I love what I do. I work day in and day out to design trading systems to help regular folks feel more secure about their wealth.

The truth is, if you want to find the best stock to buy in a sector or industry, you need:

- Expensive tools to get all the information you need to make a decision.

- Time to study the ins and outs of the stocks.

- Education: knowing, when you look at a stock chart, what it is you’re seeing.

I’m fortunate because I love my job. But not everyone knows (or, frankly, cares to know!) about moving averages, ratios or trends when it comes to their investments.

Sometimes, you’re convinced that an industry or sector (say, biotech, cannabis or solar energy) is going to take off — and you want an easy way to profit when it does … without “putting all your eggs in one basket” or spending days parsing through dozens of stocks.

I get that! And I have good news: You can buy a whole basket of individual stocks with just one click of the mouse (or tap of the finger).

An exchange-traded fund (ETF) often holds dozens of stocks, so it can be a great way to gain diversified exposure to a specific sector, industry group or investment “theme.”

For instance, in early August, I recommended my Cycle 9 Alert readers make a bullish play on the SPDR S&P Homebuilders ETF (NYSE: XHB). I wanted them to have exposure to the entire homebuilders industry group. And we’ve ridden the sector’s rally for a net gain of 85% so far! (Note: we bought options on the ETF.)

A diversified ETF will give you exposure to a broad sector, industry group or theme … and you can even use my Green Zone stock rating model to figure out which sector or industry-group ETF to buy.

For that, we can do an “ETF X-Ray” on the two funds’ stock holdings.

Today, we’ll compare the SPDR Technology Sector ETF (NYSE: XLK) against the SPDR Communications Services Sector ETF (NYSE: XLC). Keep reading for a list of the top five stocks in each fund!

Quick Story: Communications Services Sector

In September 2018, the S&P 500 underwent a “re-classification” of its major sectors.

A new sector, called “Communications Services,” was introduced. This new sector took under its wing stocks that were previously included in the “Telecommunications” sector, as well as some, but not all, of the stocks that had been under the “Technology” umbrella.

Notably, this sector classification switch broke up the so-called “FAANG” gang — the five cult-followed, big-tech stocks of Facebook Inc. (FB), Amazon.com Inc. (AMZN), Apple Inc. (AAPL), Netflix Inc. (NFLX) and Alphabet Inc. (GOOG).

While Apple remained in the technology sector, Facebook, Alphabet and Netflix moved to the new Communications Services sector.

Meanwhile, Amazon is classified as a Consumer Discretionary sector stock, though it relies heavily on technology and indeed has something of a “communications services” business through its video content platform. But I digress…

ETF X-Ray: Tech (XLK) or Communications Services (XLC)

I’ve done an ETF X-Ray on both XLK and XLC to find out which ETF to buy.

This involves three steps:

- I download the ticker symbols of the individual stocks held in each of these funds.

- I run each of those ticker symbols through my 6-factor Green Zone Ratings model for stocks.

- I take the average score earned by the stocks held in each ETF.

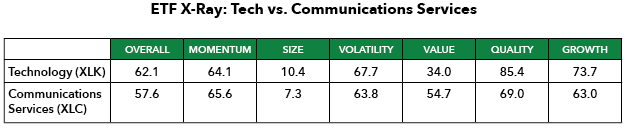

Here’s the summary result of these ETF X-rays:

My model gives an overall score and a score on each of the six factors in the table above, out of 100.

You can see that on the momentum factor, the Communications Services ETF (XLC) has only a slightly higher rating than the Technology Sector ETF (XLK): 65.6 versus 64.1.

XLC also earns a superior value-factor rating, at 54.7, versus XLK’s 34. This means, in general, you can buy stocks in the Communications Services sector at cheaper valuations than you can buy stock in the Technology sector.

And, if you’re solely a “value investor,” you should consider buying the Communications Services Sector ETF (XLC) over the more richly-priced Technology Sector ETF (XLK).

On the other hand, the individual stock holdings in the Technology Sector ETF rate higher on the size, low-volatility, quality and growth factors … as well, they earn a higher overall rating: 62.1 versus 57.6.

This means that if you’re OK with paying up for the technology sector’s higher valuations, it may be worth it as the sector ranks superior on a majority of individual factors and overall.

All this said, though, I found it interesting that there is not a drastic difference in the ratings of these two broad sector ETFs.

As you can see, the difference between each individual factor is fairly small.

The biggest difference is seen in the value factor, which shows a roughly 20-point spread (XLK = 34; XLC = 54.7).

With overall six-factor composite ratings of 57.6 (XLC) and 62.1 (XLK), both sector ETFs hold stocks that, on average, rate in the top half of the spectrum.

In short, if you’re looking for an ETF to buy, you’ll likely do just fine in either one of these broad sectors.

Top 5 Stocks in Each ETF

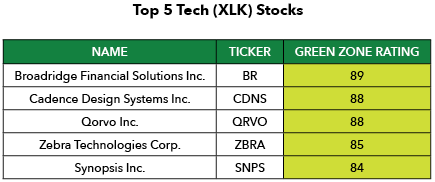

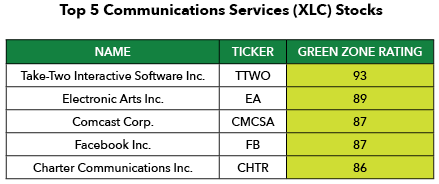

Now, for those of you who are willing to make more concentrated plays on individual stocks within these sectors, I’m sharing the top five ranked stocks in each:

All 10 of the stocks earn overall “strong bullish” Green Zone Ratings of 80 or above!

This means my model predicts that they’ll beat the market by 3X over the next 12 months.

Remember: You can use the Green Zone Ratings system on our homepage to look up these stocks yourself — and find out how they rank on each of the six factors in my model!

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets