My friend Tony owns an engineering firm.

In 2018, the company was facing difficult financial times.

He needed to make changes but didn’t know where to start.

So he called a consulting firm to look at every aspect of the company, from employees to finances.

The chart above shows the revenue for business consulting companies in the U.S.

By 2024, revenue will reach $251.4 billion — a 14.8% increase over 2020.

The business consulting sector is growing, and it has plenty of room to run.

Today’s Power Stock is a consulting company based in Washington: Barrett Business Services Inc. (Nasdaq: BBSI).

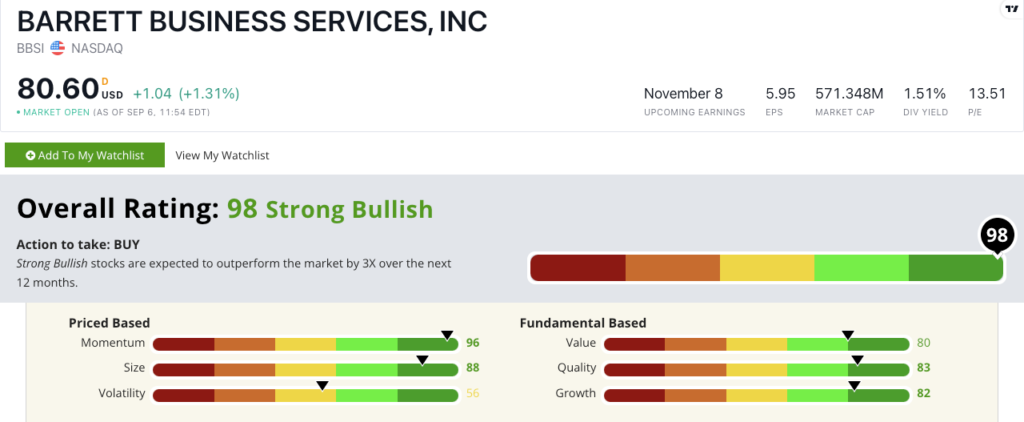

BBSI Stock Power Ratings in September 2022.

BBSI focuses its business management consulting services on small and midsize companies in the U.S.

Barrett Business Services Inc. stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system.

We expect it to beat the broader market by 3X in the next 12 months.

BBSI Stock: Strong Momentum, Quality and Growth

BBSI released strong quarterly numbers:

- Net revenue of $262.2 million — a 12% increase from the same period a year ago!

- Increased its outlook for the rest of 2022 — forecasting an 11% to 13% increase in its annual billings.

BBSI stock scores an 83 on our Stock Power Ratings system’s quality metric.

Its return on equity is 23.5%, which is more than double its peer average.

The company’s return on investment is 21%, while its industry peers average just 6.3%. Barrett Business’ financial returns are more than three times stronger than its cousins’.

BBSI scores a 96 on our momentum factor:

After a strong 2021 in which BBSI increased its billings to $6.6 billion, the stock took off. You can see that in the stock chart above.

From March to mid-August, the stock climbed 47.8%.

Barrett Business Services Inc. stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

More small and midsize businesses need help planning for the future and recruiting talent.

BBSI has a proven track record of increasing its customer base, thus increasing its revenue, even in tough financial times.

You can see why BBSI is a strong investment for your portfolio!

A note on Tony’s company: His business went from losing $1 million in 2018 to bringing in $4 million two years later.

Stay Tuned: Business Coach

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on another company that helps businesses succeed.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.