A part of the college communications class I teach asks students to respond to difficult scenarios.

One involves needing more training in the workplace.

About 90% of students answered they would rather talk to their supervisor about providing more training than seek out a new job.

It tells me that today’s employees will stay on the job if their employers invest in them.

The chart above breaks down how companies handled their training budgets in 2021.

While 47% of companies kept their training budgets level with 2020, 32% increased their spending.

I have strong conviction that while “quiet quitting” and the “great resignation” have dominated headlines, companies will invest even more to train employees … now and in the future.

Today’s Power Stock is a global leader in organizational training: Franklin Covey Co. (NYSE: FC).

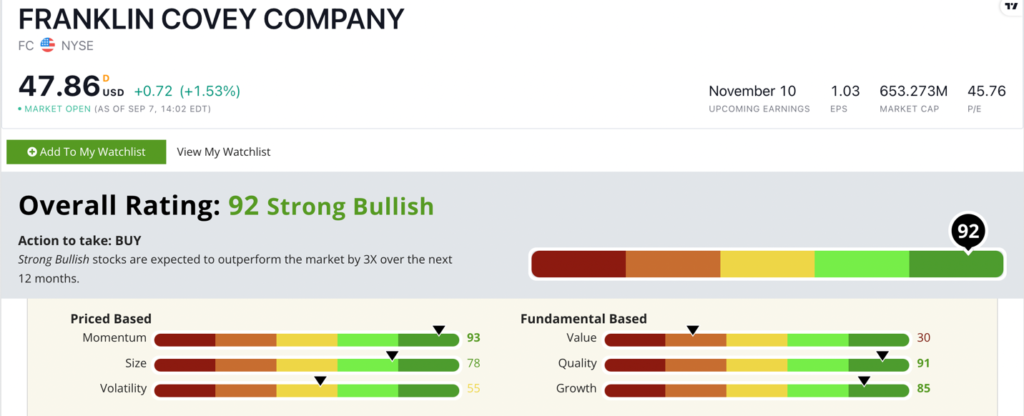

FC Stock Power Ratings in September 2022.

Not only does Franklin Covey train on the corporate level, but it also trains high school and college students before they enter the workforce.

Franklin Covey stock scores a “Strong Bullish” 92 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

FC Stock: Momentum + Industry-Beating Quality

FC just released a strong quarterly report.

Highlights include:

- Grew quarterly revenue by 13% to $66.2 million.

- Increased its online subscription delivery sales by 32% to $39.1 million.

FC’s growth is strong, as you can see from those revenue figures.

It’s also an excellent quality stock, with a return on investment of 15.3%.

Compared to the industry average of negative 0.4%, we see why Franklin Covey stock scores a 91 on our quality metric.

With its $653.3 million market cap, FC is a small-cap stock.

When looking at two stocks with similar ratings on the other five factors, history tells us smaller stocks outperform their larger counterparts.

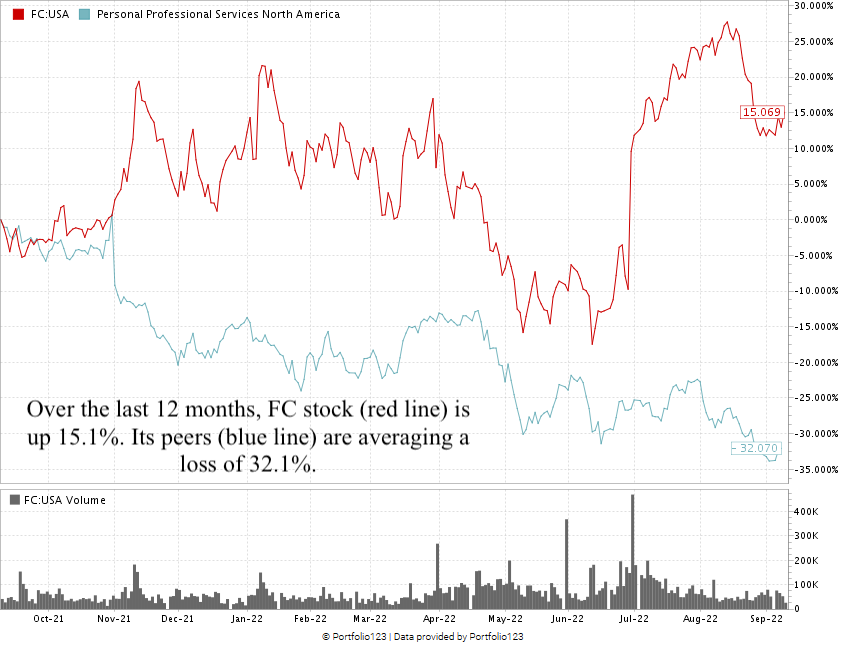

After hitting a 52-week low in June 2022, FC stock surged as much as 54.8% by mid-August.

The broader market sell-off has pared back its gains, but FC is still up 15.1% over the last 12 months.

Franklin Covey stock scores a 92 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

To combat “quiet quitting” and the “great resignation,” companies will provide more training opportunities for employees and managers.

A global leader in organizational training, FC is a smart addition to your portfolio.

Stay Tuned: “Strong Bullish” Furniture Chain

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent 90-year-old retail stock.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.