Green energy has many benefits. Solar and wind energy can reduce greenhouse gas emissions and helps alleviate problems attributed to climate change. Costs of the technologies are trending down, making green energy more affordable.

But renewable energy does have at least one drawback. It can be unpredictable and needs a backup. And that backup can be expensive.

Europe has made great strides in the green energy sector.

According to Forbes, in the first half of 2020, Europe generated more electricity from renewable sources than fossil fuels. Wind, solar, hydro and bioenergy generated 40% of the electricity across the EU’s 27 member states, while fossil fuels generated 34%.

In the United States, by way of contrast, fossil fuels generated more than 60% of electricity, while renewables accounted for less than 20%.

Green Energy Is Expensive in the EU

But that green energy carries a cost to the consumer. According to industry experts:

The cost of natural gas and electricity has surged across Europe, reaching records in some countries as businesses reopen and workers return to the office. In Europe, plans to decarbonize the economy are also playing a part as utilities pay near-record prices to buy the pollution permits they need to keep producing power from fossil fuels.

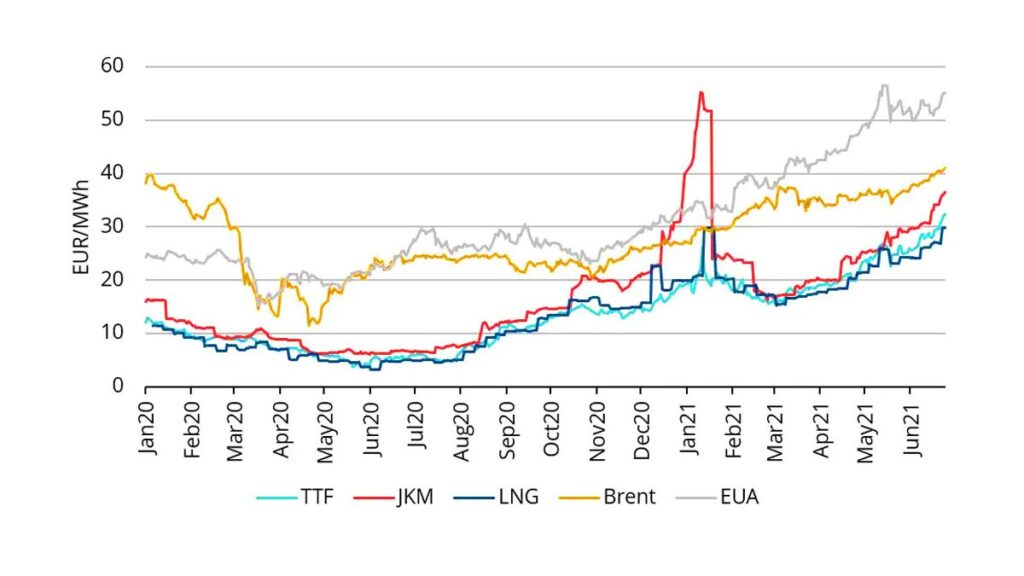

The chart below shows that natural gas in Europe is almost twice as expensive as it is in the U.S.

EU Is Spending Big on Natural Gas

Source: EnergyIndustryReview.com.

In the chart, TTF is the price of Dutch natural gas. JKM shows prices in the Japanese and Korean markets. LNG is the price of natural gas in U.S. markets. Brent is the price of crude oil used to generate an equivalent amount of energy. EUA is the price of natural gas in Europe.

There are limits to production and storage that account for the price in Europe.

Compared to Americans, consumers in Germany, Denmark, Belgium and Ireland spend more than twice as much on average for electricity. Other European countries also spend more than the U.S.

Green energy does have benefits, but it also has costs and those costs can’t be ignored by consumers.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.