Last week, I looked at energy supermajor Chevron Corp. (NYSE: CVX). Today, let’s check out Chevron’s chief global rival, Exxon Mobil Corp. (NYSE: XOM).

For decades, Exxon has been one of the bluest of blue-chip stocks. The company has an illustrious history that goes back to John D. Rockefeller himself. And it’s widely considered the world’s premier energy company.

But the past several years have not been kind to Exxon’s stock. After hitting a peak of $104.76 in July of 2014, XOM lost more than 70% of its value in the six years that followed before finally hitting a bottom last year. Shares have more than doubled off those lows, but Exxon Mobil would have to rise another 70% from current levels to flirt with its old highs.

We are bullish on energy stocks and expect them to outperform in 2021. Adam O’Dell and I dedicated the March issue of Green Zone Fortunes (which is coming out this morning) to this very theme. To see how to get our two highest-conviction energy stock selections, along with guidance on when to buy and sell these and many other stocks, click here.

So, with that as background, is Exxon Mobil worth buying at these prices?

Exxon Mobil Stock’s Green Zone Rating

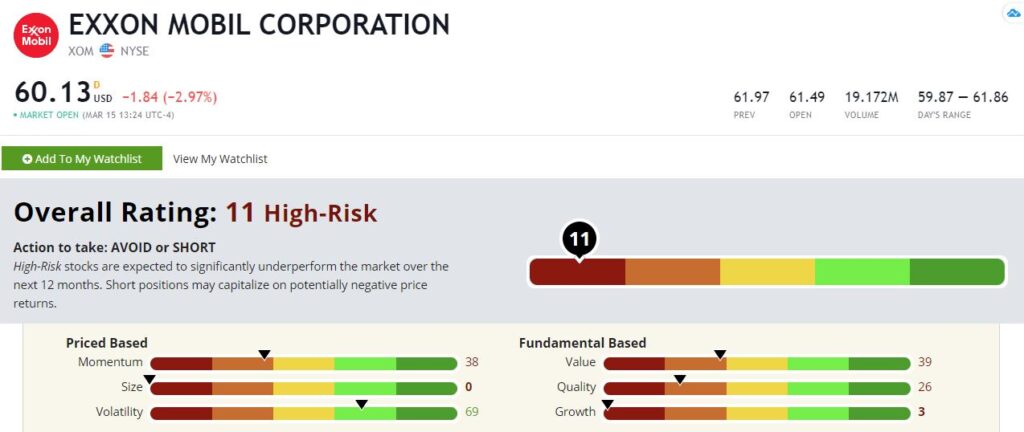

At first glance, it doesn’t look so good. Exxon Mobil rates an abysmal 11 out of 100, making it a “High-Risk” stock in our model. But as always, the devil is in the details. Let’s dig a little deeper.

Volatility — If Exxon Mobil stock has one thing going for it, it’s lack of volatility. The stock rates a 69 on volatility, meaning it is less prone to large price swings. Over time, low-vol stocks tend to outperform. But the lack of volatility wasn’t enough to boost the stock much in recent years.

Value — Exxon Mobil doesn’t rate well on a single metric. Its value rating is only 39 out of 100. Value is not an absolute metric; it’s relative. A stock has to be cheap relative to something. And those somethings — earnings, sales, etc. — are all depressed in Exxon Mobil’s case. If energy prices continue to recover, we could see that flow through to Exxon Mobil’s bottom line, which would make its value score improve. But based on the numbers we have today, Exxon isn’t cheap.

Momentum —XOM rates low based on momentum at 38. The recent performance helped a little, but more than six years of bear market conditions took their toll on Exxon’s momentum rating.

Quality — We measure quality objectively, primarily as a measure of profitability and balance sheet strength. Well, XOM has little of either of those things these days, dragging its quality rating to just 26. Given Exxon Mobil’s high debt load, it may be a while until this metric shows much improvement.

Growth — Here’s where it gets downright ugly. Exxon Mobil stock rates a pitiful 3 out of 100 based on growth. It’s not hard to understand why. The story of the past six years has been too much oil and gas, which depressed prices and stunted new growth. It is important to remember, though, that this is a backward-looking indicator. If, as we expect, we see strong growth in energy consumption in the post-COVID-19 recovery, that will only appear here months after that growth happens.

Size — Exxon Mobil is a large company. So large, in fact, that it rates as a big fat zero in this metric. Almost all companies in our universe rate higher based on this metric.

Bottom line: We’re bullish on energy. And if you believe that a rising tide lifts all boats, I wouldn’t be surprised if Exxon Mobil ends up doing far better than its pitifully low rating would suggest.

That said, I’m in no hurry to buy Exxon Mobil. Instead, Adam and I just recommended two new energy trades in this month’s issue of Green Zone Fortunes that we expect will massively outperform this lumbering behemoth. We just released these stocks to our loyal readers, but we want to help you get in on this trade as well. Click here to find out how you can access our most high-conviction trade recommendations, along with Adam’s research on using momentum to “buy high … sell higher.”

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.