I’m surprised to say it, but I’m bullish.

Inflation is soaring. Even the Federal Reserve understands that.

Minutes from the Fed’s recent policy meeting show officials expect to raise interest rates by half a percentage point at their next two meetings. That’s on top of the 0.5% increase they already completed.

But inflation isn’t the only problem investors face.

Why Fear Is a Powerful Indicator

There’s war and political turmoil in the U.S. and around the world. All the bad news weighs on consumers and changes how they shop. One Wall Street analyst expressed concern this week:

I think what you’re seeing is the consumer rolling over. Look at Target, Walmart. All the data points to the consumer world… The consumer is being more cautious with their dollar.

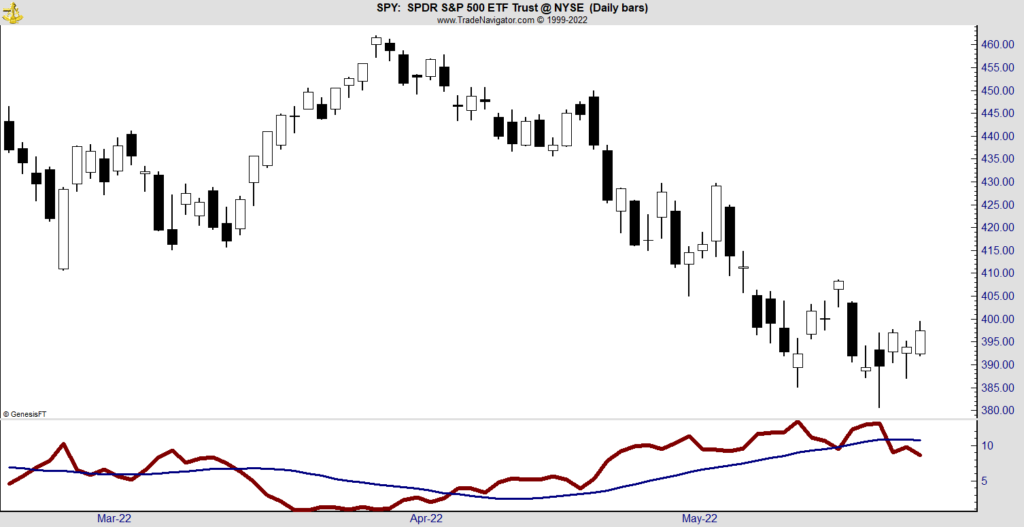

Fear is high, but the chart below shows it’s falling.

And that’s a buy signal.

The Fear Factor

I developed the indicator at the bottom of the chart to measure fear. It moves like the VIX Index, rising when fear rises. The thinner blue line is a moving average (MA) of the indicator.

When the indicator crosses above the MA, we have a sell signal. A buy signal occurs when the indicator drops below the MA.

This week, despite the bad news, we got a buy signal on the SPDR S&P 500 ETF (NYSE: SPY). I was surprised, but I don’t argue with the signals.

Over the long run, this indicator has a market-beating track record.

It’s easy to understand why. Emotions drive trends. Fear is a strong emotion. This indicator is designed to identify the transitions in fear.

It shows when fear starts to rise and then alerts us when fear subsides.

Bottom line: That’s where we are this week. This up move may prove to be a bear market rally, but for now, it’s time to trade on the bullish side of the market.

Hopefully market gains will help consumers with other problems, like inflation, that aren’t going away anytime soon.

Click here to join True Options Masters.