The S&P 500 has struggled over the last 12 months.

The benchmark index is down more than 13%.

One sector, however, has blown the doors off the broader market and its 10 sectors peers.

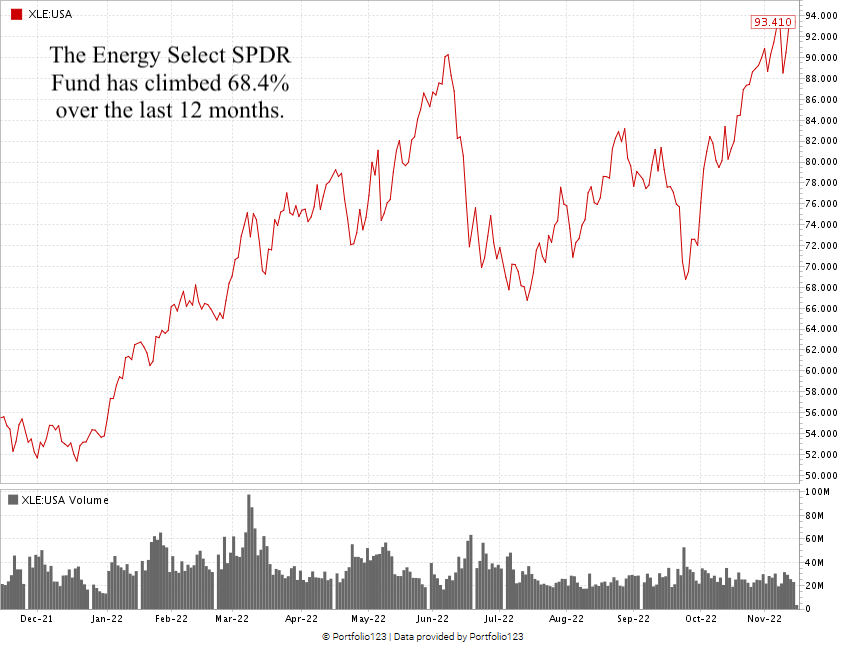

It’s energy:

Over the last year, the Energy Select SPDR Fund (NYSE: XLE), a fund that tracks the overall sector, has almost doubled in value, while the S&P 500 has lost 14.2%.

And one of the biggest names in the business is reaping the rewards of the energy bull market.

I’m talking about today’s Power Stock: Exxon Mobil Corp. (NYSE: XOM).

XOM conducts upstream and downstream operations around the world. That means it’s responsible for both production and selling oil and natural gas products. And it’s been a lucrative year across the board (more on that below).

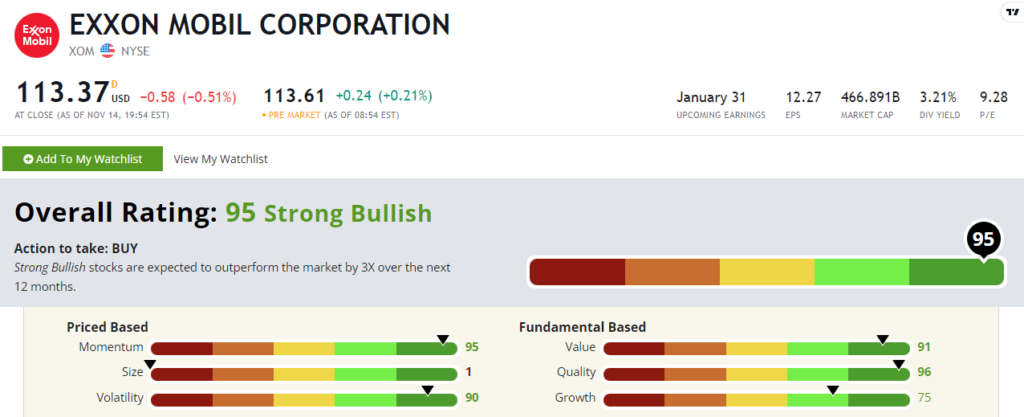

Exxon stock scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Exxon Stock: Excellent Quality + Value

Exxon just reported a strong quarter.

Highlights include:

- Quarterly net income of $19.6 billion — a 188.2% year-over-year increase!

- It grew its quarterly cash to $30.5 billion — up 62.2% from the start of Q3 2022.

XOM earns a “Bullish” 75 on our growth factor.

It scores a 91 on value thanks its price-to (earnings, sales and cash flow) ratios being in line or below the industry averages.

XOM best shines on our quality factor — scoring 96.

Its returns on assets, equity and investment are all higher than the integrated oil and gas industry averages.

This all tells us that XOM is a better value, quality and growth stock than its peers.

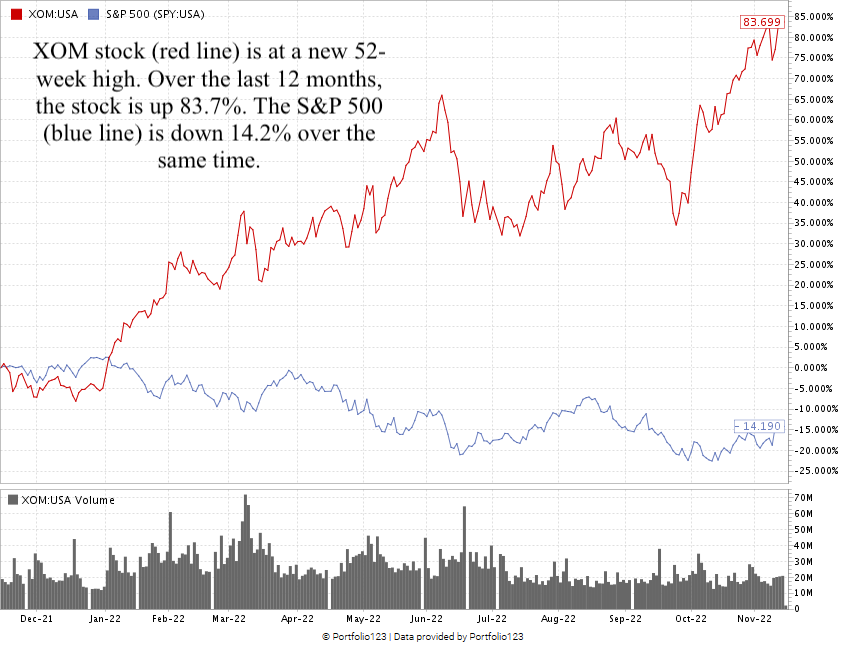

XOM is trading at a new 52-week high. It’s crushing the broader S&P 500 (blue line in the chart below) — down 14.2%.

Over the last 12 months, the stock has climbed 83.7% — earning it a 95 on our momentum factor.

XOM scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Energy has been the best-performing sector of the market over the last 12 months.

I have high confidence this trend will continue.

XOM’s momentum, quality and value are compelling reasons to add it to your portfolio.

Bonus: The company’s 3.21% dividend is an annual payout of $3.64 per share that you own.

One more thing: I’ve talked up the energy bull market a bit here, and XOM is one way to play that.

But if you want to know where the real potential for profits lies within the sector, you need to check out my colleague Adam O’Dell’s “Infinite Energy” presentation.

Renewable energy is the future, and Adam is targeting the largest untapped energy source in the world with his No. 1 stock within this mega trend.

It makes Exxon’s massive oil fields look TINY in comparison, and it does so using innovative tech that will drive renewable energy to the forefront in the future.

Stay Tuned: Terrible Teleconference Stock to Avoid

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

But sometimes I also like to highlight stocks on the other end of the spectrum. Tomorrow, I’ll tell you why a teleconferencing stock is struggling post COVID.

Until then.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets