FAANG enthusiasts, take heed. Your favorite mega-cap stocks aren’t always your best bet.

Look, you’ll get no argument from me: Facebook, Amazon, Apple, Netflix and Google are huge companies which, love ‘em or hate ‘em, have dominated for many years.

But if you’re a shrewd investor seeking to maximize your profits, I just ask you to keep in mind that there are risks to buying these massive, headline-grabbing companies.

Look no further than the antitrust complaint the U.S. Justice Department filed against Google last week.

That’s the latest example of increased scrutiny around Big Tech.

Plus, with a recognizable name can come a cult following and “bandwagon buyers,” who drive up the prices of mega-cap stocks to the point where they’re no longer a good value and at the expense of future returns.

In short, when a company gets too big, so does the size of the target on its back. Increased competition has knocked more than a few big dogs off their pedestals not long after they made it to the top.

FAANGS vs. Small-Cap Stocks

Now, I do realize this is a difficult argument to make in the age of the FAANGs.

I’m not trying to tell you that you shouldn’t own Big Tech stocks. However, if you want to make outsized gains in the next 12 months or so, you’d be wise to consider smaller companies that don’t dominate the headlines.

I’m not talking about “penny stocks.” But compared to Big Tech’s trillion-dollar valuations, stocks with market caps of a few hundred million to a couple of billion dollars have much more room to grow in the short term.

And to understand the Size factor in this context, you don’t have to look at every company’s financial statements or have access to expensive programs.

My Green Zone Ratings system — which you can access for free, with no strings attached, on the Money & Markets homepage — rates stocks on six factors, one of which is Size.

When looking at the Size factor, know that a higher score on the 0-100 scale means the company has a smaller market capitalization. Big Tech stocks rate anywhere from 0 to 5 in Size.

Please don’t take this to mean that the Size factor is powerful enough to put Facebook out of business just because the company got too big for its britches.

And it doesn’t mean that stocks with low Size ratings aren’t going to beat the market.

However, if a company has a high Size rating and rates well on several other factors in my Green Zone Ratings system (momentum, volatility, value, quality and growth) — we shouldn’t discount it because it isn’t as well-known as Apple or Amazon.

Example: Small-Cap SGC Stock

For instance, I publish a watchlist of the top 10 stocks to consider for your next investment every week. My team and I base this list on several factors, including stocks’ overall Green Zone Rating. (You can see the latest watchlist here.)

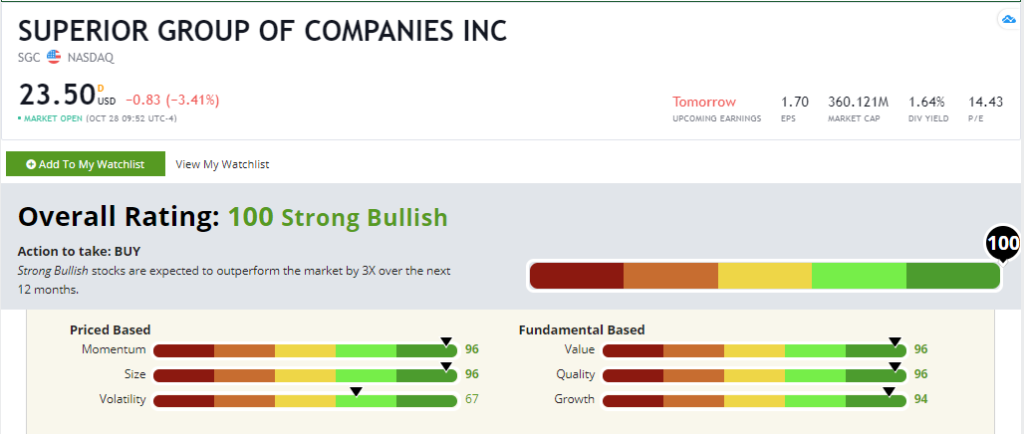

On July 7, my watchlist included a health care stock: Superior Group of Companies Inc. (Nasdaq: SGC).

By the way, Money & Markets’ research analyst Matt Clark wrote about SGC stock last month. Check out that article here.

In the four months since SGC landed on my watchlist, most of the FAANG stocks have risen in value. They’ve averaged 11.7% in gains.

But SGC has crushed the performance of those Big Tech giants. It’s up 84%!

You can see in the table below how SGC stacks up against the FAANG stocks in terms of market value, Green Zone Size rating, and Overall rating as well.

I should point out that all of these companies rate 70 or better overall according to my system, which means they’re likely to outperform the market by 2X to 3X in the next 12 months. So, the Size factor isn’t “make or break.”

And SGC ranks well in all six factors. I would never recommend buying a stock based on size alone.

Superior Group of Companies’ Green Zone Rating on October 28, 2020.

Academic Research on Stock Size

But in addition to this example, academic research is clear: Small companies outperform large companies, in aggregate, over the long run.

If you were to consistently buy a portfolio of the smallest half of all stocks in the market and simultaneously short-sell a portfolio of the largest half of all stocks in the market … you would, over time, earn a positive return, thanks to the “size factor.”

So, given the choice between two stocks that are equally rated on all other factors, we should prefer to buy the smaller one.

I told you on Monday why the Momentum factor works.

Now I want to explain why the Size factor works.

We can explain all six of my Green Zone factors by various “risk-based” or “behavior-based” causes.

With Momentum, for example, one of the behavior-based explanations is that human beings tend to under- and over-react to information flow. These persistent behaviors lead to the temporary mispricing of stocks. That mispricing allows momentum traders to make profits.

For the Size factor, there are a number of risk-based reasons that investors who are willing to buy smaller companies can earn market-beating profits.

Essentially, the theory is that smaller companies are inherently riskier than larger companies for reasons such as:

- They tend to employ greater financial leverage.

- Smaller companies operate with a smaller capital base.

- They have less access to credit.

- Their earnings tend to be more volatile.

- They have greater uncertainty about future cash flows.

- Their business model may be unproven.

- The smaller company’s management team may be less experienced.

- Their shares are less liquid, making them more expensive to trade.

- The shares may not qualify as “buyable” for large institutional investors with restrictive mandates.

- They garner less analyst attention and media coverage, decreasing transparency.

It makes sense that smaller companies face challenges that the biggest companies don’t face.

As such, buying the shares of smaller companies is not as sure a bet as buying shares of a well-known blue-chip company.

2 Things to Remember About Buying Small-Cap Stocks

But we need to keep two things in mind:

- Investors in small companies earn a “premium” to do so. And in the end, assuming you hold a diversified portfolio of small companies, you can make more money buying these somewhat riskier small-cap stocks than you can by piling into the big names. The research is crystal-clear on that.

- You don’t have to buy the tiniest “micro-cap” stock that’s worth only $10 million to earn market-beating returns from the Size factor.

In my Green Zone Fortunes service, for instance, I often recommend companies that I consider something of a “Goldilocks” size — big enough to gain traction and market share, but small enough to still give us the “juice” that small-cap stocks are known for.

For reference, the market values of companies in the “small-cap” category generally range between $300 million and $2 billion.

So, the lesson today is simple: You may know the names of all the “big guys.”

But generally speaking, we can find market-beating gains in smaller companies.

I’ll be back next week to explain two more of our six Green Zone Ratings factors: Volatility and Value.

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets