Amid a market downturn, it’s easy to panic.

You’re worried about your retirement nest egg or your supplemental income being flushed down the drain.

I understand how you feel.

We’re all worried about money nowadays.

- Unemployment is up.

- Prices of goods and services are on the rise.

- And Congress still can’t agree on another coronavirus stimulus package.

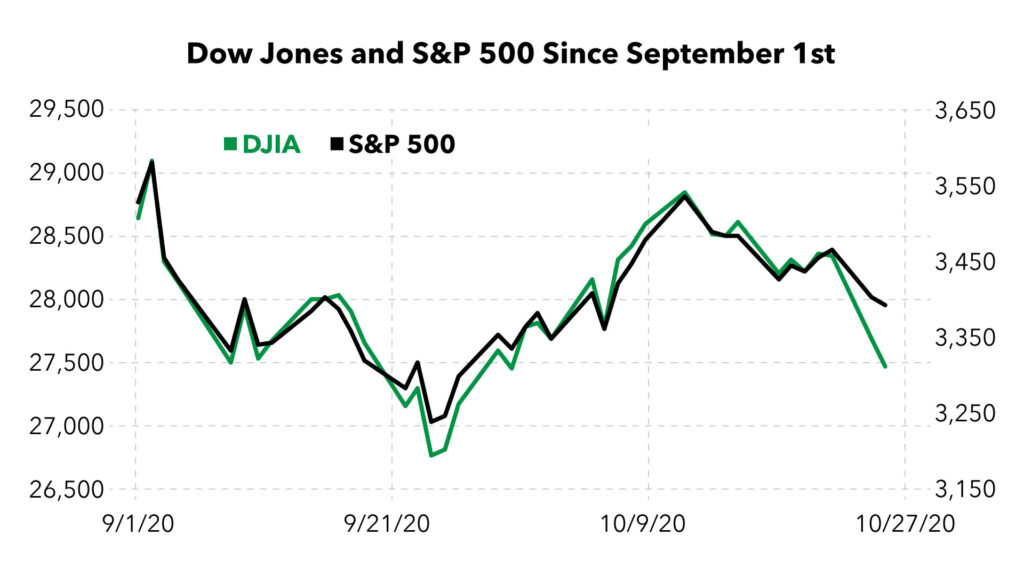

The stock market has hit a rough patch in the past couple of months after largely recovering from the crash in March.

After rising out of September lows, major U.S. indexes are plunging again this week.

The Dow Jones Industrial Average has lost 6.4% in the last three days, and the S&P 500 is down 5.6%.

You can see these drops in the chart below, which shows both indexes’ values since September 1.

Plenty of factors are contributing to this rocky market:

- New COVID-19 cases are hitting record highs.

- The presidential election is less than a week away.

- A new stimulus package won’t materialize until after the Senate returns in November.

My advice?

Don’t throw your hands up.

Remember, these short-term price movements aren’t indicative of a company. If you trade on emotion rather than looking at the bigger picture, you guarantee one thing: losses.

Instead, follow this simple checklist:

Market Downturn Tip 1: Don’t Sell in a Panic

This is the easiest thing for investors to do when the market starts to turn south.

You want to stop the bleeding in your portfolio.

Seeing all that red, you’re just as nervous as when your teacher handed back your high school English term paper.

Remember, these short-term price movements aren’t indicative of a company. If you trade on emotion rather than looking at the bigger picture, you guarantee one thing: losses.

Market Downturn Tip 2: Stop Looking at Your Portfolio

Refreshing your portfolio every five minutes on your computer, tablet or smartphone only adds to the panic you are already feeling.

Stop.

Step away from your computer. Take a walk or a drive. Pet your dog. Play a game. Call a friend.

There’s no point in continuing to check your portfolio during trading hours unless you are a glutton for anxiety.

There is nothing you can do about what’s happening.

Be smart, and stick to your strategy.

Market Downturn Tip 3: Let Us Do the Heavy Lifting

We have a team of people — including Chief Investment Strategist Adam O’Dell, myself and Charles Sizemore — who spend our days looking out for you.

Adam has a tried and true system — Green Zone Ratings — that takes the emotion out of investing and uses a sound strategy to produce gains.

The bottom line here is that you don’t need to refresh your portfolio screen or sell in a panic.

Take a deep breath, and trust that we have your back. We’ll let you know when you need to take action.

We understand that stock market downturns aren’t easy to deal with. But if you keep calm, don’t make any rash decisions and trust that we are there for you, we will get through it together.

Note: Charles and I recently talked about emotional investing in an episode of The Bull & The Bear podcast. You can watch it here.

You can check out our YouTube channel or your favorite podcast syndicator (Apple Podcasts, Google Podcasts, iHeartRadio or Spotify) to listen.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.