In popular media, the story of manufacturing is one of decline.

There is some truth to that.

Manufacturing accounts for about 12% of U.S. gross domestic product (GDP), less than half its peak value of 28% reached in 1953.

Even though manufacturing is a small part of the economy, tracking it is important.

While we often associate manufacturers with large products, such as cars and appliances, they are also responsible for all the packaging at grocery stores.

That’s why activity at manufacturers offers insights into future economic trends.

Traders also benefit from tracking this slow-moving data.

Trends in the economy drive long-term trends in the stock market.

How to Spot Economic Trends: Look at Purchasing Managers

Recessions are associated with bear markets, so it’s expensive to ignore weakness in the data.

One economic report that provides important details on the sector is the Institute for Supply Management’s monthly survey of purchasing managers (PMs).

If we think of manufacturers as the front line of the economy, PMs are the scouting party that races ahead.

PMs need to keep factories stocked with inventory to maximize profits.

In the latest survey, we see uncertainty.

Supply chains have been problematic since the pandemic.

First, there were shortages.

Some businesses decided to overstock inventory to avoid that. But that’s risky.

Volatility in commodity prices has made it expensive to hoard inventory.

High shipping costs one month may subside in three months, making it impossible to pass on the higher prices to customers.

The inventory system is now a hot potato.

Purchasing Managers Disrupt the Inventory System

A PM in the food and beverage industry summed it up: “It seems no one wants to keep inventory on hand anymore.”

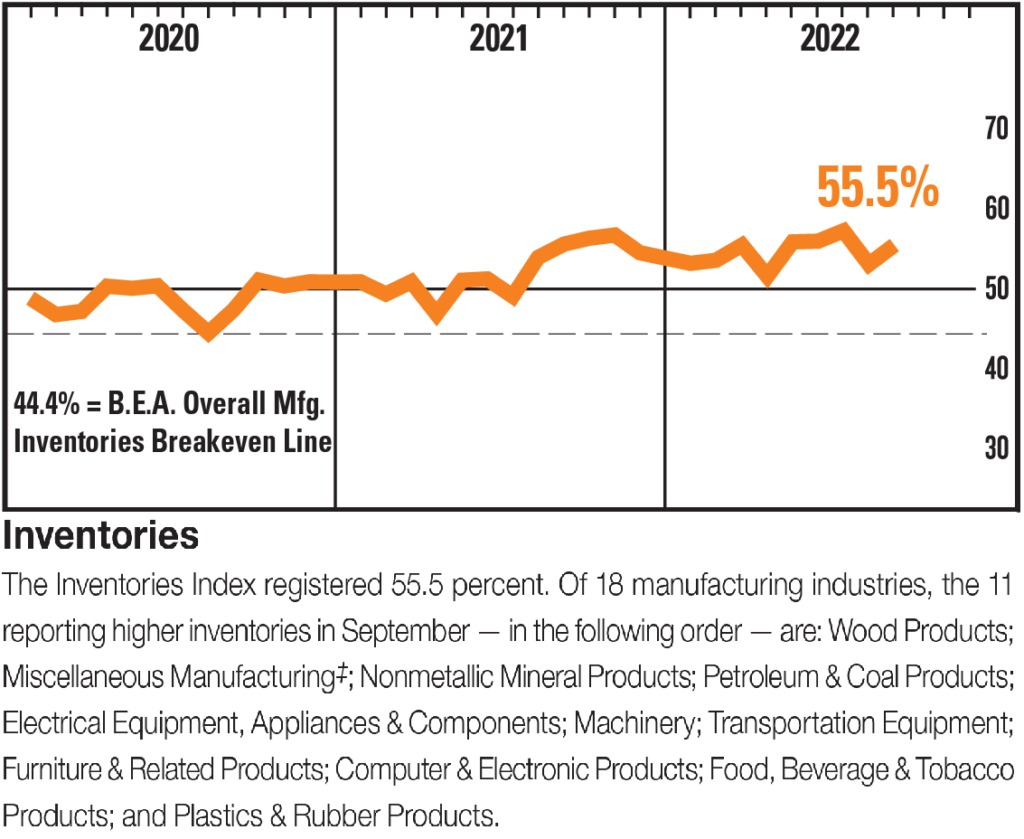

But inventories are still high.

High Inventories Signal Economic Uncertainty

Source: Institute for Supply Management.

And that’s the problem for the economy.

Manufacturers are reluctant to order since prices could fall later.

But that means they may not have critical parts when needed.

So there’s a balancing act.

Bottom line: The economy is too big to balance for long.

Declines in manufacturers’ orders will tip the economy into that long-awaited recession.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.