Exchange-traded funds (ETFs) offer diversified exposure to a specific sector, industry group or investment “theme.” You can buy a whole basket of individual stocks with just one click of the mouse (or tap of the finger).

But once you’ve homed in on the sector or industry group you want exposure to, you still must figure out which ETF to buy.

Today, I’m using our Green Zone Ratings model to “X-ray” three energy-sector ETFs. We’ll figure out which one is the best energy ETF to buy … and have a look at which factors this sector gives us exposure to.

Banging the Table on Energy Stocks

Green Zone Fortunes co-editor Charles Sizemore and I have grown uber-bullish on the energy sector over the past six months.

It’s the irony of all ironies … the narrative heading into the 2020 U.S. presidential election was that if Joe Biden won, he would dismantle the old guard oil & gas industry. Almost as if he’d be able to make it go extinct overnight.

Yet … get this: the SPDR Energy Sector ETF (NYSE: XLE) is up 85% since November 6, 2020.

That’s twice as much as the second-place sector, financials (XLF), and a dumbfounding 10 times greater return than the technology sector (XLK).

I’ve recommended bullish energy-sector plays to my Home Run Profits options traders since last December. We’re up more than 300% with our bullish bet on a top exploration and production company … and have locked in a 100% gain on a diversified energy-sector ETF play.

We got into those positions just as the energy sector made a bullish breakout from its bottom. And now that the rally shows health and strength, Charles and I are adding not one, but two, energy-sector stocks to our Green Zone Fortunes model portfolio this month.

These are our highest-conviction monthly stock selections. And we’ll give you everything you need to get into these trades along with access to our growing model portfolio. To make sure you’re one of the first to see these stocks in the March Green Zone Fortunes newsletter (it hits email inboxes on Tuesday!), sign up today!

Along with the monthly newsletter, you’ll also gain access to my research that shows you how I use momentum to “buy high … sell higher.” To see more details on Green Zone Fortunes and my Millionaire Master Class, click here.

Let’s have a look at the three energy-sector ETFs we went “fishing” in…

Green Zone Energy ETF Breakdown: XLE, XES & XOP

Three of the most popular energy-sector ETFs are the S&P Energy Sector ETF (NYSE: XLE), the SPDR S&P Oil & Gas Equipment & Services ETF (NYSE: XES) and the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP).

It seems like a good idea to buy the broad energy-sector fund (XLE). But my analysis shows that you get better diversification and higher-rated stocks by buying the exploration ETF (XOP) instead.

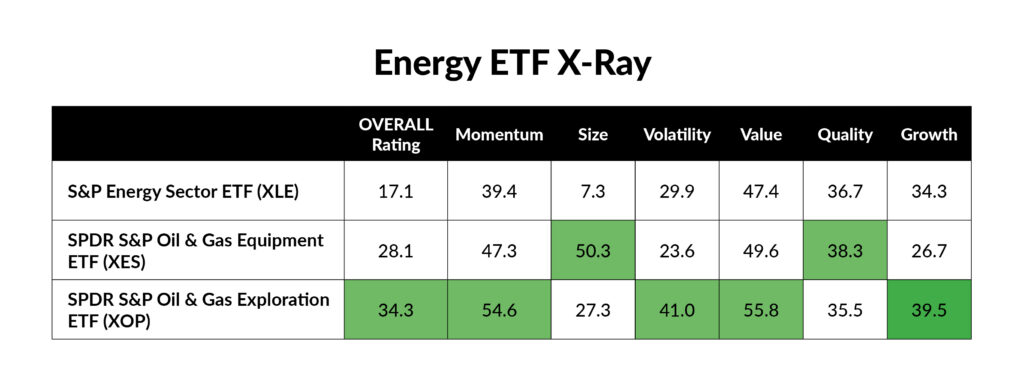

Here’s a summary table of the Green Zone Ratings for XLE, XES and XOP:

I’ve highlighted in green the top rating for each of the six factors my model rates stocks on, as well as the overall score.

As you can see, XOP wins in five out of seven categories.

Meanwhile, XLE didn’t earn a top rating for any factor.

Of course, the overall ratings for all three ETFs are less than 50. In fact, the highest-rated one, XOP, holds individual stocks that average a total rating of only 34.3.

That’s far lower than the overall ratings we look for in market-beating “Green Zone” stocks.

But here’s the thing …

The energy sector is in a unique position because nearly everybody has given up on it!

Here’s a sneak peek at what Charles and I are sharing with our Green Zone Fortunes readers in this month’s double-energy buy recommendation write-up:

Excessive pessimism and capitulation (aka “throwing in the towel”) tend to coincide with market bottoms.

And that’s where I think we are in the oil and gas industry.

Oil-and-gas insider and close friend of the late T. Boone Pickens, Salem Abraham, was just talking about the utter dejection and depression that’s palpable in the Texas oil patch.

Folks, that’s a buy signal!

My stock rating model, like any, uses historical data and metrics to derive its ratings. So it’s only natural that, after a long stretch of pain in the energy sector, the broad energy-sector ETFs rate below average right now.

But that doesn’t mean we can’t find tremendous profit opportunities within them!

That’s why I gave Charles and our research analyst, Matt Clark, explicit instructions to search within these ETFs for companies that rate highest on value and quality.

See, it’s a no-brainer to look for good “value” plays in the energy space right now. Since everyone’s already given up on these stocks, you can buy some of them for far less than they’re worth.

In fact, one of the stocks we recommend this month trades for less than its book value! It’s the classic value investment, where you can buy companies for “cents on the dollar.”

Of course, some so-called “value stocks” are cheap for a reason: The quality of their businesses are awful and deteriorating. Nobody wants to buy a “dollar” for 70 cents … only to see that dollar worth nothing a year or two later.

That’s the trap with value stocks. And it’s why Charles, Matt and I made sure the stocks we identified also had rock-solid quality scores … that the companies we recommended had maintained positive earnings, strong profit margins and low debt levels.

We also made sure that the stocks we recommended had already established a new uptrend.

See, it may seem too good to be true, but you can find stocks that are high-quality, good values … and in an uptrend.

I’m not talking about the type of uptrend that technology stocks have been in, minting new highs every year. I’m talking about new, “break out off the bottom” uptrends that are just getting started and, therefore, have a long way still to go!

Have another look at my ETF X-ray table:

XOP earns its highest factor score in value (55.8), and its second-highest score in momentum (54.6).

Most people assume you can’t get “value” and “momentum” in one stock … but you can!

And I expect the momentum ratings of each of these energy-sector ETFs will climb to 70 or 80 over the next 12 months … as the new bull market in down-and-out energy stocks continues to gather steam.

Look, adding exposure to the energy sector is a no-brainer right now. And if you want a simple, diversified way to do that … the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP) is a great energy ETF to buy today.

Of course, when you buy a diversified ETF, you have to settle for “average” rated stocks. You take the good with the bad.

So, if you’re with Charles and me — if you really believe in this sector and want to get the most bang for your buck — I’d recommend doing your research and identifying the best of the best stocks within these ETFs.

You can use the Green Zone Ratings model we make available on the moneyandmarkets.com website, of course.

Or you can let Charles, Matt and me do all the hard work for you. As I said, we’ve identified not one, but two, top-rated energy stocks in this month’s issue of Green Zone Fortunes.

And you still have time to sign up before the issue publishes tomorrow. Go here to see what Green Zone Fortunes and my Millionaire Master Class are all about.

To good profits,

Adam O’Dell

Chief Investment Strategist

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.