Analysts dug into the new inflation data that came out last week. Although it seems everything regarding inflation was already discussed, there is one view I haven’t seen anywhere else.

I looked at the difference between the headline number (8.6% for May compared to a year ago) and core inflation (6%).

I came away worried about the stock market.

Consumer Price Index: What’s the Difference?

The headline number is the Consumer Price Index (CPI) for all urban consumers. It’s the most comprehensive look at price data. Core inflation is the index for all items except food and energy.

The 2.6% difference between the two is much wider than usual. Over the past 20 years, the difference averaged 0.2%.

That tells me the Federal Reserve has targeted core inflation.

Wide Inflation Gap Calls for Action

When the difference between the two gets too wide, the Fed needs to take drastic action.

The wide spread between the two indicates that even if core inflation is low, consumers face high prices and can’t keep up. That slows economic growth.

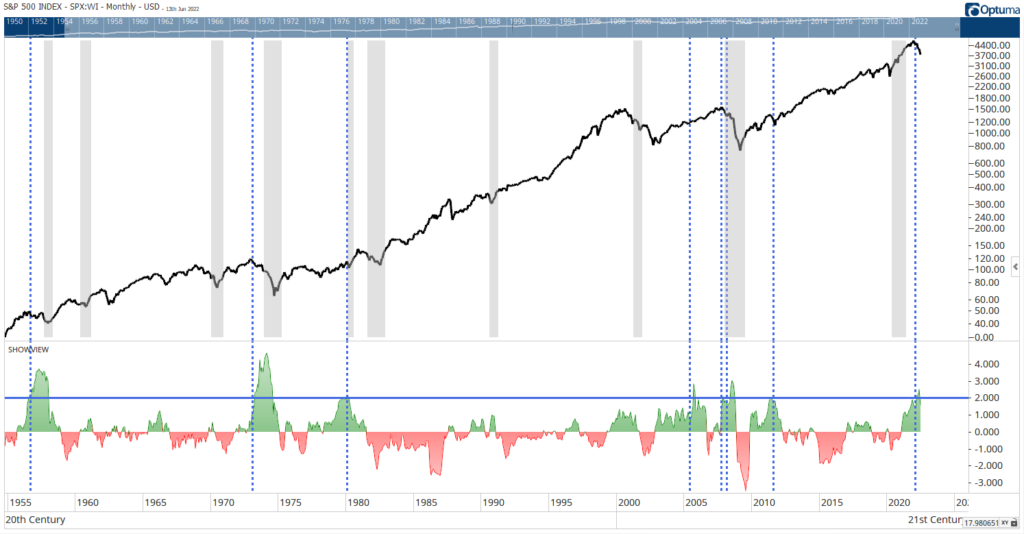

The chart below shows how unusual the current situation is.

We care about this as investors, so I included the S&P 500 Index at the top of the chart. The difference between the two inflation numbers is at the bottom. Blue dashed lines highlight times when the difference exceeded 2%. The gray bars indicate recessions.

Unusual Inflation Signal

I included recessions in the chart because most occurrences when the spread was higher than 0.2% average coincided with economic contractions. High readings also coincide with stock market declines.

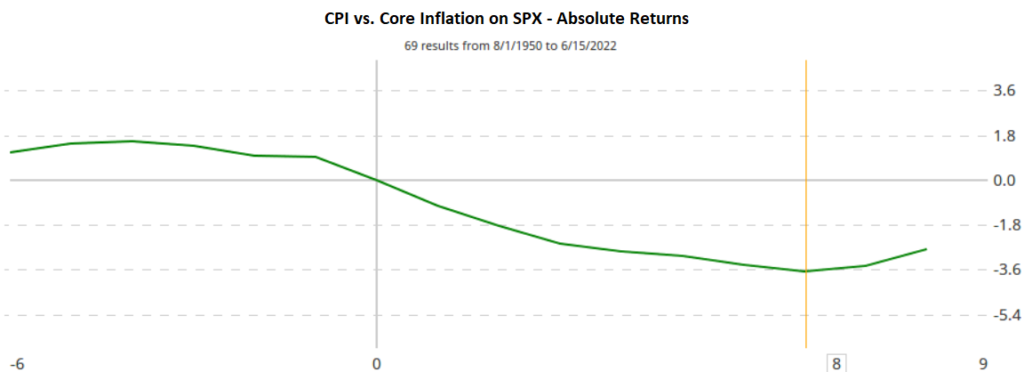

To verify that, I measured the S&P 500’s performance for nine months after the difference between headline and core CPI had topped 2.5%. That’s shown in the following chart.

We don’t have a large sample size — just eight occurrences. But the market declines for an average of eight months after the signal.

Bottom line: This is another piece of data pointing to a bear market and a recession.

Investors should consider reducing risk.

Click here to join True Options Masters.