What we want is always in contention with what we need.

We need things like food, toilet paper, toothpaste and beverages.

We want things like computers, 85-inch televisions and vacations. Although that last one feels like a necessity at times…

This same phenomenon plays out in the market with consumer staples versus consumer discretionary.

Stocks in these two sectors tend to move differently based on the state of the economy and consumer sentiment.

When things are good, the market and economy are chugging along, and we have more disposable income to spend on things like trips to the Bahamas and shiny new laptops.

This is when consumer discretionary stocks thrive.

When the opposite plays out, we tighten our purse strings and only spend money on the necessities.

And consumer staple stocks move higher.

And it looks like sentiment has taken a sudden shift…

Since the start of 2024, the Consumer Staples Select SPDR ETF (NYSE: XLP) is up more than 8%, while the Consumer Discretionary SPDR ETF (NYSE: XLY) has lost 2%.

You can see in the chart above that after a strong recovery rally starting in early May; consumer discretionary stocks turned down as investors rotated out of Big Tech and into more defensive stocks — like consumer staples — at the end of July.

Investors are wary of consumer spending slowing down. But will sentiment change following yesterday’s Consumer Price Index print showing inflation cooling even further? Today’s stronger-than-expected retail sales report should help boost confidence as well.

Today, I’ll x-ray these exchange-traded funds (ETFs) using Adam O’Dell’s Green Zone Power Ratings system to see if there’s any standout data we can draw from.

Consumer Discretionary Leads the Way

To run an x-ray of ETFs, I start by pulling all of the holdings in the ETF.

Then, I examine each of those stocks’ ratings overall and on our system’s six primary factors: Momentum, Size, Volatility, Value, Quality and Growth.

I’ll get an average of each of the factors and the overall to give me an accurate picture of how each ETF stacks up:

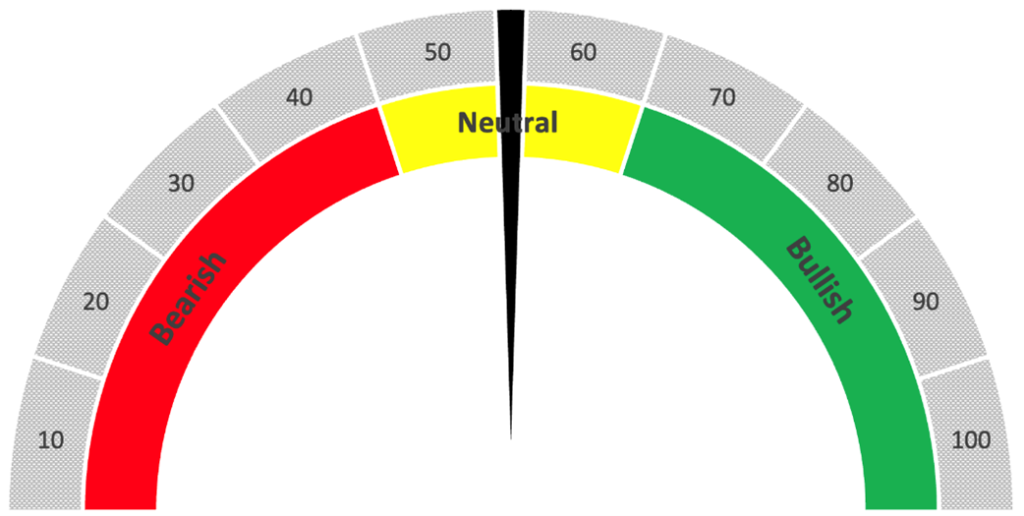

XLY Rates “Neutral” Overall

The average overall rating of the 51 stocks in the consumer discretionary ETF (XLY) is 49, putting the ETF in the “Neutral” category.

Consumer discretionary stocks rate the highest on Quality (an average of 78) and Growth (an average of 74).

Of those 51 stocks, 20 rated at least “Bullish,” with six of those rated “Strong Bullish.”

