I read an article last week that stunned me. Here’s the headline: “Dodge to Discontinue Charger and Challenger Models in 2023.”

I was floored reading that the automaker is moving on from gas-guzzling muscle cars to meet the demand for eco-friendly electric vehicles (EVs).

Dodge joins a long list of automakers making the shift.

That means more profits for companies that work with lithium-ion batteries.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” environmental stock with products designed to help dispose of lithium-ion batteries used in EVs:

- It just reported $105.4 million in revenue for the second quarter of 2022 — a 34% increase from a year ago.

- Its operating income jumped 171% year over year.

- We expect it to beat the market by 3X over the next 12 months.

Here’s why the environmental stock I share with you today will continue its strong performance throughout this whipsaw market.

Lithium-Ion Battery Recycling

Lithium-ion batteries are used in everything from laptops to EVs.

Demand for these batteries is growing as automakers move from gas-powered vehicles to electric.

But these batteries don’t last forever. This has created a lucrative market for battery recycling:

Last year, the global lithium-ion battery recycling market was worth $2.1 billion.

By 2027, Fortune Business Insights expects that number to expand by 428.6% to $11.1 billion!

Bottom line: Recycling lithium-ion batteries is a fast-growing market. Now is the time to get in.

Strong Growth and Momentum: CECO Environmental Corp.

The Inflation Reduction Act is pouring billions into renewable energy and sustainability in the U.S.

CECO Environmental Corp. (Nasdaq: CECE) makes equipment that filters air and water.

The Texas-based company’s products are also used to manufacture and recycle EV batteries.

Now, let’s look at how this environmental stock has performed.

CECE Jumps 149.2% off Its 52-Week Low

CECE is trading more than $3 over its 50-day simple moving average (green line in the chart above) — a bullish indicator for a stock.

Since hitting a 52-week low in May 2022, CECE is up 149.2%.

Over the last 12 months, the stock is up 42.5%. Its machinery manufacturing industry peers are averaging a 12.1% loss over the same time!

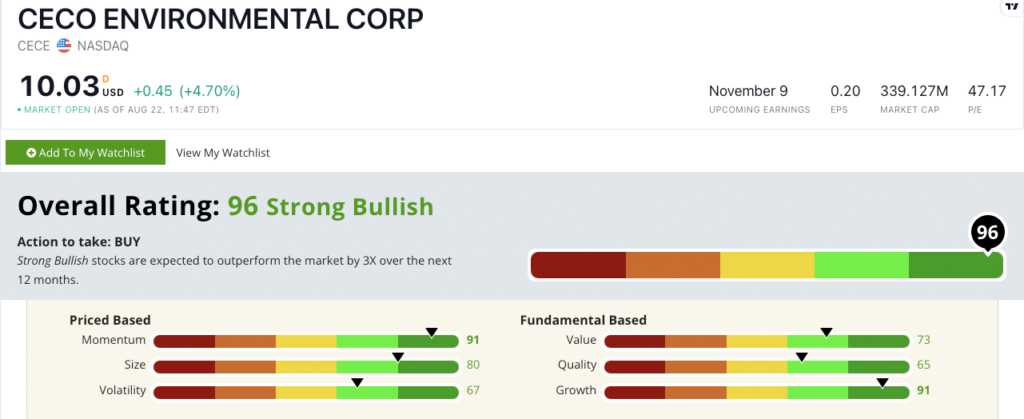

CECO Environmental Corp. Stock Power Ratings

Using Adam’s six-factor Stock Power Ratings system, CECO Environmental Corp. stock scores a 95 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least 3X over the next 12 months.

CECE rates in the green on all six of our factors:

- Momentum — After hitting a 52-week low in May, CECO Environmental stock jumped 149.2%. CECE earns a 91 on momentum.

- Growth — CECE scores a 91 on growth with a prior-year-quarterly sales growth rate of 33.9% and a trailing 12-month earnings-per-share (EPS) growth rate of 140.8%.

- Size — CECO Environmental’s $339.1 million market cap makes it the perfect-sized stock for strong gains. CECE earns an 80 on size.

- Value — The company’s price-to-sales ratio is 0.9, compared to its industry peers’ average of 2.55. Its price-to-book value is 1.6, while its peers are averaging almost double that. CECE earns a 73 on value.

- Volatility — Its run-up from a 52-week low faced little resistance. CECE earns a 67 on volatility.

- Quality — CECE’s return-ons (assets, equity and investment) are all in line with industry averages. It scores a 65 on quality.

Bottom line: Electric vehicles are becoming more popular, and demand for renewable energy is soaring.

Companies that work within the space will benefit from this expansion.

This is why CECE is a strong performer for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Stock Power Podcast, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.