It almost seemed like Federal Reserve Chair Jerome Powell was trying to give stock market investors a reality check Wednesday.

“We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates,” Powell said in a press conference following the Fed meeting. “What we’re thinking about is providing support for the economy. We think this is going to take some time.”

A few years ago, the Federal Reserve refused to even confirm changes in interest rate policies. Now, Powell assures us short-term interest rates will stay close to zero for the next two years.

That’s a grim warning.

Federal Reserve Hints at 2 Years Before Recovery

The Fed will raise rates when the economy recovers, and Powell is indicating that recovery will take at least two years.

Powell also said he expects millions of jobs are permanently lost, but the unemployment rate is impossible to calculate in the current environment. The Fed understands the problem and is committed “to do whatever we can for as long as it takes,” Powell said.

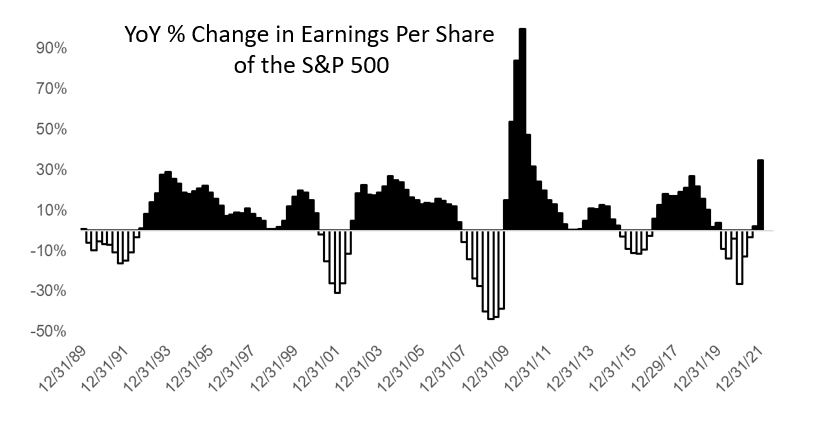

This pessimistic view is shared by analysts who expect earnings to decline for at least the next year. The chart below shows that analysts expect earnings per share for S&P 500 companies to rise sharply in the fourth quarter of 2021. That means five more quarters of declines.

Source: Standard & Poor’s

This raises concerns about recent gains in the stock market. Market prices reflect future growth, but the Fed and analysts don’t expect growth.

Powell was unusually pessimistic in his comments. He talked about millions being unemployed. He promised Federal Reserve support for as long as necessary. And he promised at least two years of low rates to allow companies and consumers to plan their purchases.

Analysts are worried and companies are confirming there is reason to worry. Starbucks announced the virus cost the company at least $3.2 billion in sales and warned that profits will be low for at least the next quarter.

Starbucks confirmed that millions of jobs aren’t coming back when management said Wednesday 400 stores are closing, including 17% of its stores in Canada.

It seems as if everyone with detailed information is worried. The only group that is optimistic is traders who are buying stocks.

The next year is going to disappoint those who bought in recent weeks.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.