On the other side, 20 stocks in the ETF rate “Bearish,” with nine being “High-Risk.”

XLY’s Highest-Rated Stocks

What’s even more interesting about the consumer discretionary sector is that three of the five highest-rated stocks are homebuilders:

- PulteGroup Inc. (NYSE: PHM).

- Lennar Corp. (NYSE: LEN).

- R. Horton Inc. (NYSE: DHI).

It is rare to see the top three stocks from the same industry group in an ETF with more than 50 tickers.

Why Are Consumer Staples Lagging?

Despite having a better performance since the beginning of 2024, the consumer staples ETF (XLP) earns a lower overall rating than XLY.

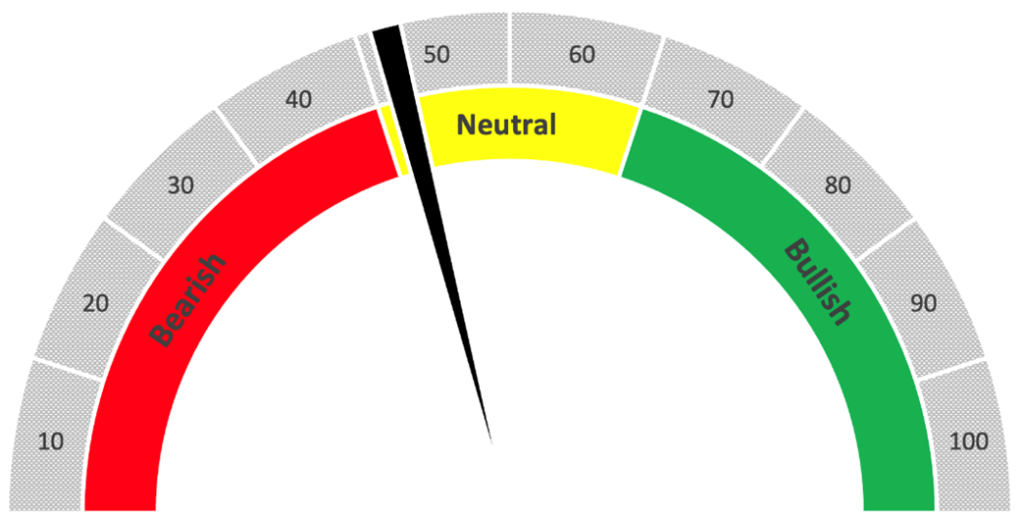

Consumer Staples Also Rate “Neutral”

XLP earns a “Neutral” 41 out of 100 on the Green Zone Power Ratings system … eight points lower than XLY.

That’s because the individual stocks in the ETF are weighted more to the bearish side.

There are 38 stocks in XLP. Nine of those stocks are rated at least “Bullish,” with only one rated “Strong Bullish.”

On the other hand, there are 20 stocks that rate “Bearish” or below, with 10 rated “High-Risk.”

XLP’s Highest-Rated Stocks

The interesting pattern is that three of the top five stocks in XLP are grocery stores:

- Walmart Inc. (NYSE: WMT).

- Costco Wholesale Corp. (Nasdaq: COST).

- The Kroger Co. (NYSE: KR).

Like XLY, having three grocery stocks in the top five of an ETF with 38 tickers is rare.

Overall, stocks listed in XLP earn the highest markets on Quality (71) and Volatility (68).

The Big Picture

The consumer discretionary sector ETF (XLY) was riding high — up nearly 10% before last month’s rotation out of Big Tech.

This is another reason why XLY rates a touch higher than XLP.

July’s CPI data throws continued support on the possibility of a Fed fund rate cut in September. That is likely to help consumer discretionary stocks recover, but it should not hurt consumer staples too much.

Right now, with the market still finding its footing after the most recent sell-off, neither of these sectors has a strong momentum foothold.

However, Green Zone Power Ratings has pinpointed individual stocks in these sectors that have the potential to outperform the broader market in the long term.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets