Federal Reserve Chairman Jerome Powell has hinted at an interest rate cut soon, which has investors wondering what direction to go in the markets — and one sector has historically outperformed after a cut.

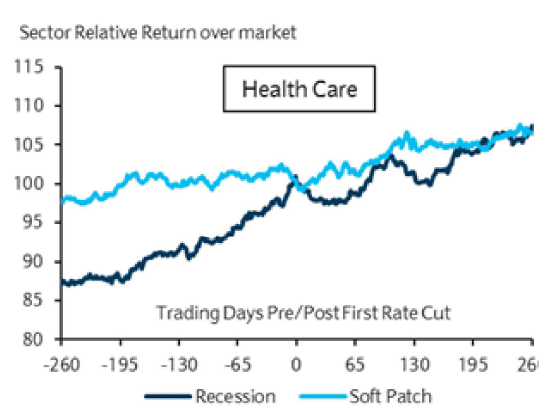

According to data from Barclays, health care stocks outperform the rest of the market by about 7% in the nine months after a rate cut. And this has been a consistent result after different levels of easing in the past.

After running deep analysis on Fed rate cut cycles, Barclays determined two types of environments: economic “soft patches” and a full-on recession. While most sectors had varying degrees of success during the different levels of downturn, health care stocks consistently performed well in both scenarios.

This is “an intuitive result given that soft patches still represent a weak economic environment,” Barclays head of U.S. equity strategy Maneesh Deshpande wrote in a note last week. The reason may be because health care stock revenues are consistent and pay out larger dividends compared to other sectors.

The Fed began a two-day meeting on Tuesday, but most economists don’t believe an interest rate cut will be announced. Instead, they’re looking for signs that some form of easing will come later in 2019.

On the other hand, what sectors struggle following an interest rate cut from the Fed?

According to CNBC, investors should be wary of durable goods:

Rate cut losers

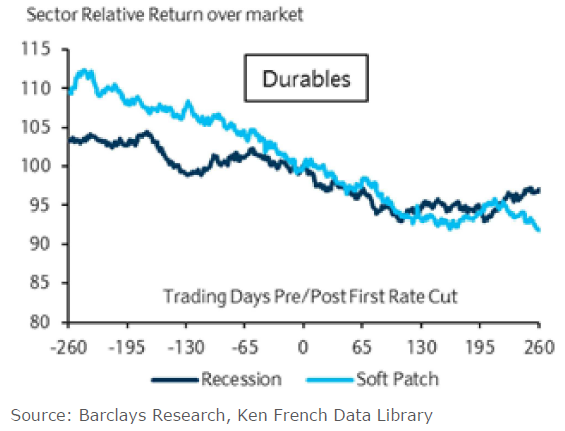

The durables sector does not fare well after the Fed lowers rates. The sector stands out because of its consistent underpeformance. The sector has historically underperformed the market between 3% and about 8% after the central bank begins to lower rates, Barclays found. Durables include goods like autos, machinery and homes, which are highly sensitive to the economic cycle.

Weaker data, along with lingering trade worries, have dampened the U.S. economic outlook and increased bets that the Fed will loosen its monetary policy stance. Market expectations for a rate cut in July stood above 86%, according to the CME Group’s FedWatch tool. Investors are also pricing in a rate cut in September and another on in December.

If the Fed does cut, it won’t be clear for a while whether it’s doing so in an economic environment of a recession or a “soft patch.”

But Deshpande said the current sector performance in stocks points to the former.

“Using the historical behavior of sectors and factors around prior rate cut cycles, we can attempt to determine whether the recent sector performances are indicating an anticipated soft patch or a recession,” Deshpande noted. “In late 2018, Utilities (recession outperformer) and Non-Durables (recession outperformed) rallied while Tech (soft patch outperformer) fell, indicating a perception that an economic slowdown would morph into a full recession. Since that time, Tech rallied back while Non-Durables and Utilities stalled.”