Traders will be busy this afternoon, to say the least.

Federal Reserve officials will wrap up their two-day meeting and release their decision on interest rates at 2 p.m. Eastern. Futures markets are pricing in a 0.25% increase.

It’s almost certain the Fed will do just that. After all, Chair Jerome Powell consistently delivers exactly what the market expects.

A half-hour after the interest rate decision is announced, Powell will take the stage for a press conference. And unlike the interest rate move, there’s nothing predictable about this part of the day.

Sometimes Powell makes comments that boost stocks. Other times, his words send stocks lower. Today, he’s speaking as stocks face technical headwinds.

As a technical analyst, I focus on price action. I, along with my colleagues, use chart patterns and indicators to forecast price moves.

Right now, there are at least four reasons to expect a market decline after Powell delivers his unpredictable message…

4 Signs a Market Decline Is Imminent

1. Stock market averages are overbought.

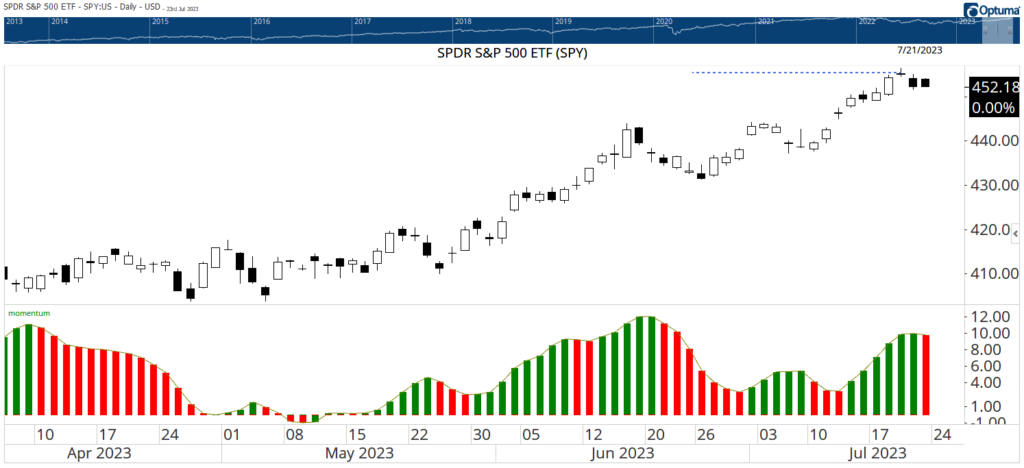

Prices have moved up “too far, too fast.” The SPDR S&P 500 ETF Trust (NYSE: SPY) gained more than 4% in the two weeks before its most recent high.

Gains of that size are unusual. They happen an average of five times a year. And a pullback starts the following week more than half the time.

Stock prices have a long-term upward bias. They go up more often than they go down. Signals showing prices fall more than 50% of the time are rare. That makes this signal important and worth watching.

2. SPY reached its upside target.

The chart of SPY below shows that the exchange-traded fund met its price target (the dashed line) last Thursday. This line was calculated based on the uptrend that began in June.

Declines lasting at least a few weeks follow this signal about 65% of the time.

The S&Peaked

3. Momentum turned down.

Momentum indicators measure how fast prices move. Traders look at dozens of these indicators. One of them is at the bottom of the chart we just looked at above.

Analysts expect changes in momentum to lead to price reversals.

Now, we can think of these indicators like a runner charging up a hill. Nearing the top of the hill, they’re likely to slow down. This allows them to catch their breath after working so hard to move up the hill. The slowdown in momentum precedes the reversal to the downside of the hill.

The indicator in the chart — which illustrates my hills analogy pretty well — compares how prices moved in the last week to their movement over the past month. It peaked last week and now seems to be headed lower. This is another reliable indicator that prices are likely to pull back or at least move in a narrow range for a few weeks.

A narrow range, kind of like what you can see in early May, is possible. However, that’s unlikely.

Traders will react to today’s news from the Fed. That could be the catalyst for a multiweek trend.

And then after today’s close, we’ll get earnings from Meta Platforms Inc. (Nasdaq: META). Amazon.com Inc. (Nasdaq: AMZN) reports after tomorrow’s close. Both Big Tech companies’ announcements move markets.

Economic news could also drive a big move. The first estimate of gross domestic product growth in the second quarter is due before the open tomorrow. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures Index, is set for Friday morning.

With momentum pointing down, news stories are more likely to spark a sell-off.

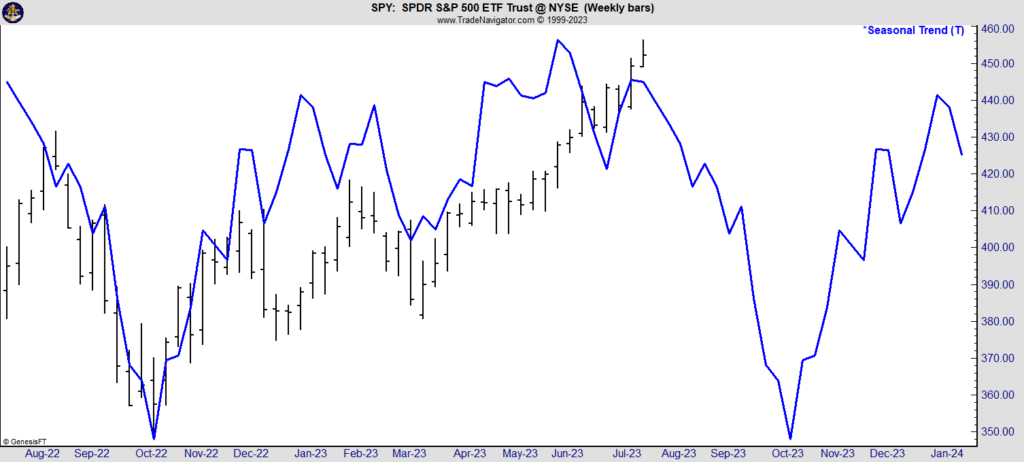

4. Seasonals turned bearish.

The last indicator pointing to a market reversal has to do with seasonality.

Seasonal trends are found based on how prices moved in previous years. Throughout the year, there are some periods when stocks tend to rise and others when stocks tend to fall. The seasonal trend in SPY peaked last week and future projections head lower until October. It’s shown as the blue line in the chart below.

The S&P’s Bearish Future

Like any indicator, seasonals are wrong sometimes. But they are still useful. We are at the beginning of this year’s strongest seasonal downtrend. It’s another reason to expect a pullback in stocks soon.

Preparing for a Pullback in the Trade Room

Markets can move up despite all these headwinds. That’s why it’s important to wait for the reversal before taking positions. When the pullback does come, it might be short-lived. Or it could be the beginning of another bear market.

We’ll be considering whether prices are likely to move up day to day in my Trade Room. Tomorrow morning’s session will start with a look at how the market is reacting to the news from the Fed and Meta.

Specifically, we’ll look for a potential opportunity to trade Amazon ahead of its earnings announcement.

Matt Clark and I look at news and trading opportunities in the room every day that the market is open. You can find us there at 9:30 a.m. Eastern.

We follow a variety of short-term trading strategies that are all based on price action. When prices are more likely to fall than rise, we trade put options. And to benefit from expected rallies, we trade call options.

While we started the week with a bearish bias, we always follow our strategy signals — not our opinions. We’ll trade positions as signals develop, and we’ll focus on the short term to avoid being caught on the wrong side of major trends.

I invite you to join us in the daily Trade Room. To learn how to access it, just click here.

Until next time,

Mike Carr

Senior Technical Analyst