The headline was attention-grabbing:

“BP rakes in quarterly profit of $8.2 billion as oil majors post another round of bumper earnings.”

CNBC was reporting on BP PLC’s (NYSE: BP) third-quarter earnings.

A profit of more than $8 billion in just three months sounds like a lot of money.

In the quarter, BP wasn’t the oil company to make money:

- Shell posted a quarterly profit of $9.5 billion.

- Chevron earned $11.2 billion.

- Exxon reported a profit of $19.7 billion.

The eye-popping numbers caught the attention of investors and politicians.

Why Gas Company Income Is a Concern

Around the world, politicians are concerned that gas companies are making too much money.

President Joe Biden said:

My team will work with Congress to look at these options that are available to us and others. It’s time for these companies to stop war profiteering, meet their responsibilities in this country and give the American people a break and still do very well.

I wondered if the politicians may be missing something.

Digging into BP’s report, I saw more to the story.

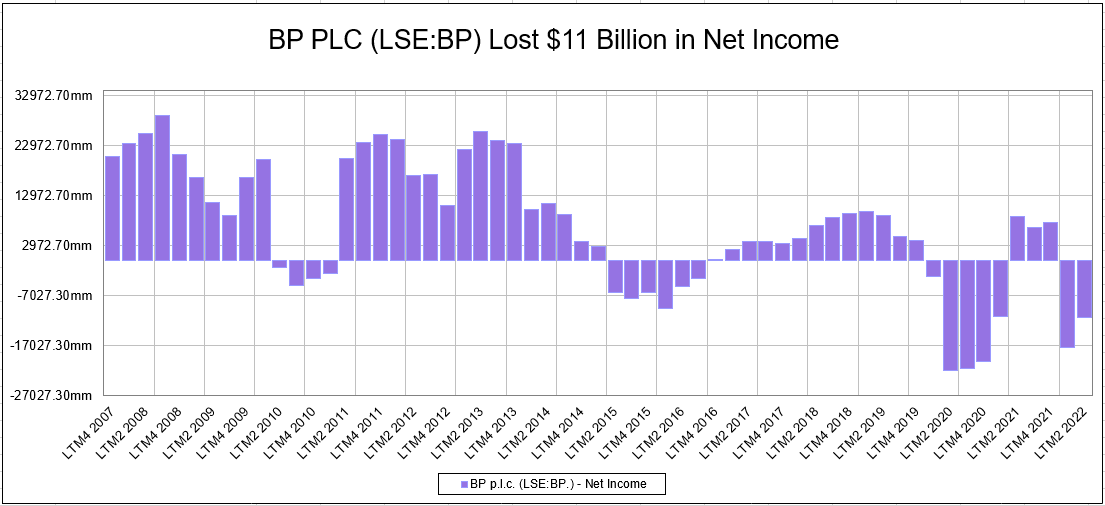

The chart below shows the company lost over $11 billion in the last 12 months.

Each bar represents the net income for the past year. That’s a different picture than the one we saw in the headlines.

Source: Standard & Poor’s.

BP’s $8.2 billion is what the company calls its “underlying replacement cost profit.”

Deeper in the report is the figure for income.

Beyond the Headlines: BP’s Struggles

The loss was due to inventory holding losses of $2.2 billion and accounting adjustments that reduced earnings by $8.1 billion.

This shows a company that’s struggling.

Oil price volatility and customer demand variations make it difficult for BP to hold the right amount of inventory.

By providing customers with what they needed, it resulted in a multibillion-dollar loss.

Rapid changes in the market are just one factor.

That $8 billion write-down reflects assets the company won’t be able to use because:

- Costs changed.

- The political environment shifted.

- Or geologists made mistakes.

These are unavoidable costs and show the industry is under pressure.

Bottom line: Despite billions in headline profits, the details show that major oil companies might not be desirable.

Click here to join True Options Masters.