 6.32% forward dividend yield pays you an impressive $1.79 per share per year to own the stock.

Stay Tuned: Health Care Is Big Business … This 1 Stock Is Not

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a high-risk health care stock that scores a pitiful 6 on our Stock Power Ratings system.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets