An ideal dividend stock will have both a competitive current yield and a history of consistently raising its dividend. High income is fantastic, but without that consistent growth, you will eventually lose ground to inflation. And high dividend growth is nice for long-term wealth building, but it doesn’t do much for you in the here and now. You need a little bit of both.

With that as our background, let’s take a look at our dividend stock of the week, Fifth Third Bancorp (Nasdaq: FITB).

Fifth Third is a regional bank headquartered in Cincinnati, Ohio, with a long history in the area. It was founded in 1858 and today has 1,149 banking centers spread across 10 states in the Midwest and Southeast.

Let’s jump into what makes Fifth Third a great dividend payer. To start, it pays a competitive yield of 3.7%. In this market, that’s downright juicy — the S&P 500 yields only 1.6% and the 10-year Treasury only 1.1%.

The bank raised its dividend by 13% in 2020 and by 9% in 2019. Since 2016, it has more than doubled its payout.

By itself, that yield is attractive enough to warrant consideration. But it’s the growth that makes Fifth Third’s dividend compelling. The bank raised its dividend by 13% in 2020 and by 9% in 2019. Since 2016, it has more than doubled its payout. And with a dividend payout ratio of just 59%, there is plenty more room for growth.

The COVID-19 pandemic was a wrecking ball to the economy last year. But the damage to Fifth Third’s loan portfolio was minimal. As of year-end, only about 10% of the bank’s outstanding loans were made to pandemic-impacted businesses, such as restaurants, hotels and travel companies. And Fifth Third reported minimal losses and delinquencies. Its loan deferral rate in its high-impact portfolio was only about 1%. The bank made it through the crisis unscathed and is in a fine position to handle whatever comes next.

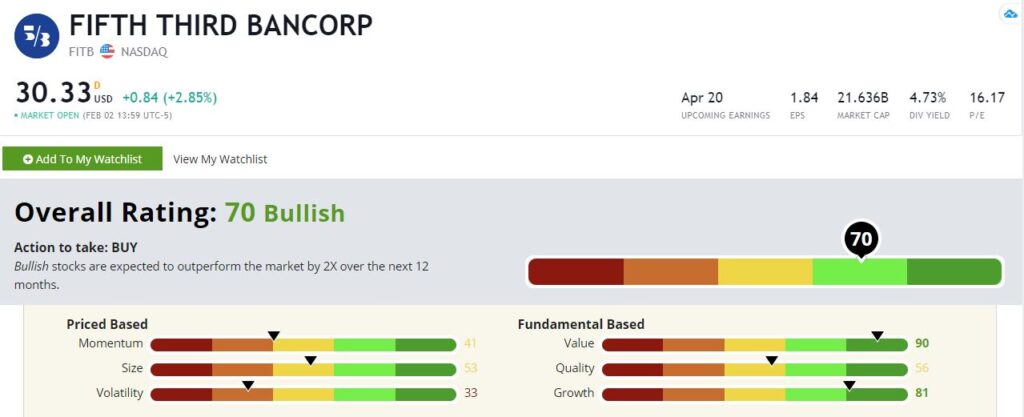

Let’s see how Fifth Third stacks up using Adam O’Dell’s Green Zone Ratings System.

Fifth Third’s Stock Rating

Overall, it looks great, rating a 70 out of 100, which puts it firmly in “Bullish” territory on our scale. Any rating over 60 is considered Bullish, and stocks in this bucket are expected to generate returns two times greater than the market’s returns over the next 12 months, based on Adam’s historical research.

Fifth Third Bancorp’s Green Zone Rating on February 2, 2021.

Let’s break it down further.

Value — Fifth Third rates highest on value, scoring a 90. This means that only 10% of the stocks in our universe are cheaper based on our criteria. This hasn’t been much of a selling point in recent years, as cheap stocks have tended to stay cheap as growth stocks have trounced value. But if recent trends are any indication, that may finally change. Value stocks have had a strong start in 2021, and I suspect that trend has legs.

Growth — Perhaps a little surprisingly, Fifth Third also rates highly on growth, coming in with a rating of 81. Large bank’s growth has been stunted since the 2008 crisis, and that created a window for smaller banks to excel. This stock doesn’t have the growth profile of a tech stock. It is a bank, after all. But trends are in its favor here.

Quality — Fifth Third rates reasonably well on quality, too, coming in at 56. It’s important to understand how our model works here. We rate quality based on numerous factors, but profitability and balance sheet strength carry the most weight. Banks carry a lot of debt, which punishes a stock like Fifth Third based on this metric. So, this is a higher-quality stock than its rating suggests.

Size — Our model favors small and midsized companies, as smaller companies tend to outperform larger ones over time — Fifth Third rates in the middle of the pack here with a size rating of 53.

Momentum — Fifth Third rates fairly low based on momentum at 41. Shares haven’t moved much over the past several years, and today’s share price is at 2017 levels. But, importantly, the stock has performed well over the past several months. It’s showing signs of life.

Volatility —Fifth Third rates at a 33 here, implying it’s more volatile than about two-thirds of the stocks in our universe. This is a negative, but it’s not a deal breaker given the stock’s high ratings elsewhere. All else equal, it’s not unusual for small and midsized companies to rate lower on volatility.

Bottom line: Fifth Third is a solidly bullish stock that should benefit from the world starting to get back to normal in 2021. Its solid yield and history of dividend growth make this a dividend stock to buy.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.