In 2008, the country faced its deepest economic downturn since the Great Depression.

In hindsight, it’s obvious high debt levels increased the pain of the recession.

Mortgage debt, in particular, created hardships. The first signs of crisis were seen in hedge funds with exposure to mortgages. Lenders like Countrywide collapsed. Millions of families lost their homes.

The crisis had long-lasting effects:

- Regulators cracked down on lenders.

- Lenders cracked down on borrowers.

- And borrowers showed more discipline.

Now, as the economy faces another crisis, borrowers are better prepared than ever.

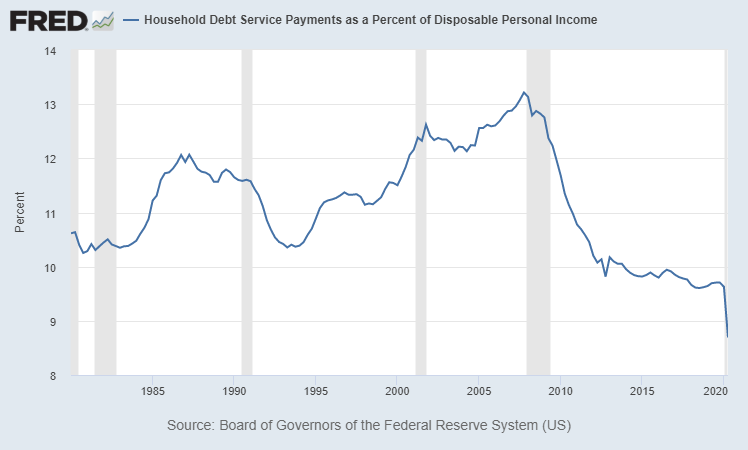

The chart below shows the percent of disposable income households dedicate to debt service payments. Even before stimulus checks enabled many to reduce debt, costs of debt were at a record low.

Consumers Are Managing Debt Well

Low interest rates are one reason for lower debt costs.

But consumer discipline might be the most important reason. As low interest rates decreased loan payments, consumers avoided excessive debt.

This data, of course, is at a national level. Some individual households are highly leveraged, while others carry no debt at all. On average, debt is manageable. But there will be many bankruptcies, and thousands of families will experience hardship.

The Financial Sector May Be a Bargain Right Now

The financial sector is not likely to experience deep losses as they did in 2008. Investors should consider this when evaluating the sector.

The Financial Select Sector SPDR ETF (NYSE: XLF) and many banks remain below their 52-week highs. This presents a potential bargain.

Investors seem to be considering the risks present when households were drowning in debt instead of the current situation where debt is reasonable.

News stories will never cover households financially prepared for the current crisis; news will focus on families that face challenges.

Looking at data that isn’t in the headlines could lead to profits for investors.

In this case, the data is pointing to the financial sector.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.